Governance

Samsung Life shares rally as governance issue looms on likely stake sale

By Sep 02, 2020 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Shares of South Korea’s largest life insurer, Samsung Life Insurance Co., have rallied in recent sessions on expectations that the company will be forced to sell part of its stake in Samsung Electronics if the proposed change in the insurance act passes the National Assembly.

Market analysts, however, warn retail investors of speculative buying in anticipation of an overhaul in Samsung Group’s governance structure.

On September 1, when the National Assembly opened its regular session to debate law revisions, Samsung Life shares surged for a third day to close up 7.2% at 65,600 won, the biggest percentage gain in three weeks. The stock has risen as much as 38% in the past month.

Analysts say the catalyst behind the rally is that with the regulatory change Samsung Life will likely return part of the proceeds from the stake sale to shareholders through dividends or try to enhance its corporate value; and the chances are better than ever that the revision will go through this time.

In June, a couple of lawmakers from the ruling Democratic Party of Korea proposed a change in the Insurance Business Act to shift insurers’ asset assessment standards from book value to market value, more in line with global standards

If the revised bill is passed, Samsung Life will be forced to sell part of its 8.51% stake in Samsung Electronics as the law stipulates that stocks held by an insurer of an affiliate company be limited to 3% of the insurer's total assets.

When Samsung Life first purchased Samsung Electronics in the 1980s, its stake was worth 540 billion won ($455 million) in book value, representing just 0.1% of the insurer’s current assets of 317 trillion won. But the value of the stake has ballooned to about 28 trillion won ($23.6 billion) in market value, meaning Samsung Life would have to offload as much as 20 trillion won worth of the Samsung Electronics shares to meet the 3% rule.

While this is the third time the insurance act revision has been proposed, this time it seems likely to get the nod as the ruling party holds the majority of the National Assembly seats. The Democratic Party controls 176 of the 300 seats.

GOVERNANCE ISSUE

The likely revision creates a complication for the Samsung Group, as the regulatory change would force the conglomerate to overhaul its governance structure.

Market watchers say one possible scenario of Samsung Life’s divestment of its Samsung Electronics shares is to transfer the stake to Samsung C&T Corp., the de facto holding company of the conglomerate -- a move that should allow Samsung Vice Chairman Jay Y. Lee to retain his grip on the group.

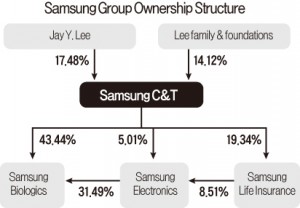

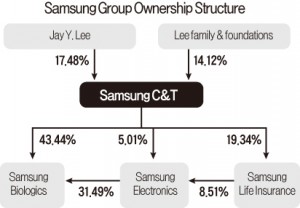

Lee is the largest shareholder of Samsung C&T, which under a circular share ownership structure, holds a controlling stake in Samsung Life, which in turn controls Samsung Electronics. Analysts say Samsung C&T’s acquisition of the Samsung Electronics stake from Samsung Life would also simplify Lee's ownership structure.

If Samsung C&T decides to buy the Samsung Electronics shares, it is widely speculated that the company would sell its 43.44% stake in Samsung Biologics Co., valued at about 22 trillion won, to secure the money needed to buy the electronics unit stake.

Some analysts, however, say that scenario is unlikely due to a taxation issue.

If a company sells down its shareholdings in one of its units, it has to pay corporate tax equivalent to 22% of the gains from the sale. So, the transactions of Samsung Life and Samsung Biologics among group affiliates would result in tax liabilities of up to 5 trillion won.

The purchase of the Samsung Electronics stake by Samsung C&T would also force the de facto holding company to buy more Samsung Electronics shares under the proposed revision to the Fair Trade Act, which requires holding companies to significantly boost their stakes in subsidiaries. Samsung C&T, which currently holds 5.01% of Samsung Electronics, would need tens of trillions of won to raise its electronics stake to the 20-30% level.

“Various scenarios on Samsung Life’s sale of Samsung Electronics shares are circulating in the market, but nothing has been decided yet,” said a Samsung C&T official. He also dismissed market talk that it would sell Samsung Biologics to secure money to buy Samsung Life, saying that “bio is one of the key businesses we’re nurturing as a future growth engine.”

CHALLENGE TO FIND REPLACEMENT

For Samsung Life, the offloading of its stake in Samsung Electronics would pose a challenge – finding another investment instrument that can bring as much return as Samsung Electronics.

The life insurer has reaped 719.6 billion won in dividend gains annually by owning 28 trillion won worth of Samsung Electronics, a dividend yield of 2.5%. Analysts said Samsung Life's sale of Samsung Electronics would be justified and satisfy its shareholders only if it can offer them at least 4% in return on investment even after the stake sale.

“Samsung Life’s investment yield from operating its overall assets was 3.2% last year. It won’t be easy for the company to maintain its current return on equity (ROE) and profitability after the sale of Samsung Electronics,” said Kim Dong-yang, an analyst at NH Investment & Securities.

SHARE OVERHANG

Samsung Life’s offloading of its Samsung Electronics stake directly in the market would cause a stock overhang, inviting indignation from both institutional and retail investors over Samsung Electronics depressed share price. Stock overhang is when a sizable block of shares, released in the market in one go, flood the market and create downward price pressure.

“The recent rally in Samsung Life shares was partly propelled by portfolio-oriented institutional investors anticipating the passage of the revised insurance act,” said a chief investment officer at a local asset management firm. “The stock may not rise further on the news. Individual investors need to be careful in speculative trading.”

Write to Jae-Yeon Ko at yeon@hankyung.com

Market analysts, however, warn retail investors of speculative buying in anticipation of an overhaul in Samsung Group’s governance structure.

On September 1, when the National Assembly opened its regular session to debate law revisions, Samsung Life shares surged for a third day to close up 7.2% at 65,600 won, the biggest percentage gain in three weeks. The stock has risen as much as 38% in the past month.

Analysts say the catalyst behind the rally is that with the regulatory change Samsung Life will likely return part of the proceeds from the stake sale to shareholders through dividends or try to enhance its corporate value; and the chances are better than ever that the revision will go through this time.

In June, a couple of lawmakers from the ruling Democratic Party of Korea proposed a change in the Insurance Business Act to shift insurers’ asset assessment standards from book value to market value, more in line with global standards

If the revised bill is passed, Samsung Life will be forced to sell part of its 8.51% stake in Samsung Electronics as the law stipulates that stocks held by an insurer of an affiliate company be limited to 3% of the insurer's total assets.

When Samsung Life first purchased Samsung Electronics in the 1980s, its stake was worth 540 billion won ($455 million) in book value, representing just 0.1% of the insurer’s current assets of 317 trillion won. But the value of the stake has ballooned to about 28 trillion won ($23.6 billion) in market value, meaning Samsung Life would have to offload as much as 20 trillion won worth of the Samsung Electronics shares to meet the 3% rule.

While this is the third time the insurance act revision has been proposed, this time it seems likely to get the nod as the ruling party holds the majority of the National Assembly seats. The Democratic Party controls 176 of the 300 seats.

GOVERNANCE ISSUE

The likely revision creates a complication for the Samsung Group, as the regulatory change would force the conglomerate to overhaul its governance structure.

Market watchers say one possible scenario of Samsung Life’s divestment of its Samsung Electronics shares is to transfer the stake to Samsung C&T Corp., the de facto holding company of the conglomerate -- a move that should allow Samsung Vice Chairman Jay Y. Lee to retain his grip on the group.

Lee is the largest shareholder of Samsung C&T, which under a circular share ownership structure, holds a controlling stake in Samsung Life, which in turn controls Samsung Electronics. Analysts say Samsung C&T’s acquisition of the Samsung Electronics stake from Samsung Life would also simplify Lee's ownership structure.

If Samsung C&T decides to buy the Samsung Electronics shares, it is widely speculated that the company would sell its 43.44% stake in Samsung Biologics Co., valued at about 22 trillion won, to secure the money needed to buy the electronics unit stake.

Some analysts, however, say that scenario is unlikely due to a taxation issue.

If a company sells down its shareholdings in one of its units, it has to pay corporate tax equivalent to 22% of the gains from the sale. So, the transactions of Samsung Life and Samsung Biologics among group affiliates would result in tax liabilities of up to 5 trillion won.

The purchase of the Samsung Electronics stake by Samsung C&T would also force the de facto holding company to buy more Samsung Electronics shares under the proposed revision to the Fair Trade Act, which requires holding companies to significantly boost their stakes in subsidiaries. Samsung C&T, which currently holds 5.01% of Samsung Electronics, would need tens of trillions of won to raise its electronics stake to the 20-30% level.

“Various scenarios on Samsung Life’s sale of Samsung Electronics shares are circulating in the market, but nothing has been decided yet,” said a Samsung C&T official. He also dismissed market talk that it would sell Samsung Biologics to secure money to buy Samsung Life, saying that “bio is one of the key businesses we’re nurturing as a future growth engine.”

CHALLENGE TO FIND REPLACEMENT

For Samsung Life, the offloading of its stake in Samsung Electronics would pose a challenge – finding another investment instrument that can bring as much return as Samsung Electronics.

The life insurer has reaped 719.6 billion won in dividend gains annually by owning 28 trillion won worth of Samsung Electronics, a dividend yield of 2.5%. Analysts said Samsung Life's sale of Samsung Electronics would be justified and satisfy its shareholders only if it can offer them at least 4% in return on investment even after the stake sale.

“Samsung Life’s investment yield from operating its overall assets was 3.2% last year. It won’t be easy for the company to maintain its current return on equity (ROE) and profitability after the sale of Samsung Electronics,” said Kim Dong-yang, an analyst at NH Investment & Securities.

SHARE OVERHANG

Samsung Life’s offloading of its Samsung Electronics stake directly in the market would cause a stock overhang, inviting indignation from both institutional and retail investors over Samsung Electronics depressed share price. Stock overhang is when a sizable block of shares, released in the market in one go, flood the market and create downward price pressure.

“The recent rally in Samsung Life shares was partly propelled by portfolio-oriented institutional investors anticipating the passage of the revised insurance act,” said a chief investment officer at a local asset management firm. “The stock may not rise further on the news. Individual investors need to be careful in speculative trading.”

Write to Jae-Yeon Ko at yeon@hankyung.com

In-Soo Nam edited this article

More to Read

-

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessions

Business & PoliticsTrump Jr. meets Korean business chiefs in back-to-back sessionsApr 30, 2025 (Gmt+09:00)

-

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, Google

Korean chipmakersSamsung in talks to supply customized HBM4 to Nvidia, Broadcom, GoogleApr 30, 2025 (Gmt+09:00)

-

EnergyLS Cable breaks ground on $681 mn underwater cable plant in Chesapeake

EnergyLS Cable breaks ground on $681 mn underwater cable plant in ChesapeakeApr 29, 2025 (Gmt+09:00)

-

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice Obstfeld

Business & PoliticsUS tariffs add risk premium to dollar assets: Maurice ObstfeldApr 29, 2025 (Gmt+09:00)

-

Comment 0

LOG IN