Venture capital

S.Korean VCs go global for breakthrough

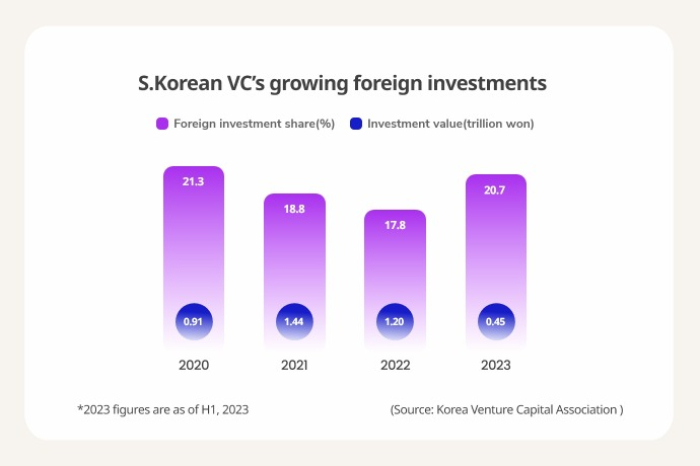

The share of S.Korean venture capitalists’ investments in foreign assets hit a three-year high of 21% their entire investment

By Oct 19, 2023 (Gmt+09:00)

5

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean venture capitalists are actively discovering attractive investment assets overseas to find a breakthrough amid a prolonged local VC drought.

According to the Korea Venture Capital Association on Wednesday, Korean VCs invested a combined 456.2 billion won ($335.8 million) in foreign companies in the first half ended June this year, accounting for 20.7% their total investment. This is their highest foreign investment after 21.3% in 2020.

Mirae Asset Venture Investment Co. was the biggest spender over the period, adding generative AI company Cohere, ad-tech solution startup Moloco Inc. and secondhand luxury watch platform Chrono24 to its portfolio through its 40 some affiliate offices across the globe.

Korean VCs’ venture into foreign markets is lately gaining traction after they have had proven track records of handsome profits from their previous offshore investments, allowing Korean VCs to partner with mainstream foreign counterparts.

Big local financiers such as fund of funds operators and state-run policy bank Korea Development Bank are especially credited for providing local VCs a springboard for global advancement.

“Fund of funds investment firms and KDB have invested a lot in funds operated by Southeast Asian VCs, raising the awareness of Korean VCs abroad,” said Kim Jong-hyun, executive director at Korea Investment Partners Southeast Asia.

Korean sovereign wealth fund Korea Investment Corp. launched $200 million and $300 million venture growth funds in 2019 and 2021, respectively, playing a key role in local VCs’ global push.

Korea Growth Investment Corp. (K-Growth), an independent fund of funds investment firm specializing in VC and PE investments, also plans to form its first global innovation fund.

A growing number of Korean-national VC partners graduating from foreign universities have deepened Korean VCs’ ties with their bigger peers overseas.

“It wasn’t easy (for Korean VCs) to do business with top-tier US VCs about five years ago but the mood has changed thanks to the growing number of Korean VCs with stronger networks,” said Lee Jin-soo, the head of global investment at Shinhan Venture Investment. “American VCs are also showing greater interest in Asia to secure more clients.”

NEW FUNDS ARE READY FOR LAUNCHING IN 2024

Thanks to the strong financial backers, more global funds by Korean VCs are slated to launch next year.

Korea Investment Partners launched a $60 million fund to invest in companies in Southeast Asia in July and plans to form a blind fund to invest in US assets in the first half of next year. The Korea VC operates offshore bases in the US, China and Singapore.

Hashed Inc., specializing in blockchain and Web3 technology investment, is also prepping its third fund early next year after introducing the first fund worth of 120 billion won in 2020 and the second fund with 240 billion won in assets in 2021.

It recently joined hands with Andreessen Horowitz (a16z), a leading US VC based in California, to lead a $54 million funding round for Story Protocol Inc.

Envisioning Partners, which launched Korea’s first-ever private fund investing in climate technologies, is also set to launch a new fund with investments from K-Growth and Pavilion Capital under Singapore’s Temasek Holdings.

Kosdaq-listed Atinum Investment Co., which manages assets in the US and China, has started expanding its investment in Southeast Asia via the fund created by Vertex Ventures and Openspace Ventures headquartered in Singapore.

It also plans to invest in DNX Ventures, an investment firm in Japan.

Partners Investment, owning a global healthcare fund, has invested in promising biotech companies such as Generate Biomedicines and SalioGen Therapeutics.

KOREAN FINANCIAL GROUPS JOIN GLOBAL PUSH

Venture capitals under Korea’s top four financial groups have also joined a race to form global funds.

KB Investment Co. under KB Financial Group Inc. launched its second global platform fund managing 250 billion won in assets this year after handsome profits from its first global platform fund formed in 2019 with 220 billion won assets.

It exited its investment in Arveller Therapeutics, a biotech company in Switzerland, with a 50% return on investment in 2021, two years after its investment.

It plans to partner with local VCs in Southeast Asia and India to manage joint funds while its office in Boston plans to form a fund to directly invest in US companies.

Woori Venture Partners under Woori Financial Group Inc. is seeking to launch a 100 billion won global fund. It was the first Korean VC to open offices in the US and China, and it has recently opened an operation in Singapore in August to enhance its portfolio in Southeast Asia.

Shinhan Financial Group Co.'s Shinhan Venture Investment Co. earlier this year created a 200 billion won global flagship fund to invest in US startups while planning to exit its offshore fund in Japan with 60 billion won assets under management next year.

Hana Ventures of Hana Financial Group Inc. does not have global funds focusing on a foreign portfolio but it has been investing in 10 overseas companies via its local funds.

Corporate venture companies are also actively betting on foreign assets that are expected to create great synergy with affiliates.

Lotte Ventures set up an entity in Vietnam in 2021 and a branch in Silicon Valley in the US in August. It will launch a Vietnam fund before the end of this year and another fund to invest in rechargeable battery and healthcare companies in the US next year.

Hanhwa Asset Management Co. is also in talks with an American VC to form a 200 billion won fund, which they will co-manage.

Write to Lan Heo and Jong-Woo Kim at why@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Venture capitalS.Korean startups, VC seek money, business opportunities in Japan

Venture capitalS.Korean startups, VC seek money, business opportunities in JapanSep 22, 2023 (Gmt+09:00)

5 Min read -

Venture capitalS.Korea to form $6.2 bn corporate venture capital fund pool by 2025

Venture capitalS.Korea to form $6.2 bn corporate venture capital fund pool by 2025Jul 24, 2023 (Gmt+09:00)

1 Min read -

Venture capitalKorean startups feel bite of funding drought in H1

Venture capitalKorean startups feel bite of funding drought in H1Jul 07, 2023 (Gmt+09:00)

3 Min read -

Venture capitalLotte to open Silicon Valley corporate venture capital unit

Venture capitalLotte to open Silicon Valley corporate venture capital unitMay 26, 2023 (Gmt+09:00)

3 Min read

Comment 0

LOG IN