Korea’s inflation rebounds in August on extreme weather

The country’s headline inflation is expected to stabilize around 3% in the fourth quarter of this year

By Sep 05, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s headline inflation re-accelerated at the fastest rate in four months above 3% in August after the extreme summer weather hiked agricultural prices but is expected to slow later this year on eased personal service prices, according to the country’s central bank.

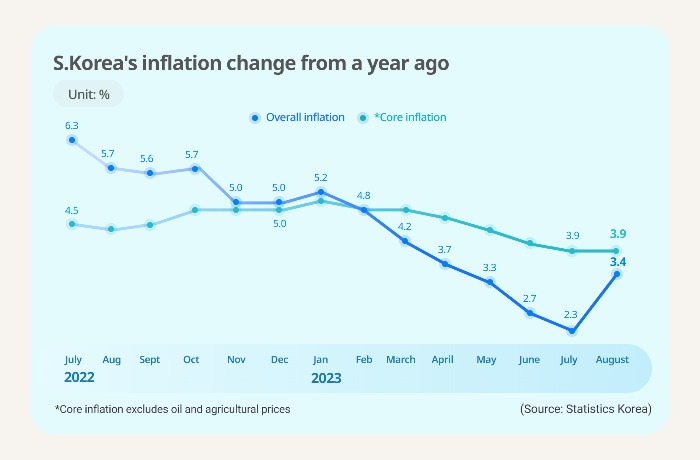

Consumer prices jumped 3.4% in August from the same month last year, the fastest since April when inflation added 3.7%, according to Statistics Korea on Tuesday.

Since February, the country’s inflation has been easing, rising at the slowest pace of 2.3% in 25 months in July. But it returned to the 3% level after three months.

It added 1.1 percentage points from a month ago, the biggest on-month gain since the addition of 1.1 percentage points in September 2000.

The extremely hot weather, coupled with torrential rains, hiked agricultural prices by 5.4% in the month from the prior year, accelerating overall inflation, according to the data.

Considering that the core inflation remained unchanged in August from the previous month, the rebound in Korea’s inflation last month was largely owing to one-off factors such as the harsh weather conditions, and the overall trend has not changed from its latest easing course, Kim Bo-kyung, a senior official at Statistics Korea, said during a press briefing on Tuesday.

Core inflation, which excludes oil and agricultural prices, increased 3.9% on-year in August, unchanged from July and the lowest since April last year with a 3.6% gain.

Core inflation less food and energy prices tracked by the Organization for Economic Co-operation and Development (OECD) also stayed unchanged on-month at 3.3%, the slowest in 16 months.

RATE CUT IN 2024

The Bank of Korea echoed the view, saying that Korea’s inflation moved broadly in line with expectations and citing the rapid rise in oil and agricultural prices as the cause for the faster-than-expected gain last month.

“The gain (in OECD core inflation) stayed unchanged (at 3.3%) in August, suggesting the inflation is still on a slowdown trend,” BOK Deputy Governor Kim Woong said on Tuesday.

Kim expected a similar move or slight rise in consumer prices in September but inflation would hover around 3% in the fourth quarter on a continued slowdown in personal service prices and stabilized agricultural prices after October.

His comment comes largely in line with BOK Governor Rhee Chang-yong’s forecast on inflation last month. Rhee projected Korea’s consumer prices would rise above 3% in August and September but gradually decline below mid-2% around the second half of next year.

Amid the lackluster recovery in Asia’s fourth-largest economy, the central bank’s inflation forecast further rationalizes a rate cut next year despite the BOK’s warning of mounting household debts.

The BOK kept the policy borrowing cost unchanged at 3.50% in its latest monetary policy meeting last month. The next rate-decision meeting is scheduled for Oct. 19.

EXPENSIVE FRUIT ON BAD WEATHER

In August, fruit prices jumped 13.1% from a year ago, the biggest gain since a 13.6% rise in January last year. The price of apples and peaches soared 30.5% and 23.8%, respectively.

Vegetable prices retreated 1.1% over the same period on the high base effect last year when the atypical heatwave made vegetables extremely expensive. Against July, vegetable prices climbed 16.5%.

Petroleum prices dropped 11.0% on-year, slower than a 25.9% fall in July with an eased base effect. Utility prices rose 21.1%, unchanged from the previous month.

Service prices added 3.0%, while personal service prices grew 4.3%, the slowest since a 4.3% gain in February 2022. Dining-out costs increased 5.3%, the slowest since 4.8% in December 2021.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

-

Central bankBOK chief’s top mission: Soft landing for household debt

Central bankBOK chief’s top mission: Soft landing for household debtAug 24, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK head says Korea inflation to dip below mid-2% in H2 2024

Central bankBOK head says Korea inflation to dip below mid-2% in H2 2024Aug 22, 2023 (Gmt+09:00)

1 Min read -

EconomyS.Korean think-tank lifts inflation forecast on oil prices

EconomyS.Korean think-tank lifts inflation forecast on oil pricesAug 10, 2023 (Gmt+09:00)

2 Min read -

EconomyKorea’s inflation eases to 25-mo low, but poised to rebound in H2

EconomyKorea’s inflation eases to 25-mo low, but poised to rebound in H2Aug 02, 2023 (Gmt+09:00)

3 Min read -

EconomyKorea exports down the most in 3 years; BOK may keep rates

EconomyKorea exports down the most in 3 years; BOK may keep ratesAug 01, 2023 (Gmt+09:00)

1 Min read -