Automobiles

Samsung Electro-Mechanics to supply hybrid camera lenses to Hyundai

The company also plans to ramp up MLCC and FC-BGA substrate output to meet vehicle AI chip demand

By Mar 10, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Electro-Mechanics Co., a leading South Korean electronics parts maker, plans to begin supplying hybrid lenses for automotive camera modules in large quantities to Hyundai Motor Co. and Kia Corp. in 2025.

According to industry sources on Sunday, Samsung also plans to significantly increase the production of automotive multilayer ceramic capacitors (MLCCs) and high-performance flip-chip ball grid array (FC-BGA) substrates used in artificial intelligence chips.

MLCCs for vehicles will soon account for at least a quarter of its entire ceramic capacitor production volume as Samsung Electro-Mechanics is striving to transform from a smartphone parts maker into a company that focuses on auto parts and AI components, sources said.

Automotive hybrid lenses, which the company plans to mass-produce next year, combine the strength of glass lenses, which have good performance but are expensive and fragile, and plastic lenses, which are cheaper and lighter but have a high risk of deformation.

Samsung’s new products boast 2,000 hours of continuous camera shooting – 1.5 times longer than existing products.

The company will be supplying the new products to Hyundai Motor and Kia first and then expand to other global automakers, sources said.

Demand for automotive camera modules is growing rapidly in line with the increasing adoption of electric vehicles, which usually require more monitoring devices to collect road data.

Tesla and other electric cars often use 20 camera lenses per vehicle to collect data and monitor the driver.

According to market tracker TSR, the global automotive camera module market is forecast to grow from $4.3 billion in 2022 to $8.9 billion by 2027.

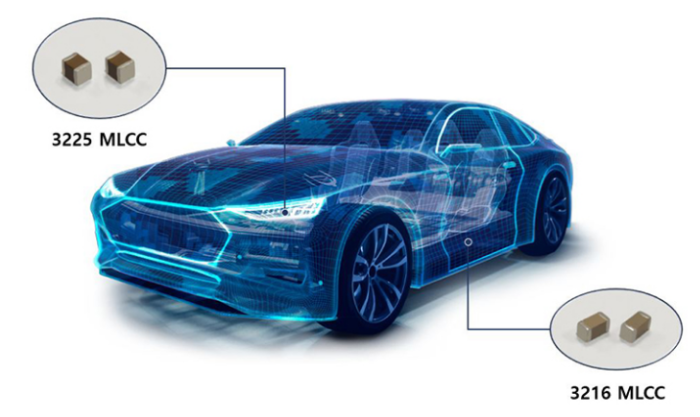

VEHICLE MLCCs

Samsung Electro-Mechanics is also said to be preparing to ramp up its automotive MLCC production.

Samsung is the world’s No. 3 MCC maker with a 13% market share as of the end of 2023, following Japan’s Murata Manufacturing Co., which controls 41% of the market, and Japan’s TDK Corp., the second player with a 16% market share.

MLCCs control the flow of electricity to provide power to semiconductors. They are essential components of a variety of electronic products, including cars, smartphones, home appliances and laptops.

Multilayer ceramic capacitors consist of several individual capacitors stacked together, provide and regulate chips' power supply and prevent electromagnetic wave interference.

An internal combustion engine vehicle uses about 4,000 MLCCs on average for systems such as powertrain, safety and infotainment. Autonomous vehicles require up to 15,000 MLCCs, industry officials said.

Samsung, which posted 850 billion won ($644 million) in sales from its vehicle MLCCs last year, is widely expected to post more than 1 trillion won in sales from the business this year.

FC-BGA SUBSTRATES

From this year, Samsung Electro-Mechanics is also expected to increase sales of its high-performance FC-BGA substrates, particularly those for AI chips.

The company last year developed an advanced semiconductor substrate for autonomous driving.

In line with the advancement of self-driving technology, autonomous driving systems require many high-performance and high-reliability chips that can process large amounts of data at high speeds without latency even in extreme driving conditions.

FC-BGA is a package substrate that transmits electrical signals and power by connecting high-density semiconductor chips to the mainboard. It is mainly used for central processing units (CPUs) and graphics processing units (GPUs) that require high-performance and high-density circuit connections.

As chipmakers are shifting toward high-density circuit substrates containing more microcircuits to improve system performance, multi-layer substrates like the FC-BGA type are replacing general substrates for electronic components of artificial intelligence, autonomous driving vehicles and computer servers.

Since starting the package substrate business in 1991, Samsung Electro-Mechanics has been supplying FC-BGA products to major companies, including Apple Inc., Qualcomm Inc. and Intel Corp.

“Given the high barrier of advanced FC-BGA substrates, business conditions are turning favorable for Samsung,” said a company official.

The company aims to achieve 2 trillion won in annual sales from its auto parts and AI chip parts business by 2025.

“We are working to improve our product mix toward increasing sales of high-value-added automotive products,” said Samsung Electro-Mechanics Chief Executive Chang Duckhyun during a recent meeting with company executives.

Write to Jeong-Soo Hwang at hjs@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Korean chipmakersSamsung Electro-Mechanics unveils chip substrate for autonomous driving

Korean chipmakersSamsung Electro-Mechanics unveils chip substrate for autonomous drivingFeb 27, 2023 (Gmt+09:00)

2 Min read -

Korean chipmakersSamsung to supply chip substrate for Apple’s next-gen M2 processor

Korean chipmakersSamsung to supply chip substrate for Apple’s next-gen M2 processorApr 21, 2022 (Gmt+09:00)

3 Min read -

Samsung Electro-Mechanics poised to benefit from Huawei’s troubles, rising demand for MLCCs

Samsung Electro-Mechanics poised to benefit from Huawei’s troubles, rising demand for MLCCsSep 09, 2020 (Gmt+09:00)

3 Min read

Comment 0

LOG IN