China’s Temu challenges homegrown e-commerce platforms in Korea

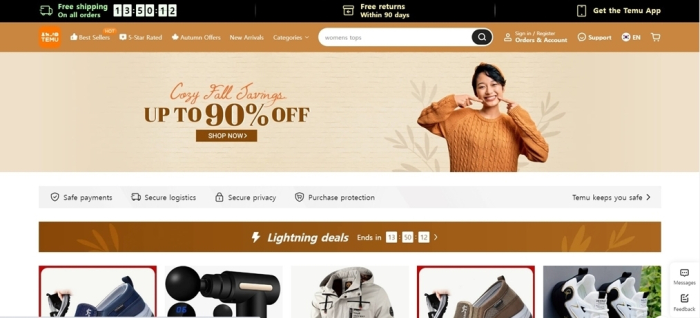

Offering sharply discounted goods and free returns, it has instantly become the most frequently downloaded app

By Oct 19, 2023 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Temu, a popular Chinese discount e-commerce platform that landed in South Korea just a few months ago, has apparently cracked homegrown players’ dominance in the online retail space.

According to data.ai, a global app market analysis service provider, Temu grabbed the No. 1 spot with 399,000 downloads in Korea from Sept. 25 to Oct. 9.

The Disney+ app, which enjoyed market leadership in recent months thanks to the popularity of the over-the-top (OTT) service’s original series “Moving,” came in second with 377,000 downloads.

Chinese tech giant Alibaba’s online shopping app AliExpress ranked third with 257,000 downloads.

Industry watchers took note of the speed with which Chinese e-commerce apps are growing in Korea’s online shopping market.

Data from app analytics firm IGAWorks shows the number of AliExpress’s monthly active users based on Android smartphones alone stood at 2.78 million in September.

That compares with two leading Korean e-commerce platforms – Tmon’s 2.3 million and WeMakePrice’s 2.11 million.

Temu, which began its Korean service in July, has attracted nearly 1 million users since its launch.

ULTRA-LOW PRICES

Chinese discount e-commerce platforms’ decent growth in Korea is linked to their offering of heavily discounted products.

Just like AliExpress, Temu sells a range of products directly from Chinese sellers, such as clothing, jewelry, beauty products and houseware at ultra-low prices.

While AliExpress promotes household items such as chargers, razors and vacuum cleaners for as low as 100 won (7 cents) as “bait products” for Korean consumers, Temu promises up to 99% off and free returns within 90 days.

Temu’s primary customers are price-sensitive middle-aged housewives, whereas AliExpress attracts younger consumers in their 20s to 40s looking for affordable daily necessities.

Operated by Chinese e-commerce giant PDD Holdings Inc., formerly Pinduoduo, Temu allows China-based vendors to sell and ship directly to customers without having to rely on intermediate distributors in the destination country, thus increasing affordability for any buyers.

COUNTERFEIT GOODS

The Chinese online shopping apps’ strategy of ultra-low prices often sparks controversy over counterfeit products in Korea.

Earlier this week, Ray Zhang, chief executive of AliExpress Korea, was summoned to a parliamentary inspection of counterfeit products sold online.

During the National Assembly investigation, Kang Min-kuk, a lawmaker of the ruling People Power Party said AliExpress is selling Korean parliamentary member badges, usually made of gold, at 15,000 won apiece.

Chinese e-commerce firms are also making aggressive forays into the US, Europe and other Asian markets.

According to data.ai, the Temu app was the most frequently downloaded app in the US since its launch in September 2022.

US business news outlet CNBC recently reported that the Temu app has become the No. 1 e-commerce platform in the country with downloads skyrocketing 50 times from 600,000 to 30 million in just one quarter.

In contrast, Amazon’s downloads have dropped off thecliff, falling 40% in a year, according to CNBC.

Temu is ratcheting up its ad spending to infiltrate the American consumer; the company is set to spend an estimated $2 billion in marketing this year.

Write to Ju-Hyun Lee at deep@hankyung.com

In-Soo Nam edited this article.

-

EntertainmentDisney Plus movin’ on up in Korea with hit K-drama series 'Moving'

EntertainmentDisney Plus movin’ on up in Korea with hit K-drama series 'Moving'Sep 06, 2023 (Gmt+09:00)

2 Min read -

EarningsNaver posts record Q2 operating profit on e-commerce, content

EarningsNaver posts record Q2 operating profit on e-commerce, contentAug 04, 2023 (Gmt+09:00)

2 Min read -

E-commerceSingapore-based Qoo10 acquires South Korean e-tailer WeMakePrice

E-commerceSingapore-based Qoo10 acquires South Korean e-tailer WeMakePriceApr 07, 2023 (Gmt+09:00)

1 Min read -

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrs

Mergers & AcquisitionsKKR, Anchor Equity tipped to exit from TMON in 7 yrsAug 26, 2022 (Gmt+09:00)

3 Min read -

E-commerceKorea's first-generation platforms collapse, ringing in new e-commerce era

E-commerceKorea's first-generation platforms collapse, ringing in new e-commerce eraOct 05, 2021 (Gmt+09:00)

2 Min read -

E-commerce platform TMON delays IPO plans

E-commerce platform TMON delays IPO plansJul 23, 2021 (Gmt+09:00)

2 Min read