Batteries

LG Energy set to ink graphite deal with Australia’s Syrah Resources

LG is forging a series of EV battery material procurement deals in response to the US EV tax credit law

By Oct 20, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s LG Energy Solution Ltd. said on Thursday it has signed an initial agreement to explore graphite procurement from Australia’s Syrah Resources Ltd. as it strives to reduce its dependence on China for the key battery component.

LG Energy, a leading global battery maker, which counts Tesla Inc. as one of its key clients, said if a final deal is reached, it would make the company’s batteries sold in the US eligible for tax breaks under the Inflation Reduction Act (IRA).

Under the non-binding memorandum of understanding, LG and Syrah will test and verify natural graphite from Syrah’s Vidalia production facility in the US state of Louisiana. The plant is scheduled for mass production in 2023.

Syrah also runs a graphite mining facility in Mozambique, which holds one of the world's largest graphite reserves.

If graphite from the US plant meets the requirements for use in electric vehicle batteries, the two companies aim to sign a binding offtake agreement by the end of this year.

The annual procurement target for natural graphite will begin at 2,000 metric tons in 2025 and gradually increase in volume over the years, LG said.

Graphite, in both natural and synthetic forms, is used for the negative end of a lithium-ion battery, known as the anode. Around 70% of all graphite comes from China, and there are few viable alternatives for making batteries.

AGGRESSIVELY DIVERSIFYING SUPPLY CHAIN

“Our partnership with Syrah demonstrates our devotion to diversifying our critical minerals portfolio by directly procuring from local and regional suppliers in North America,” said LG Energy Chief Executive Kwon Young-soo.

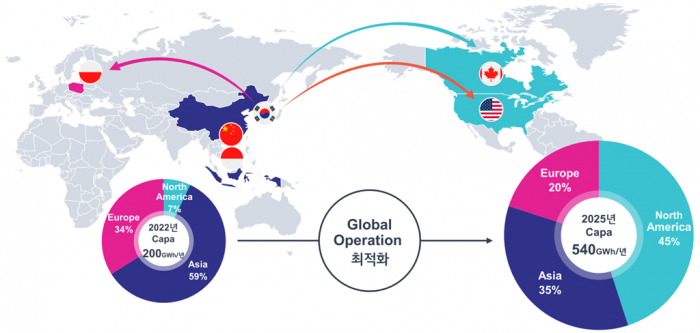

LG has been ramping up efforts to expand its raw materials procurement channels.

Last month, the Korean battery maker inked cobalt and lithium supply deals with three Canadian miners – Electra Battery Materials Corp., Avalon Advanced Materials Inc. and Snow Lake Resources Ltd.

In July, LG Signed a non-binding MOU with Kansas-headquartered Compass Minerals International Inc. to receive 40% of lithium carbonate and lithium hydroxide produced at the US facilities for seven years from 2025.

LG has also signed a binding battery-grade lithium agreement with Canada’s Sigma Lithium.

LG’s other key raw material suppliers include Australia’s Liontown Resources Ltd., Germany’s Vulcan Energy Resources Ltd. and Chile’s SQM.

The IRA, signed into law by US President Joe Biden in August, requires a certain percentage of critical minerals used in EV batteries to come from the US or its free trade partners.

From next year, EV makers must use batteries with materials sourced primarily in North America for their cars to be eligible for the tax credit of up to $7,500 per unit.

Qualifying EVs must contain at least 40% of their battery minerals and 50% of their battery components from those countries. The proportion will rise to 80% for minerals by 2027 and 100% for parts by 2029.

Write to Han-Shin Park at phs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

BatteriesPOSCO Chemical may clinch megadeal to supply cathode to Ford Motor

BatteriesPOSCO Chemical may clinch megadeal to supply cathode to Ford MotorOct 18, 2022 (Gmt+09:00)

4 Min read -

-

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliers

BatteriesLG Energy in cobalt, lithium deals with three Canadian suppliersSep 23, 2022 (Gmt+09:00)

3 Min read -

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK On

BatteriesFord CEO heads to Korea to discuss EV tax credit with LG Energy, SK OnSep 16, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN