KEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling losses

Self-rescue measures and an electricity bill hike won't likely save S.Korea’s state-run utility firm from massive losses

By May 12, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s state-run utility monopoly Korea Electric Power Corp. (KEPCO) on Friday vowed to save nearly 26 trillion won ($19.5 billion) over the next five years in what would be its most aggressive self-rescue measures ever, while its chief offered to step down over the company’s mounting losses.

This is KEPCO’s additional financial reform plan upon requests from the ruling People Power Party and the government that rejected its previous measures, saying they were not aggressive enough to restructure the organization.

The latest plan to save 25.7 trillion won until 2026 is 5.6 trillion won more than the previous savings target announced last year.

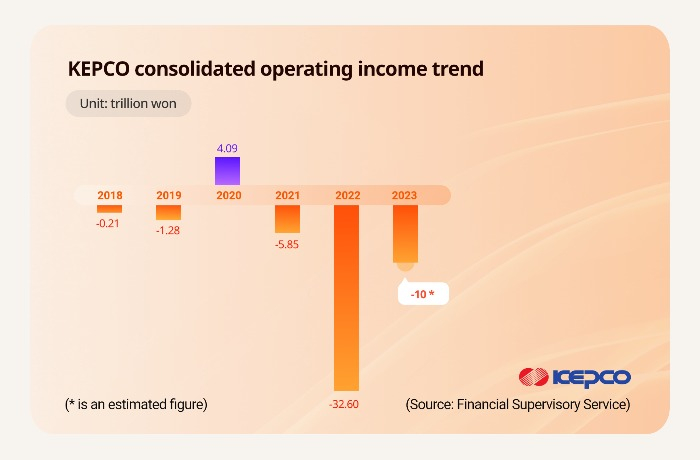

The state-run power company has released a series of reform measures as it in 2022 logged a record-high operating loss of 32.6 trillion won, more than quadruple that of the previous year.

Despite the ballooning losses, KEPCO could not raise electricity bills enough to offset the galloping energy import prices and untamed inflation due to the government’s cap on drastic utility bill hikes that could cause heavy financial burdens on households.

The country’s electricity rates were finally upped by 13.1 won per kilowatt hour (kWh) in the first quarter of this year ending in March, which was considered not enough.

Taking responsibility for the streak of losses, KEPCO President and CEO Cheong Seung-il on the same day offered to leave office. The ruling party has demanded the departure of the CEO, who was appointed during the previous Moon Jae-in government backed by the opposition Democratic Party.

Cheong's original term ends in May next year.

Following the announcement of the latest KEPCO rescue measures and the chief’s resignation offer, another hike in Korea’s electricity rate for the second quarter is expected to be announced next Monday.

MOST AGGRESSIVE SELF-RESCUE PLAN

KEPCO's most aggressive reform plans include the sale of real estate assets owned by the company and affiliates across the nation.

It plans to sell its main office building in Seoul’s financial district of Yeouido, which is valued at about 1 trillion won. It will also rent part of its art center in southern Seoul and other buildings.

Another measure includes a freeze on the wages of senior officials, and the company has asked rank-and-file employees to join the move to help improve its financial health.

Its labor union, however, denounced such a suggestion, saying that the move was made without its consultation, and the company has been forced by the government to cut costs and come up with unrealistically aggressive reform measures at the cost of employee benefits.

The company will also streamline the organizational structure through digitalization and aims to shave costs by about 5 trillion won through the rescheduling of its power facility construction and a cut in power purchases.

CALL FOR DOUBLE-DIGIT RATE HIKES

But without bolder power bill hikes, the latest measures won’t ensure a turnaround for the company, which is forecast to report about 10 trillion won in operating losses for this year.

The country’s industry ministry is expected to announce an electricity rate hike of 7 won per kWh for the second quarter next week despite KEPCO’s call for a 51.6 won hike for this year to return to profit.

KEPCO on Friday afternoon announced in a regulatory filing that it posted a 6.18 trillion won operating loss on a consolidated basis in the first quarter ending March, narrowing from a 7.79 trillion won loss a year ago.

Sales added 31.2% on-year to 21.59 trillion won in the quarter, and the net loss was reduced to 4.91 trillion won from 5.92 trillion won over the same period.

The company took a heavy toll from zooming energy import prices early last year due to high inflation, later exacerbated by Russia’s attack on Ukraine. Energy prices have dropped from last year’s peak but not enough to fully revive debt-ridden KEPCO.

“KEPCO will likely continue to suffer losses this year with a 7 won hike per kWh unless international energy prices plummet,” said Park Kwang-soo, a senior researcher at the Korea Energy Economics Institute.

To secure working capital the state-run utility monopoly with a Triple-A credit rating heavily borrowed money from the bond market last year.

The coupon rate of its AAA-rated bonds jumped to the high 5% range late last year from 2.71% early last year. It even turned to local banks to secure funds after its massive debt sales disturbed the local bond market.

It has already sold 9.95 trillion won worth of bonds to date this year, nearly one-third last year's total debt sales of 31.80 trillion won.

KEPCO shares on Friday ended at 19,700 won, up 1.9% from the previous session.

Write to Han-Shin Park and Sul-Gi Lee at phs@hankyung.com

Sookyung Seo edited this article.

-

EnergyKorea’s debt-ridden public companies selling off overseas coal mines

EnergyKorea’s debt-ridden public companies selling off overseas coal minesApr 10, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea’s inflation picks up 5.2% in January on high utility prices

EconomyKorea’s inflation picks up 5.2% in January on high utility pricesFeb 02, 2023 (Gmt+09:00)

3 Min read -

Corporate bondsKEPCO raises $368 mn via bond issuance on heated demand

Corporate bondsKEPCO raises $368 mn via bond issuance on heated demandNov 29, 2022 (Gmt+09:00)

1 Min read -

Corporate bondsKEPCO turns from bonds to banks for money on govt plans

Corporate bondsKEPCO turns from bonds to banks for money on govt plansNov 21, 2022 (Gmt+09:00)

3 Min read -

EarningsKEPCO to see record loss 2022 on slower power tariff hikes

EarningsKEPCO to see record loss 2022 on slower power tariff hikesNov 11, 2022 (Gmt+09:00)

1 Min read -

EnergyS&P lowers KEPCO’s stand-alone credit rating to non-investment grade

EnergyS&P lowers KEPCO’s stand-alone credit rating to non-investment gradeMay 27, 2022 (Gmt+09:00)

2 Min read