LG Display to pull out of LCD business; BOE, CSOT eye Guangzhou plant

LG expects to complete the deal, estimated at up to $1.5 billion, by the end of June and increase spending on OLEDs

By Feb 20, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Display Co. has put its liquid crystal display (LCD) panel plant in Guangzhou, China up for sale as the South Korean display panel maker plans to pull out of the LCD business.

LG Display is selling the Guangzhou plant, its last remaining LCD factory, and some Chinese companies have already shown interest, people familiar with the matter said on Tuesday.

The Korean company has received letters of intent (LOI) from at least four firms, including BOE Technology Group Co. and China Star Optoelectronics Technology Co. (CSOT), as well as financial investors, according to investment banking industry sources.

BOE and CSOT are the world’s two largest LCD makers.

LG plans to complete the sale by the end of June and the deal’s value is estimated at up to 2 trillion won ($1.5 billion), sources said.

LG Display has been contacting potential buyers under the table and is now officially putting the factory on the block.

The Guangzhou plant is LG Display’s first overseas production base that began operations in 2014.

LG has so far invested about 4 trillion won in the Chinese plant, which has two production lines, GP1 and GP2, which have a monthly production capacity of 100,000 and 200,000 panels, respectively.

The Guangzhou plant boasts several advanced LCD manufacturing technologies, including IPS, or in-plane switching, which improves image quality and viewing angles.

LG FACES FIERCE COMPETITION WITH CHINESE RIVALS

LG’s decision to pull out of the LCD business comes as it is struggling to compete with Chinese rivals that churn out such panels in large quantities at highly competitive prices, leading to a steady fall in panel prices globally.

Back in the mid-2000s, Korea led the global LCD TV panel market with LG and its crosstown rival Samsung Display Co. accounting for nearly half of global shipments of such displays.

However, Chinese players, led by BOE and CSOT, emerged as formidable competitors, armed with generous state subsidies.

Korean LCD makers have been losing money for years while Chinese companies have rapidly increased their global market share with cheaper panels.

Amid sharp LCD panel price declines, LG Display posted an operating loss of 2.09 trillion won in 2022 and such losses widened to 2.5 trillion won last year.

Under pressure, Samsung abandoned its LCD business and withdrew from the market in 2020, citing worsening profitability.

Industry officials said LG Display’s Guangzhou plant is attractive as it currently counts leading TV makers such as LG Electronics Inc., Samsung Electronics Co. and Japan’s Sony Corp. as well as big Chinese TV makers among its major clients.

“The Guangzhou plant is attractive as it is strategically located and its depreciation and amortization costs are almost finished,” said an industry official.

OLED, THE NEXT BIG THING

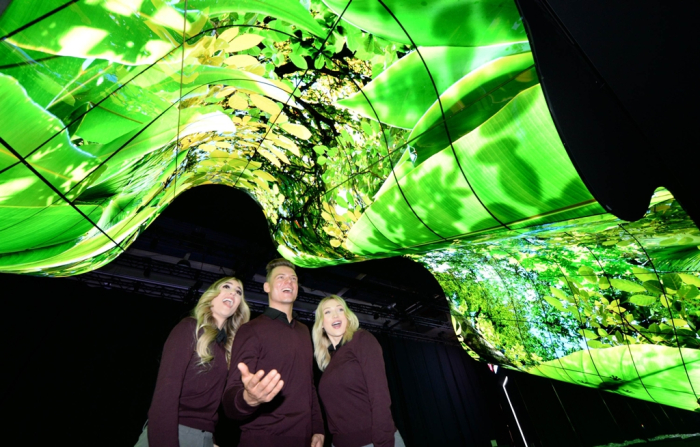

When the Guangzhou plant sale is completed, LG Display is expected to increase its investment in its organic light-emitting diode (OLED) panel business.

Korean display makers are shifting their focus to OLED panels, in which they have a competitive edge over Chinese companies in terms of manufacturing technology.

LG Display, already the world’s top OLED TV panel maker, plans to raise funds to expand its OLED production facilities.

Last March, the company borrowed 1 trillion won from LG Electronics and raised $600 million in syndicated loans from banks earlier this year.

LG Display also plans a rights offering worth 1.36 trillion won next month to raise funds.

With those funding activities, LG is expected to invest in its P10 plant in Paju, north of Seoul, to build a production line for 8.6th-generation panels used in information technology devices.

OLEDs have become the mainstream in the TV and smartphone segments.

OLED is highlighted by self-illuminating pixels that do not require a separate light source, allowing manufacturers to produce lightweight, thin and flexible display products, appealing to high-end consumers.

Write to Jun-Ho Cha at chacha@hankyung.com

In-Soo Nam edited this article.

-

ElectronicsSamsung to launch 83-inch OLED TVs equipped with LG panels in Europe

ElectronicsSamsung to launch 83-inch OLED TVs equipped with LG panels in EuropeSep 14, 2023 (Gmt+09:00)

2 Min read -

AutomobilesGenesis GV80 to come with LG’s OLED auto display in close tie-up

AutomobilesGenesis GV80 to come with LG’s OLED auto display in close tie-upJul 03, 2023 (Gmt+09:00)

3 Min read -

ElectronicsSamsung Display to dump entire stake in LCD equipment maker

ElectronicsSamsung Display to dump entire stake in LCD equipment makerJun 29, 2023 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomSamsung, LG, Sony vie for mixed-reality OLED display market

Tech, Media & TelecomSamsung, LG, Sony vie for mixed-reality OLED display marketJun 23, 2023 (Gmt+09:00)

3 Min read -

ElectronicsDisplay makers LG, Samsung gear up for OLED gaming monitor boom

ElectronicsDisplay makers LG, Samsung gear up for OLED gaming monitor boomJun 12, 2023 (Gmt+09:00)

2 Min read -

ElectronicsLG Display unveils world’s first high-resolution stretchable display

ElectronicsLG Display unveils world’s first high-resolution stretchable displayNov 08, 2022 (Gmt+09:00)

2 Min read -

ElectronicsLG Display set to benefit from post-pandemic automotive display boom

ElectronicsLG Display set to benefit from post-pandemic automotive display boomAug 19, 2022 (Gmt+09:00)

2 Min read -

ElectronicsLG Display to close LCD TV panel business for domestic use in Korea

ElectronicsLG Display to close LCD TV panel business for domestic use in KoreaJul 28, 2022 (Gmt+09:00)

1 Min read -

ElectronicsLG Display to drastically cut LCD output as Chinese rivals churn it out

ElectronicsLG Display to drastically cut LCD output as Chinese rivals churn it outMay 02, 2022 (Gmt+09:00)

3 Min read