Business & Politics

Korean chipmakers, battery makers face new risks with Trump’s comeback

Electronics firms, builders and machinery makers, meanwhile, are seen as less susceptible to possible policy changes

By Nov 07, 2024 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Mirae Asset to be named Korea Post’s core real estate fund operator

KT&G eyes overseas M&A after rejecting activist fund's offer

Meritz backs half of ex-manager’s $210 mn hedge fund

StockX in merger talks with Naver’s online reseller Kream

With Donald Trump reelected as the next US president, South Korea’s major chipmakers, automakers and battery makers are on high alert as during his campaign he pledged to reduce or eliminate subsidies and raise tariffs.

Analysts said that as the new Trump administration resumes its "America First" policy, leading Korean companies heavily invested in US manufacturing or exporters of semiconductors, batteries and automobiles are likely to face new risks.

Korea is home to the world’s two largest chipmakers Samsung Electronics Co. and SK Hynix Inc., leading battery makers such as LG Energy Solution Ltd., SK On Co. and Samsung SDI Co., and automakers such as Hyundai Motor Co., Kia Corp. and GM Korea, a unit of General Motors Co.

COULD CHIPS ACT, IRA BE OVERTURNED?

Korean chipmakers are particularly concerned that the CHIPS and Science Act, legislated under the Biden administration, might be reversed.

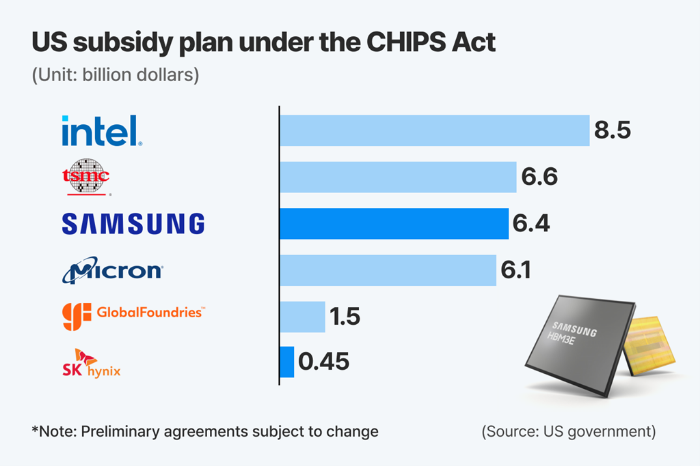

Under the act, Samsung and SK Hynix are to receive $6.4 billion and $450 million, respectively, in subsidies.

“Given Trump’s past behavior, he might try to nullify the CHIPS Act,” said an industry official.

He said if the act remains, new conditions may be imposed, aiming for expanded investments or reduced subsidies.

Speculation has it that the US government could renegotiate terms to funnel more subsidies to domestic firms such as Micron Technology Inc. and Intel Corp.

During his presidential campaign, Trump criticized Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), the world’s largest foundry player, saying, “They stole 95% of our business. It's in Taiwan right now.”

US-CHINA FACEOFF

Industry officials also raised concerns about the possibility of the Trump administration tightening sanctions on exporting advanced semiconductor equipment to China, a move that could inflict collateral damage on Samsung and SK Hynix.

Samsung operates a NAND flash memory chip plant in Xian and a chip packaging facility in Suzhou. SK Hynix runs a DRAM chip plant in Wuxi, a NAND plant in Dalian and a packaging factory in Chongqing.

Samsung’s Xian plant accounts for nearly 40% of the company’s entire NAND production globally while SK Hynix’s Wuxi plant produces about 48% of its global DRAM output.

HIGHER TARIFFS SPELL TROUBLE FOR AUTOMAKERS

Uncertainty has also increased for Korean automakers and parts suppliers, as Trump has stated he would impose 10-20% tariffs on imported vehicles and eliminate subsidies promised earlier under the Inflation Reduction Act (IRA).

The US accounted for 47.3% of Korea’s total vehicle exports valued at $108.2 billion last year.

Seoul-based iM Securities estimates that a 20% tariff could cost Hyundai and Kia an additional 400 billion ($286 million) and 200 billion won ($143 million) a month, respectively.

Analysts said higher tariffs could also halt some of GM Korea’s production lines, as the US auto giant might redirect production back to US plants. GM’s Korean unit exported 420,000 vehicles to the US last year.

If the IRA is repealed, Hyundai and Kia would lose subsidies on vehicles they manufacture in the US, including electric vehicles produced at their respective plants in Alabama and Georgia.

Hyundai recently began operations at its new EV manufacturing plant, Hyundai Motor Group Metaplant America LLC (HMGMA), in Georgia.

Battery makers are facing similar challenges.

They currently receive $35 and $10 per kWh in subsidies or battery cells and modules, respectively, produced in the US, under the Advanced Manufacturing Production Credit (AMPC) program.

President Trump could also abolish or drastically cut AMPC subsidies, industry watchers said.

ELECTRONICS, CONSTRUCTION, MACHINERY STAND TO BENEFIT

Analysts said electronics makers will be less susceptible to possible policy changes as they operate factories in the US and do not currently rely on subsidies.

LG Electronics Inc. operates a plant in Tennessee that can produce up to 1.2 million washing machines and 600,000 dryers annually. LG also plans to manufacture TVs and refrigerators at the Tennessee plant.

Samsung operates a plant in South Carolina capable of producing 1 million washing machines a year.

The construction machinery industry is optimistic about the new Trump era.

Doosan Bobcat Inc., the construction and agricultural machine-making unit of South Korea’s Doosan Group, has a production base in the US.

HD Hyundai Infracore Co. and HD Hyundai Construction Equipment Co., which built a combined production center in the US in September, will have limited tariff exposure.

Potential higher tariffs on Chinese products could improve Korean competitors’ price competitiveness, industry officials said, adding that Trump’s pledge to ease construction regulations could spark increased demand for construction equipment.

Analysts said Korean large companies are expected to strengthen their government relations teams to gauge Trump’s policy direction.

“We are building a network in the US to prepare for the new Trump administration’s policy decisions,” said an executive at a Korean conglomerate.

Write to Jae-Fu Kim, Eui-Myung Park and Hyeon-woo Oh at hu@hankyung.com

In-Soo Nam edited this article.

More to Read

-

EnergyHanwha Q Cells, OCI to benefit from expanded US CHIPS Act subsidies

EnergyHanwha Q Cells, OCI to benefit from expanded US CHIPS Act subsidiesOct 31, 2024 (Gmt+09:00)

2 Min read -

MachineryHyundai Infracore, Doosan Bobcat agree to product cross-selling in US

MachineryHyundai Infracore, Doosan Bobcat agree to product cross-selling in USMay 23, 2024 (Gmt+09:00)

2 Min read -

EarningsLG Energy Q3 profit at record high on gains from US battery tax credit

EarningsLG Energy Q3 profit at record high on gains from US battery tax creditOct 11, 2023 (Gmt+09:00)

3 Min read -

MachineryDoosan forklifts to be sold under Bobcat brand in US, eventually to Europe

MachineryDoosan forklifts to be sold under Bobcat brand in US, eventually to EuropeJul 05, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS Act

Korean chipmakersSamsung, SK Hynix asked to swallow tough pill over US CHIPS ActMar 28, 2023 (Gmt+09:00)

3 Min read -

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacy

Korean chipmakersUS CHIPS Act threatens Samsung, SK Hynix’s memory supremacyMar 02, 2023 (Gmt+09:00)

4 Min read

Comment 0

LOG IN