Foundry competition

Intel’s curious revelation of its ASML deal raises questions

The unusual announcement may be aimed at addressing market concerns about its chipmaking capabilities, analysts say

By Jan 21, 2022 (Gmt+09:00)

1

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Intel Corp.’s recent announcement that it is buying a new, advanced chipmaking tool from ASML Holding N.V. has raised questions about the ulterior motive behind its revelation, as it is rare for the relevant parties to make public what is usually kept in secret in the semiconductor industry.

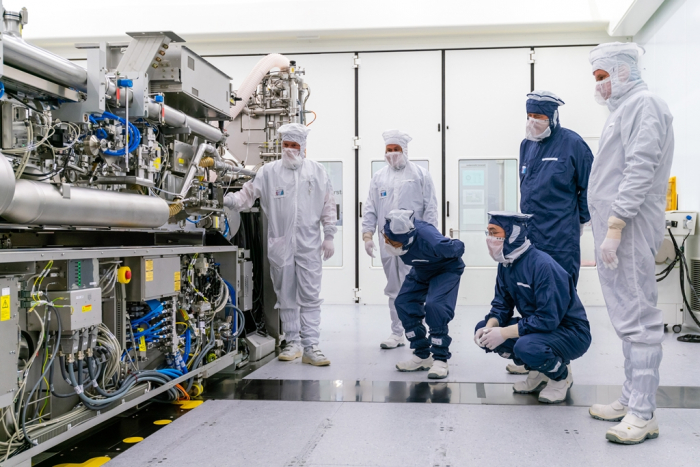

The US chipmaker said on Wednesday it has placed orders with ASML for the delivery of the TWINSCAN EXE:5200 system, the Dutch chip equipment maker’s next-generation extreme ultraviolet (EUV) lithography machine.

Intel’s purchase of the tool with more than 200 wafer-per-hour productivity is part of its plans to deploy the industry’s highest numerical aperture technology to enable its roadmap of transistor innovations, the two companies said in a joint statement.

The latest EUV machine’s technology is more advanced than the equipment with which top foundry player Taiwan Semiconductor Manufacturing Co. produces chips via its 3-nanometer chip processing node.

Industry watchers said Intel will likely use the new machines to make more advanced 2 nm chips.

CHALLENGE TO TSMC, SAMSUNG

In March of 2021, Intel announced that it is reentering the contract chip manufacturing market to challenge TSMC and Samsung Electronics Co. which have dominated the foundry sector for years.

While announcing billions of dollars of investment in the chip business, Intel said at the time it aims to produce a 1.8 nm chip by 2024 – a move industry watchers say could be far-fetched.

The US chipmaker’s unusual announcement of its deal with ASML may be aimed at addressing market concerns about its capabilities, they said.

Intel is currently building two foundry production lines in Arizona with $20 billion in investment.

Four years ago, Intel said it was withdrawing from the chip foundry market after its technology failed to produce chips with 10 nm and below process node.

Samsung, the world’s No. 2 foundry player, said in October it will be able to commercialize a 2 nm transistor process technology by 2025 to take on TSMC at the leading edge of chip processing for fabless firms, including chip designers.

Write to Shin-Young Park at nyusos@hankyung.com

In-Soo Nam edited this article.

More to Read

-

SemiconductorsUncertainty clouds Samsung as paradigm shifts toward profitability

SemiconductorsUncertainty clouds Samsung as paradigm shifts toward profitabilityOct 28, 2021 (Gmt+09:00)

4 Min read -

SemiconductorsSamsung overtakes Intel as foundry looms as next battlefield

SemiconductorsSamsung overtakes Intel as foundry looms as next battlefieldAug 02, 2021 (Gmt+09:00)

3 Min read -

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMC

Foundry competitionIntel’s jump into foundry sets off alarm bells for Samsung, TSMCMar 24, 2021 (Gmt+09:00)

3 Min read -

Foundry competitionSamsung to ramp up EUV scanners to take on foundry leader TSMC

Foundry competitionSamsung to ramp up EUV scanners to take on foundry leader TSMCMar 15, 2021 (Gmt+09:00)

3 Min read -

Samsung’s Lee hastens to Netherlands in intense rivalry with TSMC

Samsung’s Lee hastens to Netherlands in intense rivalry with TSMCOct 11, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN