Corporate restructuring

Samsung Life, Samsung Fire sell $193 mn in Samsung Electronics shares

The stake sales come as Samsung Electronics is slated to retire 3 trillion won worth of treasury shares this week

By Feb 12, 2025 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Life Insurance Co., South Korea’s largest life insurer, and Samsung Fire & Marine Insurance Co., the country’s No. 1 non-life insurance firm, have sold a combined 280 billion won ($193 million) in Samsung Electronics Co. shares.

The two insurance units of Samsung Group sold part of their stakes in affiliate Samsung Electronics in a block trade before the stock market opened on Wednesday.

The stake sales come as Samsung Electronics is slated to retire 3 trillion won worth of treasury shares through Feb. 17, which is expected to push the two insurers' shareholdings in Samsung Electronics beyond the legal limit.

On Tuesday, Samsung Life said in a regulatory filing that its board approved the company’s plan to offload some 4.25 million shares of Samsung Electronics for 236.4 billion won.

Samsung Fire & Marine’s board also decided to sell 743,104 shares for 41.3 billion won.

The shares sold by Samsung Life and Samsung Fire account for 0.08% of Samsung Electronics' total outstanding shares.

POTENTIAL VIOLATION OF FINANCIAL ACT

The two insurers’ decision aims to circumvent a potential violation of the Act on the Structural Improvement of the Financial Industry, which prohibits financial institutions from holding more than 10% of a non-financial company's shares.

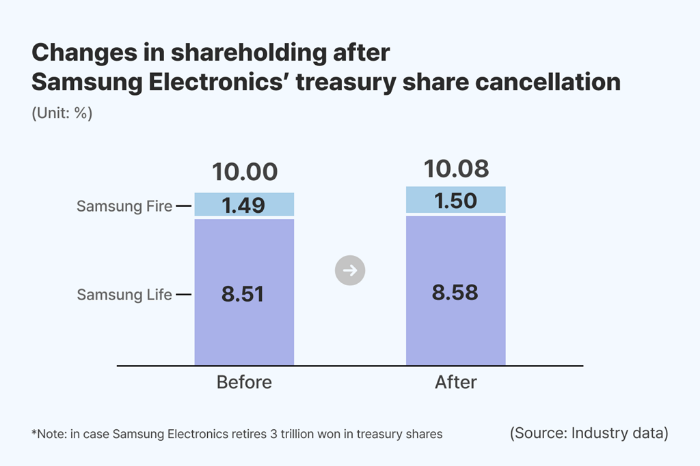

Before the stake sales, Samsung Life held an 8.51% stake in Samsung Electronics, while Samsung Fire & Marine owned 1.49% of the chipmaker.

Last November, Samsung Electronics said it would repurchase about 10 trillion won worth of its own shares from the market as part of its share value-up program.

Samsung, the world’s largest maker of memory chips, smartphones and home appliances, plans to buy and retire 3 trillion won worth of treasury shares until early next week, with the remaining 7 trillion won worth of treasury shares set to be repurchased by the end of November.

Once Samsung Electronics retires 3 trillion won in treasury shares, the total number of outstanding shares will decrease, which in turn increases Samsung Life's stake in Samsung Electronics to 8.58% and Samsung Fire's stake in it to 1.50%.

RELATED MOVE

In a related move, industry sources said last week that Samsung Life is considering bringing Samsung Fire under its wing as a subsidiary.

Samsung Life is Samsung Fire’s largest shareholder with a 14.98% stake.

Unlike other Samsung Group affiliates such as Samsung Card Co., Samsung Securities Co. and Samsung Asset Management Co., which are subsidiaries of Samsung Life, Samsung Fire is an independent company within Samsung Group.

The move follows Samsung Fire’s announcement in January that it would retire over 10% of its treasury shares from the market as part of its share value-up program.

The planned share cancellation, if fully implemented, would push Samsung Life’s ownership stake in Samsung Fire beyond the legal limit of 15% set by the Insurance Business Act.

Under a circular share ownership structure, Samsung Fire currently owns a 1.49% stake in Samsung Electronics.

If Samsung Life lowers its stake in Samsung Fire, the governance chain linking Samsung Electronics – via Samsung Life and Samsung Fire – could be disrupted.

Write to Hyung-gyo Seo at seogyo@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Corporate restructuringSamsung Life mulls putting Samsung Fire under its wing as subsidiary

Corporate restructuringSamsung Life mulls putting Samsung Fire under its wing as subsidiaryFeb 04, 2025 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsSamsung Electronics' key M&A man returns; big deals in the offing

Mergers & AcquisitionsSamsung Electronics' key M&A man returns; big deals in the offingApr 12, 2024 (Gmt+09:00)

3 Min read -

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake sale

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake saleSep 02, 2020 (Gmt+09:00)

5 Min read

Comment 0

LOG IN