Corporate restructuring

Samsung Life mulls putting Samsung Fire under its wing as subsidiary

The move comes after Samsung Fire announced plans to retire 10% of treasury shares in a value-up program

By Feb 04, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Life Insurance Co., South Korea’s largest life insurer, is considering bringing Samsung Fire & Marine Insurance Co., the country’s No. 1 non-life insurance firm, under its wing as a subsidiary.

According to industry sources on Tuesday, Samsung Life recently reported its plan to two financial regulatory bodies – the Financial Services Commission and the Financial Supervisory Service – for approval.

Samsung Life also must pass an antitrust review by the Fair Trade Commission to make Samsung Fire one of its subsidiaries.

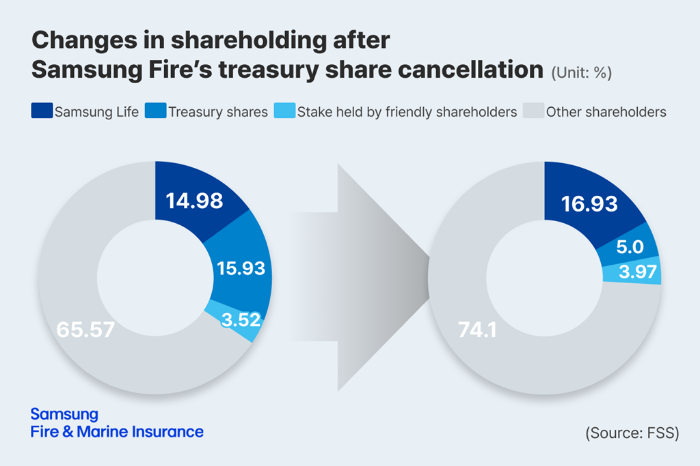

Samsung Life is Samsung Fire’s largest shareholder with a 14.98% stake.

Unlike other Samsung Group affiliates such as Samsung Card Co., Samsung Securities Co. and Samsung Asset Management Co., which are subsidiaries of Samsung Life, Samsung Fire is an independent company within Samsung Group.

TRIGGERED BY SAMSUNG FIRE’S SHARE CANCELLATION

The move follows Samsung Fire’s announcement in January that it would retire over 10% of its treasury shares from the market as part of its share value-up program.

The planned share cancellation, if fully implemented, would push Samsung Life’s ownership stake in Samsung Fire beyond the legal limit of 15% set by the Insurance Business Act.

By incorporating Samsung Fire as a subsidiary, Samsung Life aims to resolve such legal issues and enhance shareholder value for both companies, people familiar with the matter said.

On Jan. 31, Samsung Fire said in a regulatory filing that it plans to lower its treasury share ratio from the current 15.93% to below 5% by 2028.

When a company retires its treasury shares, the ownership percentage of other shareholders increases accordingly.

Analysts estimate that Samsung Life’s stake in Samsung Fire would rise to 16.93% if Samsung Fire slashes its treasury shares to 5%.

According to the Insurance Business Act, an insurer cannot own more than 15% of another company unless it obtains regulatory approval to classify it as a subsidiary.

Analysts said this means that Samsung Life must either designate Samsung Fire as its subsidiary or sell excess Samsung Fire shares.

FINANCIAL BENEFITS

Sources said selling excess shares is not the preferred option for Samsung Life.

Samsung Life’s offloading of its excess Samsung Fire stake directly in the market would cause a stock overhang, hurting Samsung Fire’s stock price.

Stock overhang is when a sizable block of shares, released in the market in one go, floods the market and creates downward price pressure.

With the stake sale, Samsung Life would also have to forgo a portion of its annual dividend income from Samsung Fire.

More critically, a stake sale could weaken Samsung Life’s influence over Samsung Fire and even affect Samsung Electronics Co.'s governance structure, sources said.

Under a circular share ownership structure, Samsung Fire currently owns a 1.49% stake in Samsung Electronics.

If Samsung Life lowers its stake in Samsung Fire, the governance chain linking Samsung Electronics – via Samsung Life and Samsung Fire – could be disrupted.

If Samsung Life brings Samsung Fire under its wing as a subsidiary, it will improve the life insurer's financial performance.

As a subsidiary, Samsung Fire’s earnings would be reflected in Samsung Life’s consolidated financial statements.

Given that Samsung Fire generates an annual net profit of between 2 trillion won and 3 trillion won ($1.4 billion-$2.1 billion), if it becomes a subsidiary, Samsung Life would see an additional annual gain of 300 billion-400 billion won on its bottom line.

Samsung Fire’s shareholders also stand to benefit, as a subsidiary plan would alleviate concerns over possible share overhang, sources said.

“If Samsung Life sells its stake in Samsung Fire in the market, Samsung Fire’s value-up initiative could lose its intended effect,” said an industry official.

Write to Hyung-gyo Seo at seogyo@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Real estateSamsung Fire headquarters up for sale at about $746 mn

Real estateSamsung Fire headquarters up for sale at about $746 mnMar 20, 2024 (Gmt+09:00)

1 Min read -

Pension fundsGEPS taps Samsung Life's alternative investment head as CIO

Pension fundsGEPS taps Samsung Life's alternative investment head as CIOMay 27, 2022 (Gmt+09:00)

1 Min read -

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake sale

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake saleSep 02, 2020 (Gmt+09:00)

5 Min read

Comment 0

LOG IN