KEPCO narrows losses with 2nd straight quarterly profit

Analysts say the power utility could raise electricity rates in the third quarter after the April elections

By Feb 23, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s power utility Korea Electric Power Corp. (KEPCO) on Friday posted its second straight quarterly profit, sharply above market forecasts, on the back of electric bill hikes and a steeper-than-expected decline in global energy prices.

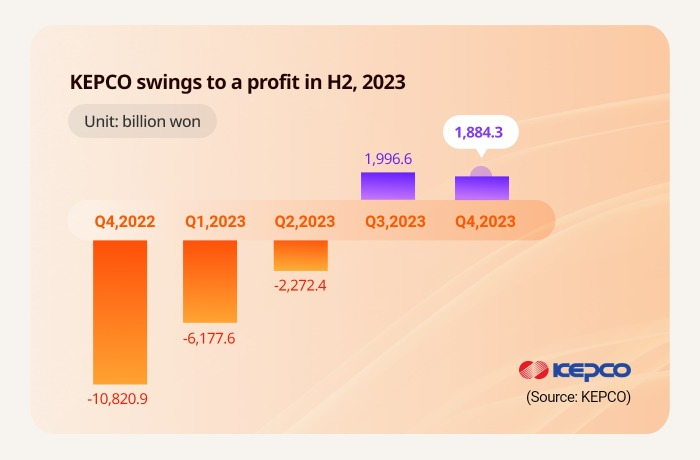

Its fourth-quarter operating profit came in at 1.88 trillion won ($1.4 billion) on a consolidated basis, 71% higher than the market consensus of 1.1 trillion won. That compared to a loss of 10.82 trillion won in the same period last year.

The state-run utility swung to a profit in the third quarter of 2023, ending nine quarters of shortfalls.

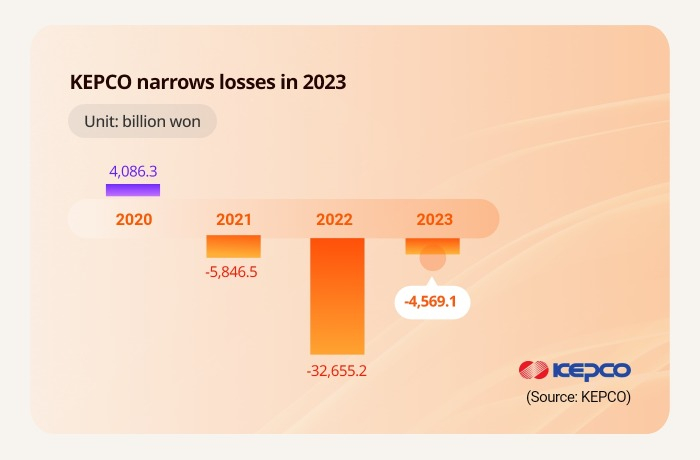

The second-half earnings sharply narrowed its losses to 4.57 trillion won for the entire 2023 year, compared to its largest-ever shortfall of 32.65 trillion won in 2022.

In the fourth quarter, its revenue increased to 22.52 trillion won, versus 19.49 trillion won a year earlier.

It has been in the deficit since 2021 because it has not fully passed energy price surges in the aftermath of Russia’s invasion of Ukraine in 2022 on to customers in line with the government's policy to curb inflation.

The fourth-quarter results raised expectations of an earnings turnaround. The market consensus for KEPCO’s operating profit is 7.5 trillion won this year and nearly 10 trillion won in 2025.

However, analysts warned the robust earnings could lead to an electricity rate freeze for an extended period and snowball its liabilities.

In the current quarter, it kept its power rates unchanged at the request of the government and the ruling People Power Party, ahead of April general elections.

The consolidated liabilities at KEPCO reached 204.06 trillion won as of the third quarter of 2023, on which it pays 11.8 billion won in interest daily.

Analysts said KEPCO could finally raise electricity bills from the third quarter after April elections as it needs to make heavy investments in power transmission and distribution grids to support large-scale manufacturing facilities, including a semiconductor cluster under construction in Yongin, about 42 kilometers south of Seoul.

On a standalone basis, KEPCO also turned a profit of 1.40 trillion won in the fourth quarter, marking its first nonconsolidated profit since the fourth quarter of 2020.

“Considering the interest costs it pays on liabilities and heavy investments required for transmission and distribution facilities, KEPCO’s EBITDA must come to at least 23 trillion won this year,” said Lee Min-jae, an analyst at NH Investment & Securities.

“It is expected to post at least 21 trillion won in EBITDA thanks to stable energy prices (in 2024), but that is insufficient to improve its financial structure,” he added.

EBITDA refers to earnings before interest, tax, depreciation and amortization.

Write to Sul-Gi Lee at surugi@hankyung.com

Yeonhee Kim edited this article.

-

-

Leadership & ManagementKEPCO's new CEO heralds electricity rate hikes, drastic reforms

Leadership & ManagementKEPCO's new CEO heralds electricity rate hikes, drastic reformsSep 20, 2023 (Gmt+09:00)

4 Min read -

EnergyKEPCO strives to drive out birds meant to bring good luck

EnergyKEPCO strives to drive out birds meant to bring good luckJul 25, 2023 (Gmt+09:00)

1 Min read -

EnergyMoody’s cuts credit view on KEPCO to lowest investment grade

EnergyMoody’s cuts credit view on KEPCO to lowest investment gradeMay 26, 2023 (Gmt+09:00)

1 Min read -

EarningsKEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling losses

EarningsKEPCO vows to save $19 bn in 5 yrs; CEO offers to resign over swelling lossesMay 12, 2023 (Gmt+09:00)

4 Min read -

Corporate bondsKEPCO raises $368 mn via bond issuance on heated demand

Corporate bondsKEPCO raises $368 mn via bond issuance on heated demandNov 29, 2022 (Gmt+09:00)

1 Min read