Venture capital

VCs give thumbs up to EV, parts/materials, travel tech

VC funding recovered 12.5% on-year in Q3 in S.Korea but the total funding in Q1-Q3 reduced by over 30% on-year

By Nov 09, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

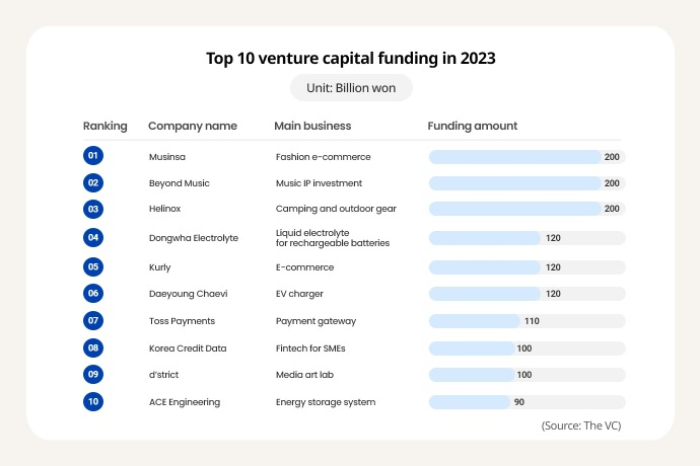

The venture capital funding crunch has continued through this year in South Korea but VCs have raised their stakes in select companies in the electric vehicle-related, deep-technology parts and materials and travel technology sectors.

Venture capital-backed companies in Korea raised 1.44 trillion won ($1.2 billion) in fresh capital in the July-September period of this year, up 12.5% from the same period of last year and 8.6% from the previous quarter, according to the Korea Venture Capital Association on Wednesday.

Total VC funding from the first quarter to the third quarter, however, dropped 32% from the same period of last year to 3.69 trillion won, suggesting that the local VC funding market remains stagnant in line with an ongoing global funding squeeze.

According to global business and investment analytics intelligence company CB Insights, global VC investment in the third quarter stood at $64.6 billion, up 11% from the second quarter but down 23% from a year ago.

Total global VC funding in the first nine months of this year also fell 45% from the same period of last year.

Despite the prolonged funding drought, some promising industries have, however, succeeded in wooing VCs.

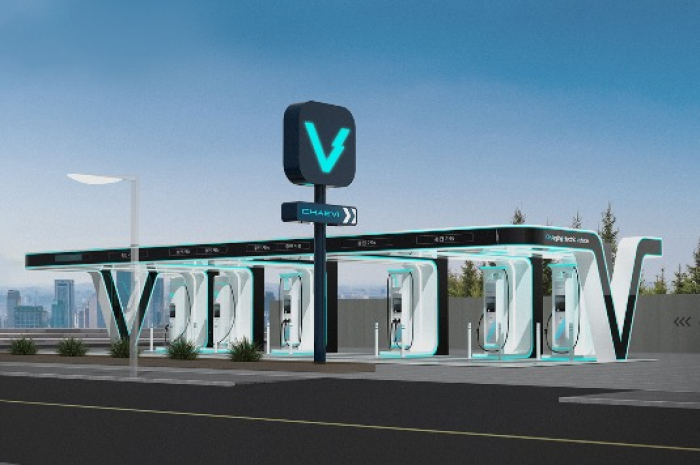

EV-RELATED COMPANIES

According to Seoul, Korea-based startup funding analytics company The VC, startups and small and medium-sized enterprises in the Korean EV sector, encompassing EV charging, batteries and electric energy businesses, raised 227.3 billion won from the first quarter to the third quarter this year.

This is double the same period of last year and triple from 2021.

The total investment excludes proceeds from M&A and initial public offering deals, as well as funding from Korea’s Tech Incubator Program for Startup (TIPS).

Daeyoung Chaevi Co., Korea’s No. 1 EV fast-charging system provider, raised 120 billion won in June from Stic Investment Inc. and KB Asset Management.

Another EV charger-developing major Everon Co. also raised 50 billion won in a Series B funding round in July, while Evar Inc., well known for its autonomous EV recharging robot and mobile charging cart, attracted 22 billion won in a Series B round in the same month.

HIGH-TECH PARTS AND MATERIALS FIRMS ON A ROLL

Parts and materials providers in the deep technology sector also drew 217.3 billion won in VC funding in the third quarter versus 199.2 billion won a year ago and 104.3 billion won two years ago.

Data processing unit (DPU) maker MangoBoost founded in 2022 has raised 70 billion won from VCs. It attracted 13 billion won in a seed funding round.

Chip designing company SEMIFIVE, one of Samsung Foundry’s design solution partners, raised 67.5 billion won.

Founded in 2017, Saige Research, a developer of AI solutions for industrial inspection and quality control, attracted 15.5 billion won.

TRAVEL TECH LOOKS PROMISING

After the end of the COVID-19 pandemic, the travel technology sector drew 189 billion won in VC funding in the first three quarters of this year, up from 173.2 billion won a year ago.

Camping and outdoor gear supplier Helinox Co. raised 120 billion won, the industry’s largest funding.

Live Anywhere Inc., a monthly housing rental reservation platform operator, attracted 5 billion won in a Series A funding round.

Other travel technology startups, including trip planning and itinerary management service provider Globaleur, also raised VC investment.

Considering the monthly number of foreign visitors to Korea has recently topped 1 million, the local tour industry has revitalized, and the market is expected to expand further, said Yim Haemin, founder and Chief Executive Officer of Creatrip Inc.

“Investment in deep tech and parts and materials companies is expected to continue to rise” despite the lingering uncertainty about the economy, said Maeng Doo-jin, the chief managing director of Atinum Investment Co., expecting generative AI and robotics technology firms with solid profit models would garner more interest from VCs.

But Kakao Ventures Corp.’s Principal Associate Jang Won-yeol projected polarization would continue in the startup VC funding market next year.

Write to Jong-Woo Kim at jongwoo@hankyung.com

Sookyung Seo edited this article.

More to Read

-

-

Venture capitalS.Korean startups, VC seek money, business opportunities in Japan

Venture capitalS.Korean startups, VC seek money, business opportunities in JapanSep 22, 2023 (Gmt+09:00)

5 Min read -

Korean startupsKorean startups join hands amid dwindling funding, acceleration support

Korean startupsKorean startups join hands amid dwindling funding, acceleration supportSep 06, 2023 (Gmt+09:00)

4 Min read -

Electric vehiclesEveron attracts $39 mn thanks to hot VC demand for EV charging

Electric vehiclesEveron attracts $39 mn thanks to hot VC demand for EV chargingJul 13, 2023 (Gmt+09:00)

3 Min read -

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN