SK Hynix swings to profit; sees 60% surge in HBM demand

Robust AI chip sales drove the turnaround. It will double HBM production capacity in 2024

By Jan 25, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

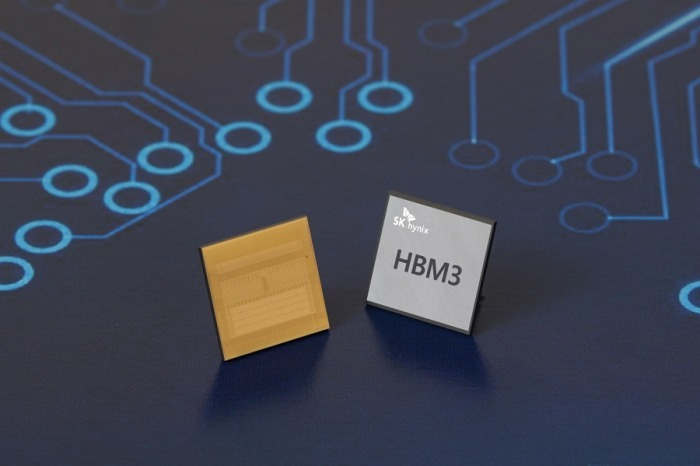

SK Hynix Inc. turned a profit in the last quarter of 2023, reversing losses over the past four quarters as high-performance chips such as double data rate 5 (DDR5) and high bandwidth memory 3 (HBM3) drove rapid sales growth, the company said on Thursday.

The stronger-than-expected results reinforced market expectations for a rebound in the memory chip market. SK Hynix said the AI boom will lead the industry upturn through 2025.

In 2024, the world’s second-largest memory chipmaker will double its production capacity for HBM, demand for which will likely surge 60% per year on average, it said during a conference call.

However, the capacity boost will not lead to a sharp increase in its overall output as it will continue to reduce legacy memory chip production in a shift toward high-value chips, including DDR5.

Its operating profits came in at 346 billion won ($260 million) in the fourth quarter of last year, beating the market consensus of 60.3 billion won, compiled by Yonhap Infomax.

In the same period of 2022, it posted operating losses of 1.9 trillion won, its first in a decade.

“In the fourth quarter of last year, the memory market conditions improved thanks to growing demand for AI server and mobile product chips, alongside their average selling price (ASP) increase,” the company said.

Sales jumped 47% to 11.3 trillion won in the October-December quarter, versus 7.7 trillion won in the year prior.

After it reported its first quarterly loss in the fourth quarter of 2022, the company shocked the market with its record quarterly shortfall of 3.4 trillion won in the first quarter of last year amid the economic slowdown and supply glut.

SK Hynix's quarterly results

unit: trillion won

Source: SK Hynix

SALES OF DDR5 AND HBM3

SK Hynix is the world’s first to develop HBM chips. It is the exclusive provider of HBM3, the fourth-generation HBM, to Nvidia, a global leader in graphic processing units (GPUs) used to power high-performance computing and AI systems.

Its sales of DDR5 and HBM3 in 2023 spiked fourfold and fivefold, respectively, compared to 2022.

Since the launch of ChatGPT, a chatbot developed by Microsoft-backed OpenAI, in late 2022, the generative AI boom has fueled the demand for high-capacity memory chips.

HBM vertically interconnects multiple DRAM chips, dramatically increasing data processing speed compared with general DRAM products. Generative AI requires multiple GPUs.

In all 2023, SK Hynix estimated its operating losses at 7.7 trillion won on a consolidated basis, eclipsing the previous year’s profits of 6.8 trillion won.

Its operating margin was negative 24% in 2023, with sales down 26.6% on-year to 32.8 trillion won.

DEMAND FOR DRAM AND NAND

SK Hynix forecasts demand for DRAM and NAND flash memories to rise by the mid to higher end of the 10% range in 2024, compared to last year.

Their inventories will reach normal levels by the end of the first quarter and the second half of this year, respectively, it added.

Samsung Electronics Co. and SK Hynix -- the world's two largest memory chipmakers -- have cut production of DRAM and NAND flash due to excess inventories in the sector.

Analysts expect SK Hynix to double capital expenditures to between 13 trillion won and 14 trillion won this year, compared to 2023.

Write to Eui-Myung Park at uimyung@hankyung.com

Yeonhee Kim edited this article.

-

Debt financingSK Hynix raises $1.5 bn in foreign bonds amid high demand

Debt financingSK Hynix raises $1.5 bn in foreign bonds amid high demandJan 10, 2024 (Gmt+09:00)

2 Min read -

-

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focus

Korean chipmakersSK Hynix bets on DRAM upturn with $7.6 bn spending; HBM in focusNov 09, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersSK Hynix leads DRAM industry’s Q2 revenue rebound, retakes No. 2 spot

Korean chipmakersSK Hynix leads DRAM industry’s Q2 revenue rebound, retakes No. 2 spotAug 25, 2023 (Gmt+09:00)

2 Min read -

EarningsSK Hynix logs loss for 3rd straight quarter in Q2 but eyes recovery in H2

EarningsSK Hynix logs loss for 3rd straight quarter in Q2 but eyes recovery in H2Jul 26, 2023 (Gmt+09:00)

4 Min read -

Korean chipmakersAI-driven GPU, advanced chip shortage: Boon for Samsung, SK Hynix

Korean chipmakersAI-driven GPU, advanced chip shortage: Boon for Samsung, SK HynixMay 31, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix: key beneficiaries of ChatGPT fever

Korean chipmakersSamsung, SK Hynix: key beneficiaries of ChatGPT feverFeb 13, 2023 (Gmt+09:00)

4 Min read