KEPCO expects all-time high $207 mn in 2024 overseas investment returns

The utility firm says its decent performance will improve its financial stability and global competitiveness

By Dec 20, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Korea Electric Power Corp. (KEPCO), the state-run utility company, expects to post its highest-ever overseas business performance this year, thanks to improved profitability at its overseas ventures and rigorous risk management.

If confirmed, the figures will be a record high for the sole provider of electricity transmission and distribution in the country on an annual basis.

Investment returns include dividends from its overseas subsidiaries and loan recovery.

Its expected 2024 overseas revenue is up 20% from last year’s 2.5 trillion won, while its overseas investment returns are a 130% increase from 132.5 billion won the year prior.

The lion’s share of its overseas investment returns came from dividends, which stood at some 290 billion won. About 10 billion won in technical support fees for power generation projects also contributed to KEPCO’s decent performance, it said.

NINE-MONTH INVESTMENT RETURNS MORE THAN DOUBLE

Since it entered the global power business market in 1995, KEPCO has been operating 37 overseas projects across 17 countries, spanning thermal power, nuclear energy, renewable energy and other new energy businesses.

As of the third quarter of this year, the company’s cumulative overseas investment value totaled 2.5 trillion won, with investment returns reaching 3.2 trillion won, translating into an investment recovery rate of 127%.

Its January-September revenue from its overseas business stood at 46.2 trillion won.

In overseas markets, KEPCO operates power generation facilities with a capacity of 10.17 gigawatts (GW).

The company secured new overseas projects worth 6.2 GW in capacity this year.

These new ventures are expected to boost revenue by 6.4 trillion won and create opportunities for other domestic companies to expand abroad, generating an additional economic effect of 4.4 trillion won.

“We aim to proactively respond to the evolving energy market and expand our overseas operations, thereby enhancing KEPCO's financial stability and strengthening our global competitiveness,” said a KEPCO official.

The company generates more than two-thirds of Korea’s power supply, mostly through its six power generation subsidiaries.

Write to In-Soo Nam at isnam@hankyung.com

Jennifer Nicholson-Breen edited this article.

-

-

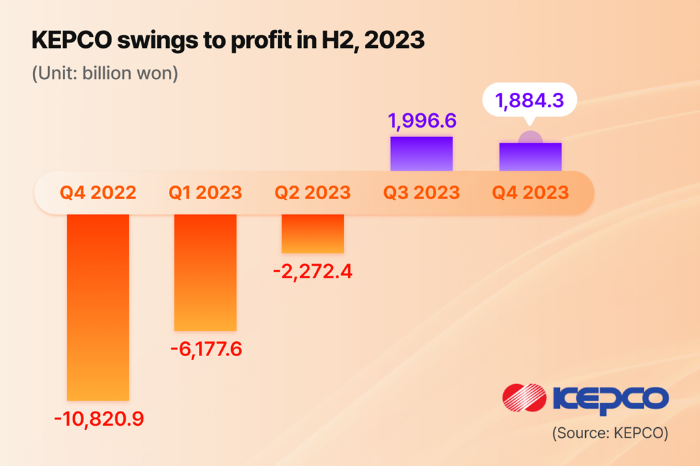

EarningsKEPCO narrows losses with 2nd straight quarterly profit

EarningsKEPCO narrows losses with 2nd straight quarterly profitFeb 23, 2024 (Gmt+09:00)

2 Min read -

Leadership & ManagementKEPCO's new CEO heralds electricity rate hikes, drastic reforms

Leadership & ManagementKEPCO's new CEO heralds electricity rate hikes, drastic reformsSep 20, 2023 (Gmt+09:00)

4 Min read