Electronics

LG Display to drastically cut LCD output as Chinese rivals churn it out

Korean display makers are focusing instead on the OLED market, where they are far ahead of Chinese firms technologically

By May 02, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

LG Display Co., a major South Korean display panel maker, plans to drastically cut production of its liquid crystal display panels for TVs, as it faces growing competition from Chinese panel manufacturers.

Starting this month, LG Display is cutting back on its input of glass substrates on its LCD assembly lines in Paju, Korea and Guangzhou in China, with an aim to slash TV LCD panel output by more than 10% in the second half compared to the first half, people familiar with the matter said on Monday.

However, the company will not entirely withdraw from the LCD business in the near future while increasing the production of value-added organic light-emitting diode panels, the sources said.

Samsung Display Co., LG’s crosstown rival, has already said it is pulling out of the LCD business by the end of 2022, citing worsening profitability.

LG’s decision to significantly lower its TV LCD panel output comes as it is struggling to compete with Chinese rivals that churn out such panels in large quantities at highly competitive prices, leading to a steady fall in panel prices globally.

According to industry tracker Omdia, the average 55-inch LCD TV panel price fell 30% over the past six months to $105 in April and is forecast to decline further to $103 this month.

The LCD panel price for 65-inch TVs shed 19.5% over the same period to $173 and is expected to drop to $170 in May.

LG Display has been in the red for years, weighed by subdued panel prices amid a supply glut caused by Chinese manufacturers’ mass production.

“It is getting harder to manufacture LCD panels above production costs amid intensified competition with Chinese companies. Samsung is giving up its LCD panel development and production because it sees panel price declines are not temporary,” said a local display industry official.

HEYDAY OVER

Profit margins from LCD panels have been steadily declining as Chinese manufacturers, led by BOE Technology Group Co. and China Star Optoelectronics Technology Co. (CSOT), are rapidly increasing their share with cheaper panels.

As of end-2021, BOE was the world’s top LCD panel maker with a 26.3% market share and $28.6 billion in sales.

Back in the mid-2000s, Korea led the global LCD TV panel market with Samsung and LG accounting for nearly half of global shipments of such displays.

In the first quarter of this year, LG Display posted 38.3 billion won ($30.2 million) in operating profit on revenue of 6.47 trillion won, down 93% and 6%, respectively, from the year-earlier period.

The panel price fall is expected to accelerate in the second half as LCD TV demand is weakening at a faster-than-expected rate with people quickly returning to their pre-pandemic lifestyles after a long period of stay-at-home guidelines.

Industry watchers said LG Display may eventually abandon its LCD business as it finds it harder to maintain price competitiveness against its Chinese rivals.

NEXT BIG THING: OLEDs

Korean display makers are shifting their focus to OLED panels, in which they have a competitive edge over Chinese companies in terms of manufacturing technology.

Due to high technological barriers, Chinese panel makers are barely producing OLED panels, while Korean companies dominate the market.

Omdia data showed LG Display controlled 99.7% of the OLED TV panel market in 2021, while Samsung Display had the remaining 3%.

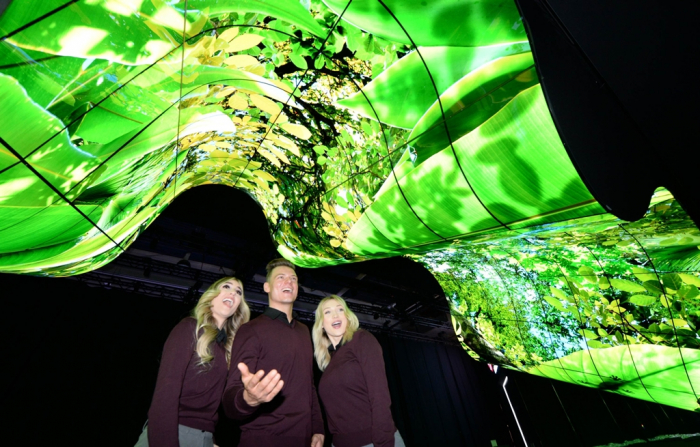

OLED is highlighted by self-illuminating pixels that do not require a separate light source, allowing manufacturers to produce lightweight, thin and flexible display products, appealing to high-end consumers.

Samsung Display said in May last year it plans to spend as much as 3 trillion won to build a new OLED line for small-size panels used in smartphones and laptops.

One of its key clients is Samsung Electronics Co., the world’s largest smartphone maker. OLED panels are becoming increasingly mainstream in the smartphone display segment.

“Korean display makers should increase their OLED investments to keep their industry leadership. Otherwise, it could be just a matter of time before they are again overtaken by Chinese rivals,” said an industry official.

Write to Ji-Eun Jeong at jeong@hankyung.com

In-Soo Nam edited this article.

More to Read

-

ElectronicsOLED materials makers set to shine as Samsung, Sony unveil new TVs

ElectronicsOLED materials makers set to shine as Samsung, Sony unveil new TVsMar 21, 2022 (Gmt+09:00)

3 Min read -

ElectronicsLG launches world’s first 42-inch OLED TV in UK at £1,399

ElectronicsLG launches world’s first 42-inch OLED TV in UK at £1,399Feb 18, 2022 (Gmt+09:00)

2 Min read -

ElectronicsLG welcomes Samsung’s likely re-entry into OLED TV market

ElectronicsLG welcomes Samsung’s likely re-entry into OLED TV marketJan 05, 2022 (Gmt+09:00)

2 Min read -

-

Samsung pulls out of LCD panel market to bet on quantum dot OLED

Samsung pulls out of LCD panel market to bet on quantum dot OLEDAug 31, 2020 (Gmt+09:00)

2 Min read

Comment 0

LOG IN