Chips, forex gains shore up Samsung's Q2 earnings

Samsung expects a much slower memory chip bit growth in 2023, and flat to slightly lower smartphone sales in H2, 2022

By Jul 28, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

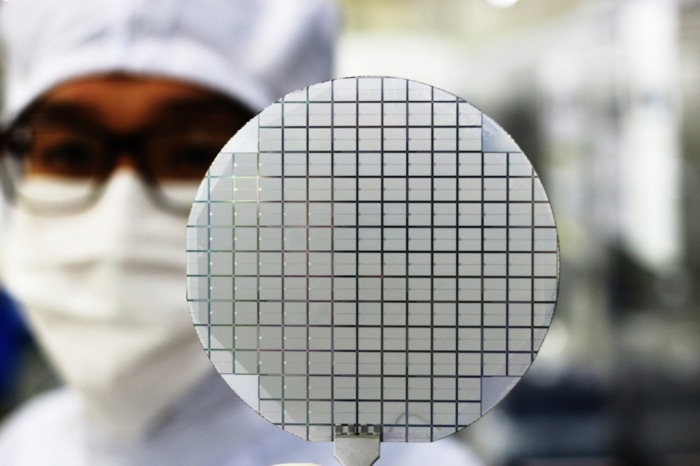

Samsung Electronics Co.’s second-quarter earnings remained steady compared to three months before, with robust memory chip sales for data center servers offsetting softer demand for personal computers and mobile gadgets.

The semiconductor division was the only one among Samsung’s five segments that saw a year-on-year growth in operating profit. Its operating profit surged 44% on-year to 10 trillion won ($7.7 billion), accounting for 41% of the company’s quarterly operating profit as a whole.

The world’s largest memory chipmaker on Thursday reported a 14.1 trillion won ($12 billion) operating profit for the April-June quarter, little changed from the first quarter’s 14.12 trillion won.

Quarterly revenue came in at 77.2 trillion won versus 77.78 trillion in the first quarter. But it reversed its record-setting revenue growth of the previous three quarters, hit by declining sales of smartphones and home appliances.

Year-on-year, operating profit leapt 12.18%, with sales up 21.25%.

SEMICONDUCTOR DIVISION

Foreign exchange gains further boosted the second-quarter sales of semiconductor chips to a record high. The weaker won boosted translation gains from overseas sales.

By contrast, sales of smartphones, TVs and home appliances decreased by one-third to 360 billion won in aggregate from the year previous. Three other segments, including displays and mobile networks, posted a slight on-year decline in operating profit.

The Russia-Ukraine war and an economic slowdown slammed consumer goods segments, which is likely to leave Samsung’s second-half smartphone sales little changed or slightly lower on-year.

“Particularly, we took a hit from a steeper-than-expected demand fall for mobile products,” a Samsung executive told a second-quarter conference call.

“NAND Flash, used mainly in consumer goods, showed a noticeable decline, compared with DRAM chips.”

But memory chips for data center servers are expected to prop up its semiconductor division on the back of growing demand for both in-house servers and public clouds.

MICROCHIPS

Earlier this week, Samsung made its first shipment of 3-nanometer semiconductor chips, or the industry’s most advanced chips, ahead of foundry leader Taiwan Semiconductor Manufacturing Company (TSMC).

The company is working on its upgraded version to mass produce them from 2024. To do so, it is developing its second-generation gate-all-around (GAA) transistor technology.

“We’ve already secured a large mobile application company as a customer (for the second-generation microchip) and will diversify our product lines of mobile chips,” the executive said.

As for DRAM bit growth, or increasing bits stored per unit area, Samsung said its bit growth in 2023 would be much slower than previous years due to ongoing component shortages and delayed deliveries of production equipment.

Also, the executive cited the increasing difficulty of reducing nanometers for faster computer processing.

DISPLAYS, TVs

Samsung pulled out of the LCD business in the first half of this year due to price competition with Chinese rivals. Now it is switching toward advanced display models such as OLED, quantum dot and automotive displays.

To make up for falling demand in the TV market amid an economic downturn, Samsung will pivot to premium products such as Neo QLED, which has a higher resolution than other displays and superlarge-size TVs, as well as MicroLED TVs in various sizes, or light-emitting diode (LED) display TVs.

CAPITAL EXPENDITURES

Asked about whether to adjust facility investment plans lower in light of growing economic uncertainties, Samsung neither confirmed nor denied such market speculation.

“About short-term facility investment, we will flexibly respond to market conditions,” another Samsung executive said during the call.

In May, its parent Samsung Group’s announced its largest-ever investment plan of 450 trillion won over the next five years.

Meanwhile, Samsung seeks to add 7,000 employees this year alone, most of them will be dispatched to foundry business lines, as it is ratcheting up competition with bigger rival TSMC, sources with knowledge of the matter said on Tuesday.

Write to Ji-Eun Jeong at jeong@hankyung.com

Yeonhee Kim edited this article

-

Korean chipmakersSamsung to ramp up hiring for foundry business

Korean chipmakersSamsung to ramp up hiring for foundry businessJul 27, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung Elec. celebrates world's first shipment of 3-nanometer chips

Korean chipmakersSamsung Elec. celebrates world's first shipment of 3-nanometer chipsJul 25, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung presents Texas with $200 bn chip investment plan proposition

Korean chipmakersSamsung presents Texas with $200 bn chip investment plan propositionJul 22, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung develops world’s fastest graphics DRAM chip

Korean chipmakersSamsung develops world’s fastest graphics DRAM chipJul 14, 2022 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung Elec's Q2 earnings signal end of upward run

Korean chipmakersSamsung Elec's Q2 earnings signal end of upward runJul 07, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung's 3 nm chip narrows microchip gap with TSMC

Korean chipmakersSamsung's 3 nm chip narrows microchip gap with TSMCJun 30, 2022 (Gmt+09:00)

3 Min read -

EarningsSamsung’s stock underlines cloudy outlook despite record Q1

EarningsSamsung’s stock underlines cloudy outlook despite record Q1Apr 28, 2022 (Gmt+09:00)

4 Min read