SK Hynix explores HBM chip collaboration with Kioxia

The collaboration proposal comes as SK Hynix is said to oppose a Kioxia-Western Digital merger

By Mar 04, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

SK Hynix Inc. is exploring collaboration with Japanese chipmaker Kioxia Holdings Corp. to produce high bandwidth memory (HBM) chips, which have been enjoying soaring demand for artificial intelligence applications, according to foreign media reports.

The South Korean chipmaker, a major shareholder of Kioxia, has proposed joint production of the high-capacity, high-performance chips at the plants co-operated by Kioxia and the US-based Western Digital Corp. in Japan, Jiji Press said last week.

Kioxia, the world’s No. 2 NAND flash manufacturer, is said to be in discussions with Western Digital about the proposal from SK Hynix.

In response to the report, SK Hynix said: “There is no change in our stance that if there is a collaboration opportunity, we will enter into discussion on that matter.” But it declined to comment further.

The report comes as SK Hynix, the world’s second-largest memory chipmaker, is understood to oppose the integration of Kioxia and Western Digital due to concerns their marriage would create the world’s largest NAND memory manufacturer.

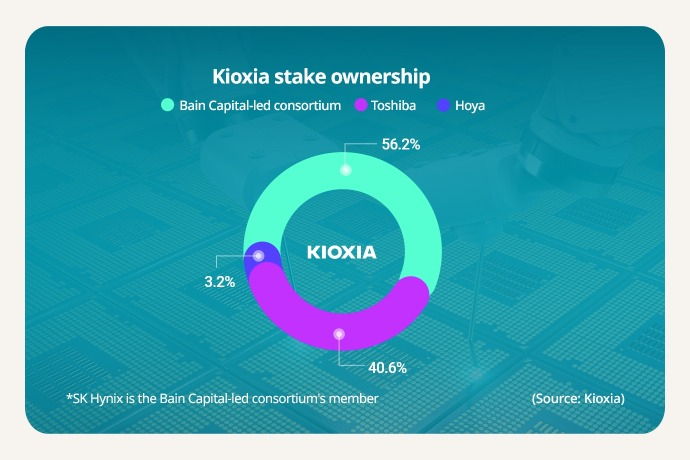

SK Hynix holds a 19% stake in Kioxia indirectly via a Bain Capital-led consortium, which in 2018 acquired the former semiconductor division of Toshiba Corp. for $18 billion.

Bain Capital has been seeking to merge Kioxia, the world’s No. 2 NAND flash manufacturer with fourth-ranked Western Digital, to fight the prolonged memory industry slump.

If Kioxia and Western Digital merge, their combined share in the global NAND memory market would also jump to be on par with or bigger than that of current leader Samsung Electronics Co., which commanded 31.4% as of the end of September last year.

But the proposed deal needs to get the nod from SK Hynix and other major shareholders.

Kioxia and Western Digital control 14.5% and 16.9% of the NAND flash market, respectively, as of the end of September last year. Second-ranked SK Hynix commands 20.2% of the market.

To court SK Hynix’s approval of their combination, Kioxia has offered SK Hynix the opportunity to produce semiconductors at its plants in Japan, Reuters reported last month, citing Jiji Press.

Industry observers see a high possibility of SK Hynix collaborating with Kioxia to produce HBM chips in Japan to meet the soaring demand.

If Kioxia accepts the collaboration offer, SK Hynix is expected to manufacture HBMs and expand their output at Kioxia’s existing plants in Kitakami, Iwate Prefecture and Yokkaichi, Mie Prefecture, Japan.

The partnership is expected to cement SK Hynix’s leadership in the HBM segment, which it almost evenly splits with Samsung Electronics.

Kioxia will likely transform NAND flash lines into those for HBMs, used for generative AI applications, high-performance data centers and machine learning platforms, contributing to a revival in Japan’s semiconductor market.

For the HBM3, SK Hynix is a key supplier to Nvidia Corp. The next-generation, high-capacity memory is embedded in Nvidia's AI accelerators.

Japan aims to triple the sales of its chip manufacturing companies to 15 trillion yen ($100 billion) by 2030. It plans to spend 10 trillion yen to revive its semiconductor industry over the next decade, starting in 2023.

Write to Eui-Myung Park at uimyung@hankyung.com

Yeonhee Kim edited this article.

-

Korean chipmakersSamsung doubles down in HBM race with largest memory

Korean chipmakersSamsung doubles down in HBM race with largest memoryFeb 27, 2024 (Gmt+09:00)

3 Min read -

EarningsSK Hynix swings to profit; sees 60% surge in HBM demand

EarningsSK Hynix swings to profit; sees 60% surge in HBM demandJan 25, 2024 (Gmt+09:00)

3 Min read -

Korean innovators at CES 2024Samsung to double HBM chip production to lead on-device AI chip era

Korean innovators at CES 2024Samsung to double HBM chip production to lead on-device AI chip eraJan 12, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chips

Korean chipmakersSamsung showcases HBM3E DRAM, automotive chipsOct 21, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix may block Kioxia-Western Digital merger

Korean chipmakersSK Hynix may block Kioxia-Western Digital mergerOct 18, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIW

Korean chipmakersHBM market to nearly double; next-gen DRAM to revive demand: KIWSep 11, 2023 (Gmt+09:00)

4 Min read