Korean chipmakers

NAND chips may sustain double-digit price drops in Q4

Some NAND chip producers may slash production to reduce losses, TrendForce says

By Sep 27, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

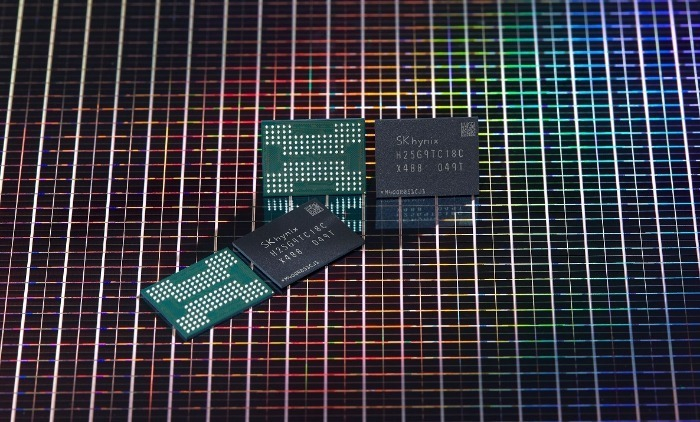

NAND flash memory chip prices are expected to sustain a double-digit decline in the fourth quarter of this year due to oversupply and waning demand, according to research firm TrendForce.

The price of NAND flash chips dropped by 13-18% on average in the current quarter as memory chipmakers “began offering rock-bottom prices” to reduce inventory, the research house said in a note published on Monday.

It forecast that all types of NAND chips will suffer a 15-20% price decline in the October-December quarter.

The price drops may push NAND flash manufacturers to sell their memory chips at a loss, putting pressure on some of them to slash production “as a way to reduce losses,” it noted.

In June, SK Hynix Inc., the world’s second-largest memory chipmaker, decided to hold off on a 4.3 trillion won ($3.3 billion) plan to build a new NAND chip factory amid falling chip prices.

“Price competition among suppliers is bound to intensify as more products enter the market,” it said, referring to the recent releases of upgraded solid-state storage device (SSD) models. Flash memory chips are embedded in an SSD.

In April, SK Hynix unveiled an advanced SSD, equipped with 128-layer 4D NAND chips as the semiconductor industry is shifting toward higher-density and faster semiconductor chips.

“Since the market is generally pessimistic regarding demand next year, the status of manufacturer transactions has been poor and inventory pressure has not eased significantly," TrendForce added.

End-product manufacturers retain high inventory levels in both whole devices and components and thus their willingness to buy flash memory chips has decreased.

For DRAM chips, the market tracker projected a 13-18% drop on-quarter in fourth-quarter prices in a recent separate note, on top of a 10-15% decline in the third quarter.

Samsung Electronics Co., the world’s top memory chipmaker, is forecast to report an 18.7% fall on-year to 12.9 trillion won in third-quarter operating profits, according to research firm FnGuide.

Operating profits at SK Hynix, which derives more than 90% of its sales from memory chips, will likely slide 38.8% on-year to 2.6 trillion won, FnGuide said.

Write to Sung-Soo Bae at baebae@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flash

Korean chipmakersSamsung’s $22 bn new chip plant up and running to make NAND flashSep 07, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix unveils world's first 238-layer NAND; Samsung SSD 20 times faster

Korean chipmakersSK Hynix unveils world's first 238-layer NAND; Samsung SSD 20 times fasterAug 03, 2022 (Gmt+09:00)

3 Min read -

-

Korean chipmakersUS chipmakers announce 10% hike in NAND flash prices

Korean chipmakersUS chipmakers announce 10% hike in NAND flash pricesMar 02, 2022 (Gmt+09:00)

1 Min read

Comment 0

LOG IN