Blight of failing e-commerce startups in South Korea

VC funding for South Korean e-commerce startups has plunged 90% over the last two years amid the industry’s bleak outlook

By Apr 03, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Linkshops, once touted as a future unicorn candidate in South Korea, declared bankruptcy last month even after garnering 15.4 billion won ($11.4 million) in funding from investors, including renowned US venture capital firm Altos Ventures Management Inc.

It was one of a few Korean e-commerce startups forced to shut down their business amid the grim outlook for the country’s e-commerce market facing growing headwinds, ranging from falling demand in the post-pandemic era to fierce competition from ascending Chinese peers offering better deals.

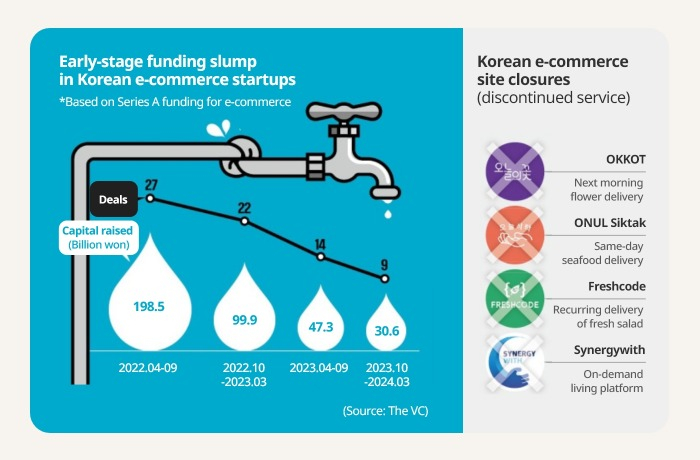

According to data from Seoul-based venture capital and startup funding tracker The VC on Tuesday, total Series A funding for Korean e-commerce startups from October 2023 to March 2024 stood at 30.6 billion won, only one-third the total funding in the same sector during the same period last year.

Over the cited period, total VC deals in the Korean e-commerce sector shrank to nine from 22.

Compared to the same period two years ago when total deals hit 27, total Series A funding have plummeted 90%.

Series A funding rounds, generally raising between $2 million and $15 million, is considered a barometer of a startup’s growth potential given that investors are looking for companies with not only a great idea but also a strong strategy for turning that idea into a successful money-making business.

The slump in Series A funding for e-commerce startups underlines venture capital’s pessimistic views on the e-commerce market.

In stark contrast, AI startups in Korea raised 107.2 billion won in total in Series A funding rounds in the past six months, up 80% from a year ago. Combined deals also increased to 18 from 14 during the same period.

“The money, which chased the e-commerce boom a few years ago, has changed its course to pour in AI and deep technology,” said an official from the VC industry. “Early stage investment in e-commerce is virtually wiped out.”

NO ONE IS SAFE WITHOUT EYE-POPPING INNOVATION

Linkshops, a wholesale clothing brokerage platform, blamed the ascent of China-based fashion platforms offering much cheaper clothes produced and shipped mainly from Guangzhou for its collapse.

Founded in 2015, the Korean e-commerce site facilitated purchases between local and overseas companies and the Dongdaemun and Namdaemun fashion wholesale markets, Korea’s shopping mecca for clothes and other fashion items designed and sold by independent brands and stores.

Given its sudden downfall, its hands were tied and it had no time to find new investors or sell its business, the company said.

Other once-promising Korean e-commerce platforms are in the same boat.

OKKOT, a next-morning wholesale flower delivery platform, and Onul-hoi by Onul Siktak, a same-day fresh seafood delivery marketplace, also discontinued their services.

Salad delivery site Freshcode suffered the same fate.

“Kurly, which already received pre-IPO investment, still grapples with losses, suggesting that it takes a tremendously long time for e-commerce startups to make a profit,” said an official from the related industry. “Venture capitalists have little patience in the funding winter.”

Some investors argue that the Korean e-commerce market is already a red ocean dominated by a handful of big players Coupang Inc. and Gmarket, while leading vertical startups like Kurly Inc. and Ably Corp. fiercely vie for niche markets.

Worse yet, three major Chinese e-commerce operators - AliExpress, Temu and Shein – are rapidly expanding their presence in Korea, posing a big threat to fledgling Korean e-commerce startups.

“There is no room for a new e-commerce platform unless the new one is armed with a surprisingly innovative business model like drone delivery service,” said a venture capital official.

IDEA VERSUS PRICING

As the market is so crowded, pricing has become a key success factor in e-commerce, instead of technology or service, forcing mobile marketplaces to engage in price warfare.

This is a complete U-turn from the industry's earlier startup business strategy of leading market innovation with new services such as Market Kurly’s next-morning delivery or Ably’s AI-powered product curation and suggestion service.

To escape the vicious circle, some e-commerce startups are actively venturing into overseas markets to find fresh demand.

NoTag Shop, a Korean product electric marketplace targeting consumers in Southeast Asia, manages 59 channels across 12 countries, including Hong Kong, Indonesia, Singapore, Malaysia, Taiwan, Vietnam and Thailand.

Go2Joy runs a hotel booking platform in Vietnam, while Maccaron is now India’s largest Korean beauty products e-commerce site.

The three startups have recently succeeded in raising funds in Series A rounds.

Write to Eun-Yi Ko at koko@hankyung.com

Sookyung Seo edited this article.

-

E-commerceKorea probes AliExpress as Chinese e-commerce threat grows

E-commerceKorea probes AliExpress as Chinese e-commerce threat growsMar 07, 2024 (Gmt+09:00)

4 Min read -

-

E-commerceChina’s Temu challenges homegrown e-commerce platforms in Korea

E-commerceChina’s Temu challenges homegrown e-commerce platforms in KoreaOct 19, 2023 (Gmt+09:00)

3 Min read -

EarningsCoupang’s Q2 profit soars to a record, driven by e-commerce

EarningsCoupang’s Q2 profit soars to a record, driven by e-commerceAug 09, 2023 (Gmt+09:00)

1 Min read -

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read -

Korean startupsS.Korean fashion platform Ably attracts $39 mn before Series C round

Korean startupsS.Korean fashion platform Ably attracts $39 mn before Series C roundMar 23, 2023 (Gmt+09:00)

2 Min read -

-

E-commerceKorea's first-generation platforms collapse, ringing in new e-commerce era

E-commerceKorea's first-generation platforms collapse, ringing in new e-commerce eraOct 05, 2021 (Gmt+09:00)

2 Min read