Foreign buying of Korean stocks hit record high in Q1

Overseas investors net purchased $11.7 billion worth of Korea-listed stocks, mainly blue chips like Samsung and Hyundai

By Mar 31, 2024 (Gmt+09:00)

MBK’s Korea Zinc bid aimed at corporate governance, shareholder value

S.Korea set to scrap financial investment income tax

In South Korea, cash is king on US election, Samsung uncertainties

NPS commits $436 mn to Koramco, Hana Alternative for real estate lending

South Korea’s Viva Republica drops Korean IPO plan, seeks US debut

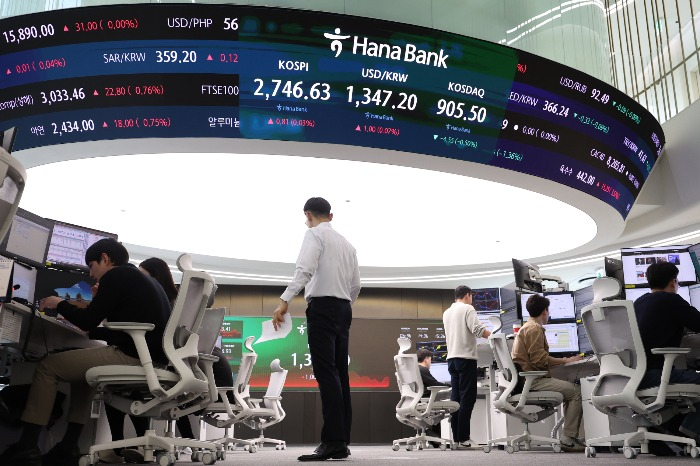

Foreign investors gobbled up a record 15.8 trillion won ($11.7 billion) worth of stocks listed in South Korea during the first three months of this year, driven by the AI-triggered semiconductor boom. But whether investors will remain bullish hinges on earnings results and US rate decisions.

According to the Korea Exchange (KRX) on Saturday, overseas investors net purchased 15.8 trillion won worth of Korean stocks listed on the main Kospi bourse in the January-March period.

It's their largest-ever quarterly net buying in the market since such data started to be compiled in 1998. The previous record was 14.8 trillion won in the third quarter of 2009.

By month, foreigners net purchased Korean stocks worth 3.5 trillion won in January, 7.8 trillion won in February and 4.4 trillion won in March.

They mainly bought Korean microchip stocks amid the growing AI boom. Some lower valuation stocks also expected to benefit from the Korean government’s so-called value-up program, designed to bolster the value of local stocks with a price-to-book ratio (PBR) of less than 1.

Their favorite stock was bellwether Samsung Electronics Co., the world’s largest memory chip seller. Foreign investors net bought 5.5 trillion won worth of the stock in the first quarter.

Korea’s largest carmaker Hyundai Motor Co. and SK Hynix Inc., the world’s No. 2 memory chip maker and No. 1 high bandwidth memory (HBM) chip supplier, were their second and third top picks, respectively, with net purchases of 2.1 trillion won and 1.7 trillion won each.

Among their top 10 picks, three were chip stocks and five were auto and financial stocks considered low PBR stocks. They have all climbed since the end of last year, with an average gain of 22.6%, far outperforming Korea’s benchmark stock index Kospi’s 3.4% increase over the same period.

SHIFT TO GROWTH STOCKS

In the coming months, investors are expected to bet on growth stocks more than undervalued stocks as earning season approaches.

“In February, low-PBR stocks were in the limelight but attention has shifted to growth stocks in March,” said Kim Dae-wook, an analyst at Hana Securities Co. “Heading into the April earnings season, investors are expected to cherry-pick the best stocks among growth stocks.”

Investors are expected to keep a close eye on heavyweight Samsung Electronics’ first-quarter earnings result, said Lee Kyung-min, an analyst at Daishin Securities Co.

The company will announce its first-quarter earnings guidance on April 5.

After chip stocks, including Samsung’s crosstown rival SK Hynix, accelerated recently on the AI-driven chip boom, investors are forecast to decide their next investment move after confirming whether their expectations have turned into reality, Lee added.

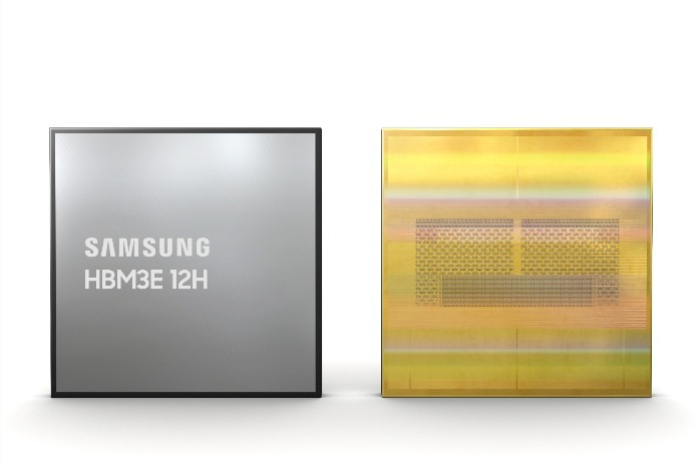

Samsung Electronics and SK Hynix are top players in the global HBM chip market. HBM chips are essential for running AI chips, mostly graphics processing units (GPU) whose demand is skyrocketing amid a worldwide frenzy in generative AI.

Investors have recently turned bullish on the two Korean chip giants amid surging demand for HBM chips despite a slow recovery in overall memory and NAND chip demand.

Shares of global HBM leader SK Hynix have leaped nearly 30% from the end of last year to 183,000 won on Friday.

Samsung Electronics shares also recently gained another boost from growing expectations that it would soon strike a deal to supply its latest HBM chips to Nvidia Corp.

On Friday, the stock closed up 2% from the previous session at 82,400 won, breaching the 80,000 threshold for the first time in two years.

After their recent rally, these stocks could take a breather, some other analysts said.

Foreign investors may take profits from the stocks if the US Federal Reserve finally cuts policy rates after the second quarter, a move that is highly anticipated.

A slowdown in foreign buying could put a cap on the Kospi’s overall gain later on, according to analysts.

Write to A-Young Yoon at youngmoney@hankyung.com

Sookyung Seo edited this article.

-

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip era

Korean chipmakersSamsung set to triple HBM output in 2024 to lead AI chip eraMar 27, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix earmarks $91 bn to construct world's largest chip fab

Korean chipmakersSK Hynix earmarks $91 bn to construct world's largest chip fabMar 21, 2024 (Gmt+09:00)

1 Min read -

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadership

Korean chipmakersSamsung to unveil Mach-1 AI chip to upend SK Hynix’s HBM leadershipMar 20, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung rallies on expectations of Nvidia’s HBM order

Korean chipmakersSamsung rallies on expectations of Nvidia’s HBM orderMar 20, 2024 (Gmt+09:00)

3 Min read -

Korean chipmakersSK Hynix mass-produces HBM3E chip to supply Nvidia

Korean chipmakersSK Hynix mass-produces HBM3E chip to supply NvidiaMar 19, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketKorea announces measures to upvalue local shares

Korean stock marketKorea announces measures to upvalue local sharesFeb 26, 2024 (Gmt+09:00)

2 Min read -

Korean stock marketNPS to invest up to $8.2 bn in undervalued Korean stocks

Korean stock marketNPS to invest up to $8.2 bn in undervalued Korean stocksMar 01, 2024 (Gmt+09:00)

3 Min read -

EarningsSK Hynix swings to profit; sees 60% surge in HBM demand

EarningsSK Hynix swings to profit; sees 60% surge in HBM demandJan 25, 2024 (Gmt+09:00)

3 Min read