KEPCO's new CEO heralds electricity rate hikes, drastic reforms

S.Korea’s state-run utility company faces mounting losses due to the country’s low power rates, its main revenue source

By Sep 20, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s near-monopoly power company Korea Electric Power Corp. (KEPCO) is expected to raise electricity rates and lessen its outsized reliance on power generation by exploring new revenue sources to stay afloat, its new chief hinted.

“The most pressing issue we now face is how to end the current financial crisis,” KEPCO President and CEO Kim Dong-cheol said during his inauguration ceremony on Wednesday.

“It is a must to normalize electricity rates, especially at a time when international oil prices are galloping again, and the US dollar is strengthening.”

The new CEO’s call for normalization of electricity rates hints at a possible rate hike in the fourth quarter of this year, market analysts say.

The Korean government is also eyeing the recent rebound in global oil prices and the stronger US dollar, and their impact on KEPCO’s financial health, said an official from Korea’s Ministry of Trade, Industry and Energy.

Kim, a former four-term lawmaker, has become the state utility company’s first politician-turned-CEO since its inception more than six decades ago.

RECORD-HIGH OPERATING LOSS

He has arrived to rescue the debt-ridden KEPCO after its former chief, Cheong Seung-il, stepped down from the position in May, about a year before his term was to end, to take responsibility for the company’s streak of losses.

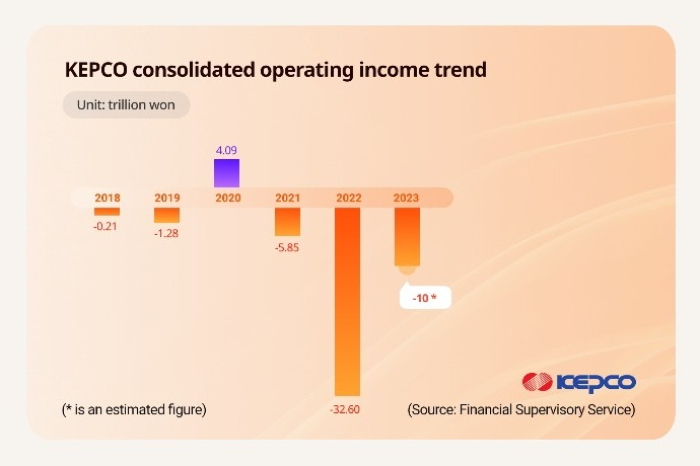

In 2022, KEPCO logged a record-high operating loss of 32.6 trillion won ($24.6 billion), more than quadruple that of the previous year. This year, Its loss is estimated at 10 trillion won.

The key culprit for its massive losses is the country’s cheap electrical rates, on which it heavily depends as a revenue source.

Because KEPCO is a state-owned utility company, however, it does not have the right to decide its rates but must consult with the government.

Fearing heavy financial burdens on households, the government has been reluctant to raise KEPCO's already cheap rates, even when global energy prices skyrocketed after Russia’s attack on Ukraine in early 2022.

After failing to increase electricity rates last year, KEPCO’s losses have snowballed.

To turn a profit, KEPCO has called for a 51.6 won hike this year but a series of rate hikes this year have fallen far short of that figure.

To cover its funding shortfalls, KEPCO has aggressively sold its bonds. It raised 10.3 trillion won from debt sales by May, reaching nearly one-third of last year’s total issuance of 31.8 trillion won.

CALL FOR COMPREHENSIVE BUSINESS REFORM

The company will soon reach its bond sale ceiling as it is caught in a vicious cycle of growing bond sales and mounting debt, which could lead to credit rating downgrades, and in turn, higher borrowing costs, said Kim.

Since 2021, the company’s debts have piled up to 47 trillion won and its total debt ratio has shot up to 600%, with total liabilities of 201 trillion won as of end-June. That's the largest amount among listed firms in the country, Kim noted.

In May, Moody’s cut KEPCO's baseline credit assessment — a gauge of a company’s debt credibility — from baa2 to baa3, the lowest investment grade.

“Overly cheap electricity rates below production costs will exacerbate energy bingeing and escalate energy import costs, which would aggravate the national trade deficit,” said Kim.

The new CEO has called on the company's employees to find new revenue sources beyond power sales.

He sees KT Corp., which successfully transformed from a landline phone service company into a digital platform company; and POSCO Holdings Inc., a former steelmaker that reinvented itself as an advanced materials company, as role models.

Italian utility company Enel Group is a foreign peer that KEPCO could emulate, said Kim, noting that Enel’s operating profit reached 16 trillion won last year after its successful business diversification, centered on the addition of the renewable energy business.

“If KEPCO holds ownership of new and renewable energy businesses, the nation’s power production costs would drop and cushion the blow from any rate hikes,” said Kim.

Along with renewable energy, the new CEO has vowed to reinvigorate KEPCO’s nuclear power business, which was one of President Yoon Suk Yeol’s presidential campaign pledges.

Under the new CEO, KEPCO’s delayed self-rescue plan, including the sale of property and cuts in employee benefits, which have met with strong opposition from its labor union, are expected to gain traction.

Write to Han-Shin Park at phs@hankyung.com

Sookyung Seo edited this article.

-

EnergyMoody’s cuts credit view on KEPCO to lowest investment grade

EnergyMoody’s cuts credit view on KEPCO to lowest investment gradeMay 26, 2023 (Gmt+09:00)

1 Min read -

EarningsKEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling losses

EarningsKEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling lossesMay 12, 2023 (Gmt+09:00)

4 Min read -

EarningsKEPCO to see record loss 2022 on slower power tariff hikes

EarningsKEPCO to see record loss 2022 on slower power tariff hikesNov 11, 2022 (Gmt+09:00)

1 Min read -

EarningsKEPCO at record loss on fuel costs; wider losses seen in 2022

EarningsKEPCO at record loss on fuel costs; wider losses seen in 2022Feb 25, 2022 (Gmt+09:00)

2 Min read