Energy

KEPCO sells 15% stake in KEPCO E&C for $269 million

S.Korea’s debt-ridden state-run utility company sold the stake to Mirae Asset’s SPC to secure funds to ease its liquidity crunch

By Jan 02, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Korea Electric Power Corp. (KEPCO), South Korea’s state-owned utility company grappling with mounting losses, has secured additional funds of about 350 billion won ($268.6 million) from selling its 15% stake in subsidiary KEPCO Engineering & Construction Co. (KEPCO E&C).

According to sources from the local power industry on Tuesday, KEPCO sold its 14.77% stake, or 5,645,094 shares, in KEPCO E&C to a special purpose company formed by Mirae Asset Securities Co. at 62,000 won apiece in a price return swap (PRS) deal.

Under the term, the parties have to make up the difference to each other if KEPCO E&C's stock price either rises above or falls below the sale price of 62,000 won.

KEPCO raised 350 billion won from the stake sale, and its stake in the subsidiary fell to 51%, enough to control KEPCO E&C’s management. It is still the largest shareholder, followed by No. 2 shareholder Korea Development Bank with 32.9%.

The stake sale comes after KEPCO failed to sell its partial stake in the subsidiary via after-hours block trading late last year.

The proceeds from the stake sale are expected to enable KEPCO to sell new corporate bonds this year to lower its snowballing debt, topping 200 trillion won.

KEPCO CAN SELL MORE BONDS

According to the Korea Electric Power Corporation Act, the state-run utility firm is allowed to issue bonds worth up to five times the sum of its equity capital and reserves.

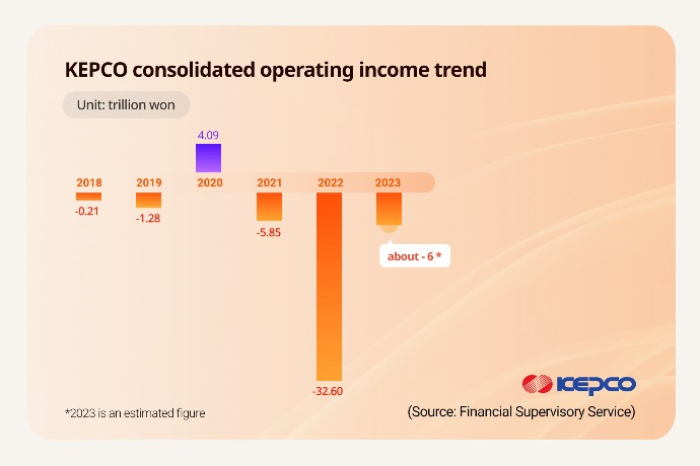

But considering that KEPCO is estimated to have logged an operating loss of about 6 trillion won in 2023, its bond issuance limit would decrease to 74.5 trillion won, falling short of its current debt sale balance of 80.1 trillion won.

This means the Korean utility company would not be able to issue new corporate bonds this year after its book closure in March and should repay 5.6 trillion won worth of bonds immediately.

To prevent such a dire state of affairs, KEPCO late last year asked its six power-generating subsidiaries and KEPCO KDN Co. to pay it interim dividends worth about 3.2 trillion won, which helped the utility giant reduce its operating losses.

Coupled with this, the successful sale of its stake in KEPCO E&C will elevate the company’s bond issuance ceiling for more bond sales this year.

But industry observers said dividend payments from its subsidiaries and subsidiary stake sales are only temporary measures and clearly limited solutions to improving KEPCO’s ailing financial health suffering from cumulative losses of about 40 trillion won since 2021.

KEPCO has been in a vicious circle of increasing bond sales and snowballing debt, which could lead to credit rating downgrades, and in turn, higher borrowing costs, warned its new chief Kim Dong-cheol, who took the helm in September last year.

In May last year, Moody’s cut KEPCO’s baseline credit assessment, a gauge of a company’s debt credibility – from baa2 to baa3, the lowest investment grade.

KEPCO E&C shares rose 3.1% to end at 64,000 won on Tuesday, whereas KEPCO shares closed down 0.3% at 18,840 won.

Write to Sul-Gi Lee at surugi@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Leadership & ManagementKEPCO's new CEO heralds electricity rate hikes, drastic reforms

Leadership & ManagementKEPCO's new CEO heralds electricity rate hikes, drastic reformsSep 20, 2023 (Gmt+09:00)

4 Min read -

EnergyMoody’s cuts credit view on KEPCO to lowest investment grade

EnergyMoody’s cuts credit view on KEPCO to lowest investment gradeMay 26, 2023 (Gmt+09:00)

1 Min read -

EarningsKEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling losses

EarningsKEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling lossesMay 12, 2023 (Gmt+09:00)

4 Min read -

Corporate bondsKEPCO raises $368 mn via bond issuance on heated demand

Corporate bondsKEPCO raises $368 mn via bond issuance on heated demandNov 29, 2022 (Gmt+09:00)

1 Min read -

Corporate bondsKEPCO turns from bonds to banks for money on govt plans

Corporate bondsKEPCO turns from bonds to banks for money on govt plansNov 21, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN