Electronics

Samsung ups smaller OLED workforce to fend off Chinese rivals

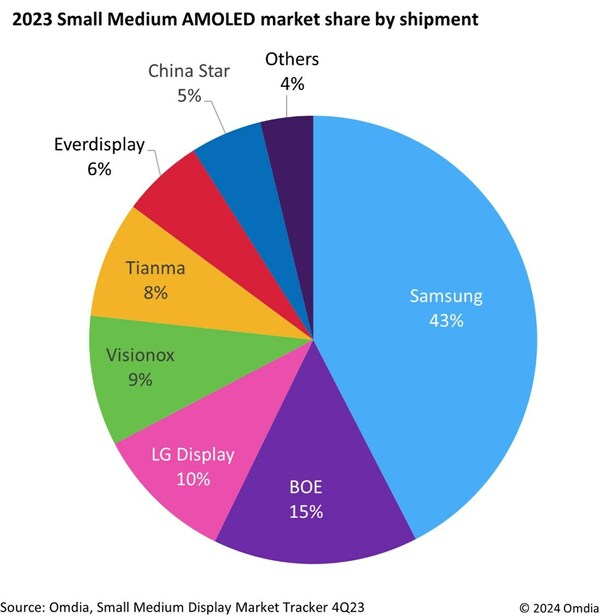

Samsung Display’s global AMOLED market share fell to 43% in 2023 from 56%, while BOE’s share rose to 15% from 12%

By Apr 04, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Display Co., South Korea’s top screen maker, increased its workforce for smaller organic light-emitting diode (OLED) panels used for portable information technology devices such as smartphones to deal with the rapid ascent of Chinese rivals including BOE Technology Group Co.

Leading global smartphone maker Samsung Electronics Co.'s display subsidiary transferred about 500 engineers of large OLED panels, about 30% of the big screen developers, to the divisions for small and medium-sized product development, according to industry sources on Thursday.

“Samsung ramped up its development workforce first to keep technology competitiveness as its best defense to fend off Chinese rivals' fast growth powered with low-priced products,” said an industry source in Seoul.

The market for smaller OLED panels has swelled on strong demand growth for new products such as extended reality (XR) devices and automotive displays, while the large OLED panel sector has shrunk on the sluggish TV market. The smaller OLED panel market was forecast to more than triple to $8.9 billion by 2029 from an estimated $2.5 billion this year, according to industry research firm Omdia.

Samsung Display still dominated the market in 2023 but Chinese competitors are biting into its market share.

The South Korean supplier to Apple Inc. made up 43% of the global active matrix organic light emitting diode (AMOLED), a type of OLED display device for IT products such as smartphones, last year, down from 56% in 2022, Omdia said.

Meanwhile, BOE increased its share in the market to 15% from 12% during the period.

GLOBAL DISPLAY LEADER

South Korea had led the global display market for 17 years before ceding the throne to China in 2021 when the Chinese started to dominate the global liquid-crystal display (LCD) market with cheap products.

Chinese display makers expanded their market shares in the smaller OLED panel sector helped by the government’s support and strong domestic demand.

The market share differential between China and South Korea narrowed to 10 percentage points last year from about 40 percentage points in 2022. Samsung Display and its local competitor LG Display Co. accounted for a combined 53% of the global AMOLED market last year, while their Chinese rivals such as BOE and Visionox Technology Inc. made up 43%, according to Omdia.

“Since Chinese AMOLED makers have large demand for smartphones domestically, they will continue to increase their shipments and close the gap in shipment share with industry leader Samsung,” Hiroshi Hayase, Omdia’s display research manager, said in a note.

Samsung Display President & CEO Choi Joo Sun warned that it is just a matter of time for Chinese companies to catch up with South Korean makers in the OLED industry.

“Korean OLED technology is ahead of the Chinese only by one or one and a half years,” Choi told reporters.

In the foldable display market, Samsung Display surrendered its top position with a 36% market share in the fourth quarter of last year to BOE with a 43% share.

The Chinese display giant is expected to increase its market share as smartphone makers in the mainland are aggressively expanding their presence in the global foldable smartphone market.

“Concerns are snowballing that South Korea may also cede its dominance in the OLED sector after giving up the LCD sector to China,” said an industry source in Seoul.

SHIFT FROM LARGE TO SMALL

South Korean display makers need to maintain their dominance in the smaller OLED panel sector to keep their leadership in the overall OLED industry.

The large OLED panel industry lost steam as the global TV market has been in a doldrum. Global TV shipments were predicted to shrink 9.7% to 196 million units this year from 217 million units in 2020, according to industry tracker TrendForce Corp.

On the other hand, demand for smaller OLED panels is expected to keep growing, especially as Apple expands its use for such panels from iPhones to iPads, MacBooks and Vision Pros. The move is expected to intensify competition among global panel suppliers from 2026, industry sources said.

Samsung Display, the frontrunner in the sector, is building the world’s first 8.6-generation IT OLED line in South Korea slated to start mass production in 2026 to maintain the leadership. The 8.6-generation manufacturing line specialized in monitors and tablets is expected to ramp up its price competitiveness by doubling its production capacity compared to the existing sixth-generation line.

The company unveiled a plan to invest 4.1 trillion won ($3 billion) in April 2023 to establish a production line to manufacture 10 million OLED panels for laptops a year.

Samsung Display aims to reclaim the top spot in the global display segment in 2027 through the facility.

LG Display, the world’s top manufacturer of large-size OLED panels, also decided to spend 416 billion won out of the 1.3 trillion won it raised last month on smaller products, although it has yet to decide on the investment in an eighth-generation production line.

The company is expected to accelerate the investment once it completes the sale of its LCD panel plant in Guangzhou, China, for 1.5 trillion won in the first half, industry sources said.

Chinese display makers are also aggressively investing in the smaller OLED sector. BOE announced a plan to build its first 8.6-generation OLED production facility in Chengdu with an investment of 63 billion yuan ($8.7 billion) last year.

Write to Chae-Yeon Kim at why29@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

ElectronicsSamsung Display surrenders foldable screen throne to BOE

ElectronicsSamsung Display surrenders foldable screen throne to BOEMar 15, 2024 (Gmt+09:00)

2 Min read -

-

ElectronicsLG Display to raise $971 mn in rights offering for OLED business

ElectronicsLG Display to raise $971 mn in rights offering for OLED businessMar 04, 2024 (Gmt+09:00)

1 Min read -

ElectronicsLG Display to pull out of LCD business; BOE, CSOT eye Guangzhou plant

ElectronicsLG Display to pull out of LCD business; BOE, CSOT eye Guangzhou plantFeb 20, 2024 (Gmt+09:00)

3 Min read -

ElectronicsLG Display plans $1 bn rights offering for smaller OLED biz

ElectronicsLG Display plans $1 bn rights offering for smaller OLED bizDec 18, 2023 (Gmt+09:00)

2 Min read -

ElectronicsITC launches probe into Samsung’s suit vs China’s BOE over OLED

ElectronicsITC launches probe into Samsung’s suit vs China’s BOE over OLEDDec 01, 2023 (Gmt+09:00)

3 Min read -

ElectronicsSamsung Elec to invest $3.1 bn in S.Korean OLED plant

ElectronicsSamsung Elec to invest $3.1 bn in S.Korean OLED plantApr 04, 2023 (Gmt+09:00)

2 Min read

Comment 0

LOG IN