Samsung raises $2.2 billion via ASML stake sale for chip investment

The chipmaker will spend the funds to expand its facilities in Pyeongtaek, Korea and Taylor, Texas

By Aug 15, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Samsung Electronics Co., the world’s largest memory chipmaker, has sold 3.55 million shares in Dutch chip equipment maker ASML Holding N.V. for an estimated 3 trillion won ($2.2 billion).

With the sale of the shares amounting to a 0.9% stake in the second quarter, Samsung’s stakeholdings in ASML fell to 0.7% from the first quarter’s 1.6%, according to Samsung’s first-half business report.

In 2012, the South Korean tech giant bought ASML shares amounting to a 3% stake for a strategic partnership and has since trimmed its shareholdings to book gains from the hike in the Dutch firm’s share prices.

ASML’s shares, listed on the Nasdaq, have risen significantly on expectations of a sooner-than-expected chip industry recovery. In mid-May, the stock hit a one-year high of $735.93. On Monday, the stock closed at $666.55 in the US market.

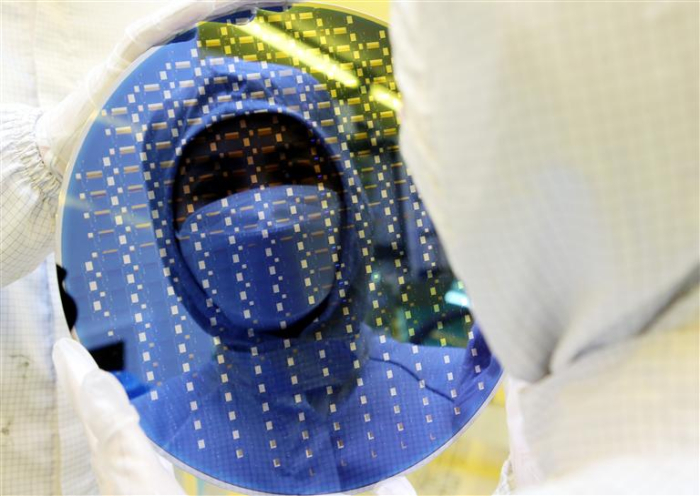

ASML is the world’s only maker of chip manufacturing machines, known as extreme ultraviolet (EUV) scanners that uses lithography technology,

In the semiconductor industry, having cutting-edge equipment to produce advanced chips is crucial to chipmakers' survival, particularly foundries that make products for others, such as fabless firms and chip designers.

One of those devices is the EUV scanner used to draw elaborate and detailed patterns on semiconductor wafers.

ASML counts most leading chipmakers among its clients, including foundry leader Taiwan Semiconductor Manufacturing Co. (TSMC), Intel Corp. and SK Hynix Inc.

FUNDS FOR CHIP INVESTMENT

With the 3 trillion won raised, Samsung is expected to ramp up efforts to expand its chipmaking facilities in Korea and abroad to stay ahead of rivals when the chip market rebounds from the current slump, industry sources said.

The Korean chipmaker has said it won’t cut chip investment even when the market is in a quandary.

The company earmarked 25.2 trillion won in capital expenditures for facility investments in the first half, of which 90% went to chip facility expansion and upgrades.

The first-half spending is a 24% increase from 20.2 trillion won in the year-earlier period.

In the second quarter, Samsung posted 670 billion won in operating profit on a consolidated basis – its worst performance in 14 years. Sales fell 22.3% on-year to 60 trillion won.

Its chip business posted an operating loss of 4.36 trillion won in the second quarter.

While Samsung’s dismal second-quarter chip losses underscore the severity of the semiconductor industry downturn, most leading chipmakers have expressed optimism that the market would stage a rebound in the latter half of this year.

Echoing such views, Samsung said the memory market will likely rebound as early as the fourth quarter.

Industry officials said the foundry segment could see a gradual recovery as early as the current quarter.

Samsung is currently spending heavily to expand its foundry facilities in Pyongtaek, Korea and a plant in Taylor, Texas.

STRONG TIES WITH ASML REMAIN INTACT

Analysts said Samsung’s recent sale of its stake in ASML won’t negatively affect its relationship with the Dutch firm.

As ASML’s second-largest client, Samsung has worked to keep the partnership solid. Samsung Chairman Jay Y. Lee has dropped by the company every time he visits Europe.

To raise money for chip investments, Samsung also sold its 1.6% stake worth $1.3 billion in Chinese electric vehicle and rechargeable battery maker BYD Co. in 2021.

In the first half, Samsung also received a record 21.85 trillion won in dividends from its overseas affiliates, a 158-fold increase from 137.8 billion won in the year-earlier period.

Samsung said the dividends will be used to expand chip plants in Korea and abroad.

As of the end of 2022, Samsung, on a consolidated basis, held 115.23 trillion won in cash and cash equivalents.

On a standalone basis, the company had 3.92 trillion won in cashable assets at end-2022.

Write to Jeong-Soo Hwang and Ik-Hwan Kim at hjs@hankyung.com

In-Soo Nam edited this article.

-

EarningsSamsung Elec shares regain momentum after narrower chip loss in Q2

EarningsSamsung Elec shares regain momentum after narrower chip loss in Q2Jul 27, 2023 (Gmt+09:00)

6 Min read -

EarningsSamsung chip turnaround likely in second half after dismal Q2

EarningsSamsung chip turnaround likely in second half after dismal Q2Jul 07, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Electronics makes 17-fold gains from investment in ASML

Korean chipmakersSamsung Electronics makes 17-fold gains from investment in ASMLJun 05, 2023 (Gmt+09:00)

3 Min read -

EarningsSamsung bets on H2 recovery with heavy spending after record chip losses

EarningsSamsung bets on H2 recovery with heavy spending after record chip lossesApr 27, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSamsung ‘demanding customer’ for ASML as orders rise

Korean chipmakersSamsung ‘demanding customer’ for ASML as orders riseFeb 20, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersIntel’s curious revelation of its ASML deal raises questions

Korean chipmakersIntel’s curious revelation of its ASML deal raises questionsJan 21, 2022 (Gmt+09:00)

1 Min read