Samsung's foundry sales nearly match DRAM revenue

Its foundry sales have narrowed their gap with DRAM revenue to the smallest level ever

By Mar 20, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

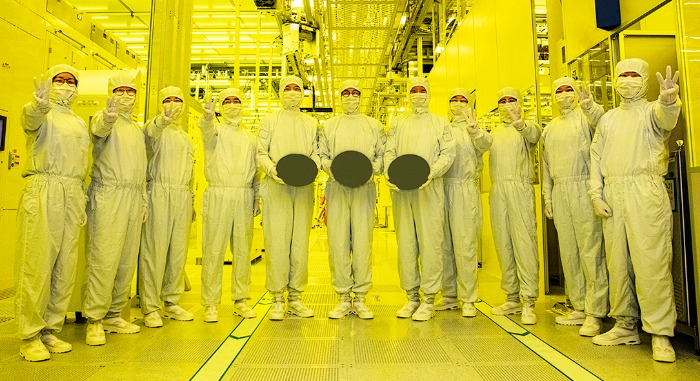

Contract chipmaking sales at Samsung Electronics Co. nearly matched its DRAM chip revenue in the final quarter of last year, narrowing their sales gap to the smallest level ever.

Despite the shrinking semiconductor market and declining chip prices, Samsung’s foundry business remained resilient and fared better than global competitors. Its sales are expected to outstrip those of Samsung's mainstay memory chips for the first time for all of 2023.

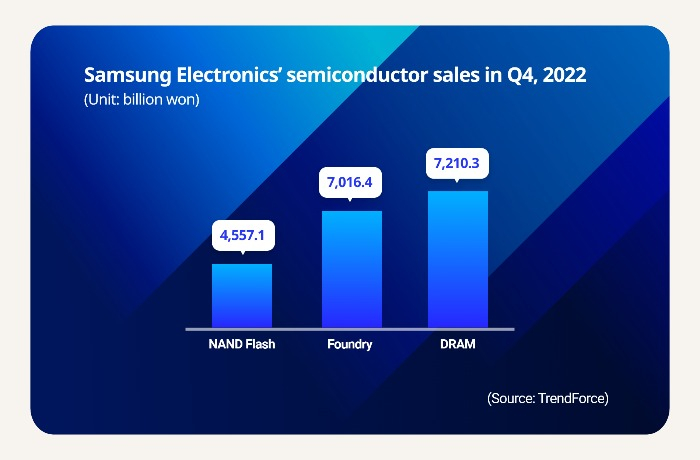

The world’s top memory chipmaker posted 7 trillion won ($5.4 billion) in foundry sales in the October-December quarter of 2022, according to research firm TrendForce on Sunday.

The figure is close to its DRAM sales of 7.2 trillion won ($5.5 billion) in the same period and marked their narrowest gap ever.

In the third quarter, Samsung’s foundry revenue came to 7.3 trillion won, versus 9.6 trillion won from DRAMs.

Based on the fourth-quarter results, contract chip manufacturing for chip designers and fabless companies will likely produce more revenue than each of the DRAM and NAND flash chips for Samsung, which lags far behind Taiwan's TSMC Co.

The sharply reduced gap between foundry and DRAM sales was attributable in large part to a double-digit drop in DRAM prices, alongside the rapid fall in NAND flash prices. By comparison, foundry companies enjoyed steady demand for sophisticated and user-specific chipsets.

The foundry chip business is less susceptible to economic cycles than DRAM and NAND flash, hit hard by softening demand from manufacturers of PCs, smartphones and other electronic gadgets.

Compared to NAND flash, Samsung’s foundry sales already exceeded the former's revenue for the first time in the third quarter of 2022. Sales from NAND flash chips reached 5.6 trillion won in the quarter, versus the foundry division's 7.3 trillion won.

In the fourth quarter, foundry sales further widened the gap with NAND flash revenue, which stood at 4.6 trillion won.

The world’s 10 leading foundry companies saw their fourth-quarter sales decline 4.7% on average, versus three months before.

Samsung’s foundry revenue dwindled by 3.5%. But its market share edged up 0.3 percentage points to 15.8% on-quarter in the fourth quarter of 2022.

DRAM prices plummeted 23% on-quarter in the October-December period, with NAND flash prices down 28%.

Samsung controls half of the world’s DRAM market, while accounting for 30% of NAND chip supplies.

According to research firm Omdia, sales from Samsung’s foundry business are forecast to reach $20 billion to $25 billion this year, outstripping DRAM’s projected revenue of $17 billion to $18 billion.

Write to Sungsu Bae at Baebae@hankyung.com

Yeonhee Kim edited this article.

-

Korean chipmakersSystem on chips: Samsung’s new high-stakes foundry business

Korean chipmakersSystem on chips: Samsung’s new high-stakes foundry businessMar 09, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung eyes wider foundry client base with Ambarella deal

Korean chipmakersSamsung eyes wider foundry client base with Ambarella dealFeb 21, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip sales

Korean chipmakersSamsung’s foundry revenue exceeds mainstay NAND chip salesDec 13, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung Foundry: Driving force behind digital transformation

Korean chipmakersSamsung Foundry: Driving force behind digital transformationDec 01, 2022 (Gmt+09:00)

5 Min read -

Korean chipmakersSamsung Elec to expand foundry business to tackle TSMC

Korean chipmakersSamsung Elec to expand foundry business to tackle TSMCOct 24, 2022 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung to ramp up hiring for foundry business

Korean chipmakersSamsung to ramp up hiring for foundry businessJul 27, 2022 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung flexes foundry muscle amid supply chain woes

Korean chipmakersSamsung flexes foundry muscle amid supply chain woesDec 15, 2021 (Gmt+09:00)

3 Min read