Economy

Semiconductors power Korea’s tech exports to 15-month high

Semiconductor exports rise 19.3% to $11,1 billion in December with overseas sales of memory chips up 57.5%

By Jan 16, 2024 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s tech products exports rose for a second straight month to a 15-month high in December 2023 as overseas sales of semiconductors enjoyed double-digit growth for the second straight month, government data showed on Tuesday, adding to hopes that Asia’s fourth-largest economy's recovery momentum is gathering steam.

Exports of information and communications technology (ICT) products rose 8.1% to $18.3 billion last month, the largest increase since September 2022, according to the Ministry of Science and ICT. Overseas sales of ICT goods, which made up about 30% of the country’s total exports in 2023, grew 7.6% in November.

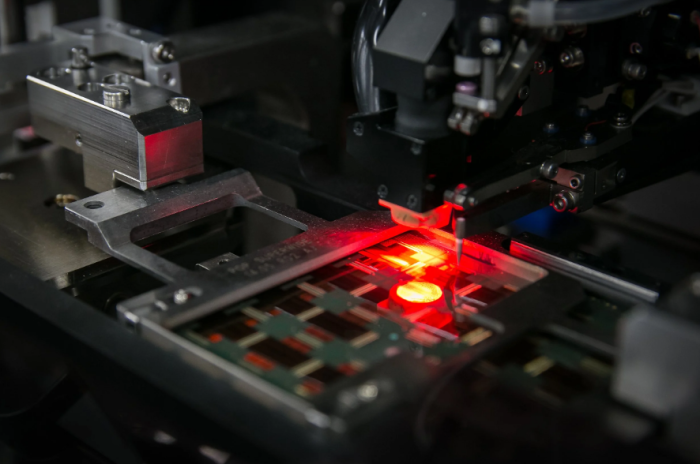

Semiconductor exports advanced 19.3% on-year to $11.1 billion in December, nearly double the 10.7% rise the previous month. Overseas sales of memory chips soared 57.5% to $7 billion last month as their prices rose for three straight months. South Korea is home to the world’s two largest memory chipmakers – Samsung Electronics Co. and SK Hynix Inc.

Display exports rose 7.3% to $1.7 billion, extending their growth streak to five months, as strong demand for mobile device screens raised outbound shipments of organic light-emitting diode (OLED) models and liquid-crystal displays (LCDs).

On the other hand, mobile phone exports dipped 1% to $940 million as overseas sales of parts fell 9.5%, offsetting an 83.6% jump in finished smartphone exports.

Exports of computers and peripherals skidded 29.6% and shipments of communications equipment declined 25.5% as the slowing global economy hurt investments in communications infrastructures.

EXPORTS TO CHINA, VIETNAM UP

Tech product sales to China including Hong Kong rose for the second straight month, gaining 16.3% to $7.9 billion.

“Exports to China, the production base for major ICT devices such as PCs and mobile phones, are showing signs of improvement centered on parts thanks to the global ICT demand recovery,” the ministry said in a statement.

ICT exports to Vietnam where global tech giants such as Samsung operate smartphone factories advanced 4.3% to $2.9 billion on higher shipments of displays for mobile devices, extending their rising streak to five months.

Sales of tech goods to the US, the world’s largest economy, grew 2.5% to $2.6 billion on strong exports of chips, smartphones and secondary batteries.

Shipments to the EU and Japan, however, fell 8% and 2.7%, respectively.

South Korea’s total imports of ICT products slipped 7.2% to $10.9 billion last month, resulting in a trade surplus of $7.3 billion for those goods.

Separately, the country’s total exports rose 5% to $57.6 billion in December, the largest since July 2022, from a year earlier on strong sales of semiconductors, cars and ships, customs data showed. Imports skidded 10.8% to $53.2 billion, producing a trade surplus of $4.5 billion, according to the data.

In 2023, the country’s overseas sales slid 7.5% to $632.4 billion, while imports fell 12.1% to $642.6 billion, resulting in a trade deficit of $10.2 billion.

Write to Kyung-Ju Kang at qurasoha@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

EarningsSamsung’s narrowed Q4 chip losses fuel bullish 2024 outlook

EarningsSamsung’s narrowed Q4 chip losses fuel bullish 2024 outlookJan 09, 2024 (Gmt+09:00)

4 Min read -

Korean chipmakersChip cycle hits rock bottom but uncertainty lingers: Chey

Korean chipmakersChip cycle hits rock bottom but uncertainty lingers: CheyDec 19, 2023 (Gmt+09:00)

2 Min read -

EconomyS.Korea’s chip exports rebound, ending 15-month losing streak

EconomyS.Korea’s chip exports rebound, ending 15-month losing streakDec 01, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returns

Korean chipmakersSamsung, SK Hynix expect high 2024 profits as memory market returnsNov 30, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN