Electronics

Samsung Display surrenders foldable screen throne to BOE

Samsung Elec to launch the Galaxy Z Fold6, Flip6 in H2 while mulling cheaper foldable smartphones for the long term

By Mar 15, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Chinese smartphone manufacturers’ aggressive push for foldable models has threatened the dominance of Samsung Electronics Co., the world’s second-largest mobile phone maker, and its screen subsidiary Samsung Display Co. in the high-end device market.

Samsung Display, South Korea’s top display producer, accounted for 36% of the global foldable display market in the fourth quarter of 2023, while China’s BOE Technology Group Co. made up 42%, according to industry analysis firm DSCC.

The outlook for Samsung Display remained dark as the Chinese display giant was expected to ramp up supplies to Huawei Technologies Co., which plans to launch a new foldable smartphone model in the first quarter.

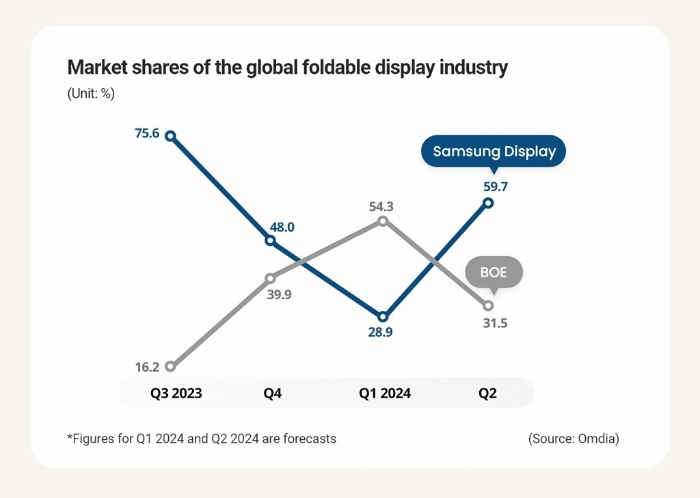

Samsung Display’s foldable display market share is forecast to fall to 28.9% by revenue in the January-March period from 48% in the previous three months, while BOE’s share was predicted to jump to 54.3% from 39.9%, industry tracker Omdia said.

BOE is likely to ship 2.56 million foldable display units, more than double Samsung Display’s 1.25 million units, according to Omdia.

The South Korean company is expected to reclaim the throne in the foldable screen sector in the second quarter as Samsung Electronics is likely to increase orders for such displays ahead of its launch of new foldable smartphones in the third, industry sources in Seoul said. Omdia also predicted Samsung Display’s share to rebound to 59.7% in the July-September period.

HUAWEI TO TOP FOLDABLE PHONE MARKET

Industry sources doubted if the recovery is sustainable, however, as Chinese smartphone makers such as Huawei and Honor are aggressively expanding their shares in the global foldable phone market.

Sales of Chinese makers’ foldable phones soared 106% in the third quarter of 2023 from a year earlier as those companies offered premium smartphones at some 30% lower prices than Samsung Electronics’ models. Patriotism also grew among Chinese customers amid the intensifying trade war against the US, helping sales of smartphone makers on the mainland, industry sources said.

Chinese foldable phones have been booming rapidly in the country as Huawei’s Mate X5 and Pocket 2 rapidly gained popularity.

The surging sales are expected to help Huawei to top the global foldable smartphone market in the first quarter. DSCC forecasted the Chinese tech behemoth’s share in the world’s foldable phone market at around 40% in the first quarter, while Samsung was predicted to only account for a share in the high-10%.

“Chinese makers are increasing the launches of foldable smartphones to beat Samsung amid a lack of new models by (Samsung),” said an electronics maker source in Seoul.

The maker of the Galaxy Z series and Samsung Display is taking measures to deal with the rapid growth in the Chinese rivals.

Samsung Electronics is scheduled to release the Galaxy Z Fold6 and Flip6 in the second half while considering lower-end foldable models for the long term.

Samsung Display has ramped up production yields and changed bezel manufacturing processes to improve productivity and maintain performance competitiveness over Chinese makers.

Write to Jeong-Soo Hwang at hjs@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

ElectronicsSamsung to develop Galaxy Fold, Flip-customized games

ElectronicsSamsung to develop Galaxy Fold, Flip-customized gamesOct 08, 2023 (Gmt+09:00)

3 Min read -

Comment 0

LOG IN