BOK hints at policy rate peak but in no hurry to cut rates

The Korean central bank held the country’s policy rate flat at 3.50% for an eighth consecutive session in January

By Jan 11, 2024 (Gmt+09:00)

MBK’s Korea Zinc takeover attempt to spur search for white knights

Korea Zinc, MBK face proxy war for zinc smelter

Korea Zinc shares skyrocket after buybacks in tender offer

Lotte to liquidate rubber JV in Malaysia, sell overseas assets for $1 bn

Samsung to unveil 400-layer bonding vertical NAND for AI servers by 2026

South Korea’s central bank on Thursday hinted its policy rate may have peaked after leaving the rate unchanged for the eighth straight meeting but refrained from signaling any imminent doveish policy pivot amid lingering concerns about the country’s high household debts.

“The need for further rate hikes has become less certain than before,” Bank of Korea Governor Rhee Chang-yong told reporters during a press briefing on the BOK’s rate decision to hold the policy rate flat at 3.50% earlier.

Korea’s central bank maintained the current rate for the eighth straight session following rate freezes in February, April, May, July, August, October and November last year. Before that, the BOK delivered seven consecutive rate hikes from April 2022 to January 2023.

“Inflation continued moderating while external (inflation) risks from volatile international oil prices and the Middle East crisis have eased,” said Rhee, adding that the rate was kept unchanged unanimously at the January monetary policy meeting.

But Rhee brushed off growing market expectations for near-term BOK rate cuts, saying that policy board members shared the view that it is too early to discuss any rate cuts now.

"My personal view is that I see little chance (of any rate cuts) for the next six months," said Rhee.

“Until we are assured that inflation slows to the target level, we will maintain the tightening stance for the sufficiently long term to ensure price stability."

The five-year debt yield fell 4.0 bps to 3.257% in the domestic bond market, and the 10-year note yield dropped 3.9 bps to 3.307%.

KEEPING EYE ON HOUSEHOLD DEBTS

Rhee has been voicing concerns over the country’s high household debts since last year.

According to BOK data on Wednesday, Korea’s total household loans added 10.1 trillion won ($7.7 billion) from 2022 to 2023, reversed from the previous year’s 8.8 trillion won on-year drop. The country's household borrowing balance from banks stood at a record high of 1,095 trillion won as of the end of last year.

The household debt ratio to Korea’s gross domestic product in 2023 came in at 100.8%, down from 104.5% the year prior but it could tick up at any time if interest rates are lowered, according to the bank.

"Any premature rate cut could reignite inflation expectations which could adversely affect the economy by triggering expectations of a property market boom, rather than work to support growth," said Rhee.

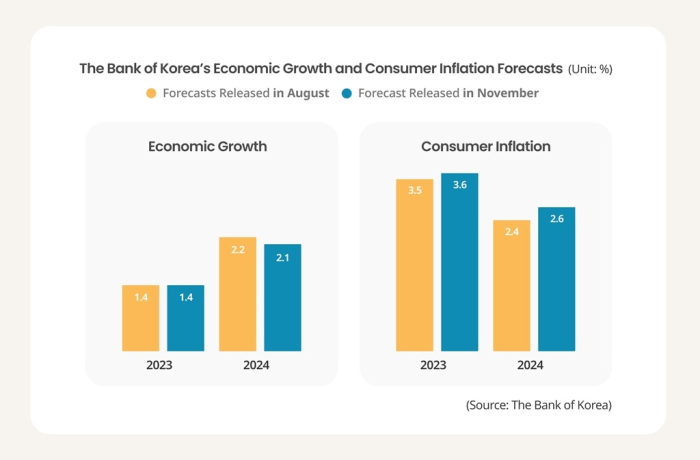

Korea’s headline monthly inflation averaged 3.6% in 2023, down from 5.1% in 2022. The bank expects inflation to ease further and average 2.6% this year, which is still above its 2.0% target.

THE KOREAN ECONOMY NEEDS A BOOSTER

Consumer inflation, however, eased for a second month in December to 3.2%, somewhat reducing concerns about persistent price risks.

Despite the BOK’s reluctance, the latest inflation trend, coupled with the country’s slow economic recovery pace, has raised expectations that the central bank would cut interest rates in the third quarter at the latest or earlier, according to market analysts.

The Korean central bank forecasts the country’s economy to grow 2.1% in 2024, following an estimated 1.4% expansion in 2023. However, its expansion slowed from a 2.6 percent gain in 2022 and a 4.1 percent advance in 2021.

Exports — a main growth engine for the country — decreased 7.4 percent on-year in 2023 amid the sluggish performance of chips coupled with global economic uncertainties, although they expanded in December for a third straight month.

The BOK will wait for a cue from the US Federal Reserve’s monetary easing, which is highly anticipated this year following the Fed’s last rate decision meeting.

Meanwhile, it is expected to keep an eye on the recovery pace of the Chinese economy.

“We need to check whether the Chinese economy’s impact on our country’s growth would be the same after the rapid change in the trade structure,” said Rhee, adding that it is becoming more challenging to predict the interrelation between the two economies.

The US overtook China as Korea’s biggest export market for the first time in two decades last December, according to Korean government data.

Write to Jin-gyu Kang at josep@hankyung.com

Sookyung Seo edited this article.

-

EconomyKorea’s consumer inflation reaches 3.6% in 2023 on high utilities

EconomyKorea’s consumer inflation reaches 3.6% in 2023 on high utilitiesDec 29, 2023 (Gmt+09:00)

2 Min read -

Central bankSouth Koreans expect inflation to slow, relief to BOK’s hawkish stance

Central bankSouth Koreans expect inflation to slow, relief to BOK’s hawkish stanceDec 27, 2023 (Gmt+09:00)

3 Min read -

EconomyKorean current account surplus at 19-month high on exports recovery

EconomyKorean current account surplus at 19-month high on exports recoveryDec 08, 2023 (Gmt+09:00)

2 Min read -

Central bankBOK chief says rates need to stay high for over 6 months

Central bankBOK chief says rates need to stay high for over 6 monthsNov 30, 2023 (Gmt+09:00)

3 Min read -

Central bankBOK chief’s top mission: Soft landing for household debt

Central bankBOK chief’s top mission: Soft landing for household debtAug 24, 2023 (Gmt+09:00)

2 Min read