Terra debacle: For whom the blockchain bell tolls

Developers without altruism and ethics won't have front-row seats in the new world

May 27, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

In capitalism and the market economy, one’s monetary compensation is measured by his or her degree of contribution to improving the lives of others. As such, it is the most innovative and fair economic system. Those who delight customers with product or service innovations make good money. The market does not decide based on authority or hierarchy; nor does status nor policy matter. The anonymity of such transactions accumulates like stars in the sky to construct market justice.

Then just how judicious is it to raise capital through blockchain technology or by using cryptocurrency? Last November, the global cryptocurrency industry’s market capitalization reached a whopping $3 trillion, far outpacing the figure for the automobile industry. If we have to choose between a world without cryptocurrency and a world without cars, which should it be?

The sudden debacle of Terra (UST/ LUNA) cannot be explained simply by the inevitable fall of speculative investors, who are drawn to shiny new tokens like moths to a flame. The fundamental question here is what kind of future does blockchain promise us – and this is directly related to the future of cryptocurrency. The innate value of a digital asset lies in digital ledger technology.

Co-founder and CEO of Singapore-based Terraform Labs Do Kwon placed DeFi (decentralized finance) at the center of his business. DeFi offers financial instruments without relying on intermediaries such as brokerages, exchanges or banks by using smart contracts on a blockchain. Cryptocurrencies are at the center of the transactions. The more people use the token, the more the ecosystem grows; and with it, its value.

Unfortunately, many cryptocurrency investors were solely interested in the up and down of the token prices, rather than the ecosystem’s sustainability or the structure. Even though the price will naturally rise if and when the Terra ecosystem enriches people’s lives, not enough investors were doing their due diligence on that aspect.

Developers focused more on maintaining the Luna or Terra token prices as opposed to advancing the blockchain network, which requires significantly more time and work. The stablecoin UST’s tie to the greenback, while it lasted, was not made possible through innovation in blockchain technology but was akin to the method used by Cho Hee-pal, the mastermind behind South Korea’s largest Ponzi scheme to date.

The negative impact of the disintegration of some 50 trillion won worth of Luna/UST in just a week was bigger than the fraud scandal of Lime Asset Management Co. back in 2015. Terraform’s downfall, however, differs from the previous two in that the culprit did not run away. Interestingly enough, Kwon is still a very active member of the blockchain community.

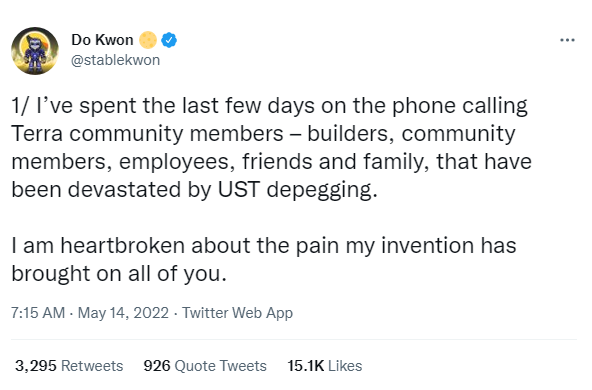

Earlier this month, the 30-year-old tweeted: “I am heartbroken about the pain my invention has brought on all of you.” But the short thread did not convey serious reflection and the level of responsibility he should feel about how the complete collapse of Luna/UST will affect the lives of its investors.

The one thing in common among developers that aspire to become crypto millionaires is this: They do not consider the road to the riches seriously enough. Many of them believe that one needs to first have money to do something meaningful. In other words, they believe it is money, not innovation, that changes the world – the most kkondae* attitude ever.

Back in the 1980s when I was in my 20s, students who majored in natural sciences or engineering were considered to be nerds who weren't well-versed in how the real world works. The roles have since been reversed. They now monopolize vocabulary such as algorithms, selection sort, and stablecoin. Young developers socialize and communicate exclusively among themselves. They look down on liberal arts graduates who inquire, “Isn’t a digital asset different than gold?” The programmers feel superior watching the world go berserk over the token they’ve “created.”

The possibility of blockchain technology opening up a whole new world to the human species remains. The accompanying technologies, such as quantum computing, are also formidable. But it isn’t comparable to the invention of the automobile industry, which liberated mankind from the limitations of distance and space. The ultimate goal of blockchain is to store all financial transactions onto a digital ledger. But why should we? Who pays for the massive cost for such a transition? Who benefits from this transition? The blockchain community has yet to answer these simple questions.

The trust in DeFi has been eroded not by governments’ checks and balances but by developers’ greedy and deceptive behavior. It has gotten so bad that the innate value-generating ability of digital assets is now in question. Programmers who are cultlike followers of technocentrism and mammonism cannot play leading roles in the new world. Technological advances devoid of altruism and ethics are punishable as fraud and lies.

And that, in essence, is the definition of market justice.

*Kkondae is a South Korean expression to describe a usually older, condescending person who is self-entitled and self-righteous.

Jee Abbey Lee edited this op-ed.

-

CryptocurrenciesCrypto investors threaten Terraform founders with class-action lawsuit

CryptocurrenciesCrypto investors threaten Terraform founders with class-action lawsuitMay 17, 2022 (Gmt+09:00)

3 Min read -

CryptocurrenciesPolice identify visitor to Terra founder's home as crypto streamer

CryptocurrenciesPolice identify visitor to Terra founder's home as crypto streamerMay 17, 2022 (Gmt+09:00)

3 Min read -

CryptocurrenciesCryptocurrency Luna plunges 99% after linked stablecoin loses peg

CryptocurrenciesCryptocurrency Luna plunges 99% after linked stablecoin loses pegMay 13, 2022 (Gmt+09:00)

6 Min read