Cryptocurrencies

Cryptocurrency Luna plunges 99% after linked stablecoin loses peg

Investors went on a selling spree, reminiscent of the rapid decline of Lehman Brothers in 2008

By May 13, 2022 (Gmt+09:00)

6

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The value of Luna, the cryptocurrency linked to stablecoin TerraUSD, now hovers just above $0.

Just a week ago, its market capitalization was around $37.8 billion.

TerraUSD, also known as UST, plunged below the $1 mark despite supposedly being pegged one-to-one to the US dollar.

Before we get further into the demise of Luna, here is what makes the greenback the most stable currency – the world’s reserve currency.

Thanks to the strength of the US economy and its financial markets, the dollar is what central banks and monetary authorities around the globe hold in large quantities for use in international transactions and investments.

Working on the stability of the formidable greenback, UST, an algorithmic stablecoin, uses code to maintain the price of a buck.

STABLECOIN STUMBLE

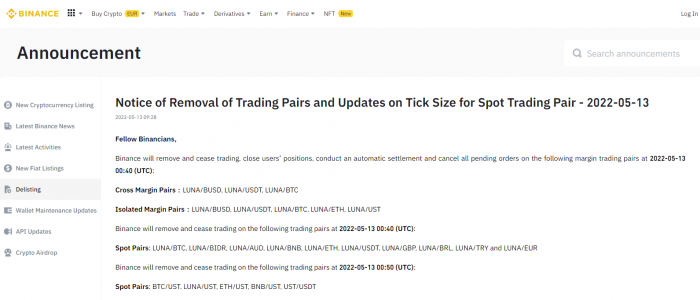

The world’s largest cryptocurrency exchange Binance announced Friday it will remove Luna and UST from its platform – following what is widely considered to be one of the industry's biggest meltdowns.

Binance indefinitely suspended the trading of the two across most of its spot pairs Thursday evening; and froze Luna trading across all cross margins and isolated margin pairs.

South Korean crypto exchanges Upbit and GOPAX will follow suit with delistings scheduled for May 16 and 17 respectively.

A day prior, Upbit, Bithumb, Coinone, and Korbit have unanimously put a halt on the trading of Luna to prevent a further selling spree.

On Coinbase, the price of a single Luna stands at $0.0095 as of Friday afternoon. The figure is in sharp contrast to April 5 when it reached $116 per token.

When compared to a day and a week prior, the price of Luna on Thursday tumbled 96.8% and 99.7%, respectively.

The fall of one of the most prominent stablecoins has dampened overall investor sentiment in digital assets.

Bitcoin slid below the $30,000 mark at one point during trade on Thursday – for the first time since last July. The figure has since recovered past $30,400 per BTC during intraday trade Friday.

Ether, Ripple, and Solana all slid by 18 to 29% on Thursday.

FROM STELLAR START TO CONTROVERSY

All eyes are on Do Kwon, the CEO of Terraform Labs.

The 31-year-old attended Seoul-based Daewon Foreign Language High School before majoring in computer engineering at Stanford University.

After working as an engineer at Microsoft and Apple, Kwon founded Terraform Labs with Ticket Monster founder Shin Hyun-sung in 2018.

Dunamu Inc., which operates South Korea’s largest cryptocurrency exchange Upbit, invested in Terraform in its early stages through the investment arm Dunamu and Partners. Dunamu became the country’s first conglomerate in the digital asset industry in late April.

Binance had also injected capital into Terraform as a seed investor.

Despite the smooth beginning, Terraform Labs is in a rocky situation with Washington.

In late February, a US court ordered the company and CEO Kwon to comply with a subpoena issued to him by the US Securities and Exchange Commission.

The SEC served the company’s founder with a subpoena last September during a blockchain event in New York. The top US financial watchdog accused Kwon and Terraform of allowing its citizens to trade securities without obtaining the required licensing.

Kwon retaliated by saying the SEC violated his right to due process for serving him a subpoena in public. He also stressed the SEC does not have jurisdiction over him or his company as he is a South Korean citizen and the company is based in Singapore.

BANK RUN

So how do Luna and UST work in conjunction with each other?

UST is a stablecoin created on the Terra ecosystem and its value is pegged to the greenback. Luna, on the other hand, is the native token for the Terra ecosystem and the reserve currency for UST.

UST differs from other stablecoins like Tether and USD Coin in that it is not backed by any real-world assets such as bonds. In this sense, the success of the Terra ecosystem is dependent on investors’ trust that the influx of Luna in circulation will not decrease its value.

The company used decentralized finance (DeFi) protocol Anchor to support the price of Luna.

Anchor is a savings, lending and borrowing platform built on the Terra platform, which allows users to earn up to 19.5% in yields on UST deposits and take out loans against holdings. Critics have previously pointed out that high-interest rates are unsustainable given how expensive it would be to maintain those rates.

At one point, a whopping 70% of all UST liquidity was deposited into Anchor.

When the value of Terra fell below a buck on Tuesday, the price of Luna also tumbled despite the company issuing more of the token. UST holders embarked on a selling spree, resulting in what the media described as a “death spiral.”

Investors who had deposited their Luna into Anchor cashed out amid the bearish sentiment and exacerbated the situation. UST had previously enjoyed a 60% leverage vis-a-vis Anchor protocol.

RECONSTITUTION PLAN

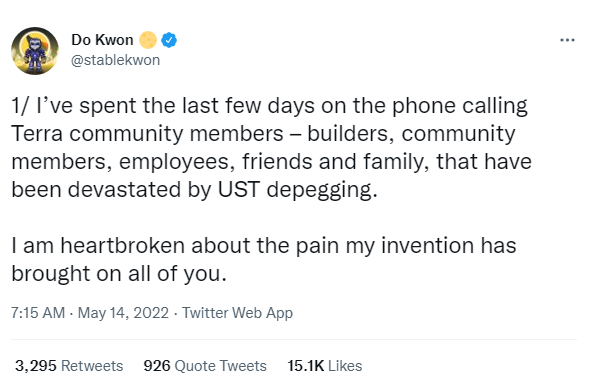

Do Known broke the silence and apologize to the Luna and UST investors on Twitter Friday night.

He wrote: "I’ve spent the last few days on the phone calling Terra community members – builders, community members, employees, friends and family, that have been devastated by UST depegging. I am heartbroken about the pain my invention has brought on all of you."

The CEO elaborated, "Neither I nor any institutions that I am affiliated with profited in any way from this incident" and emphasised he has not sold any Luna nor UST during the price plunge.

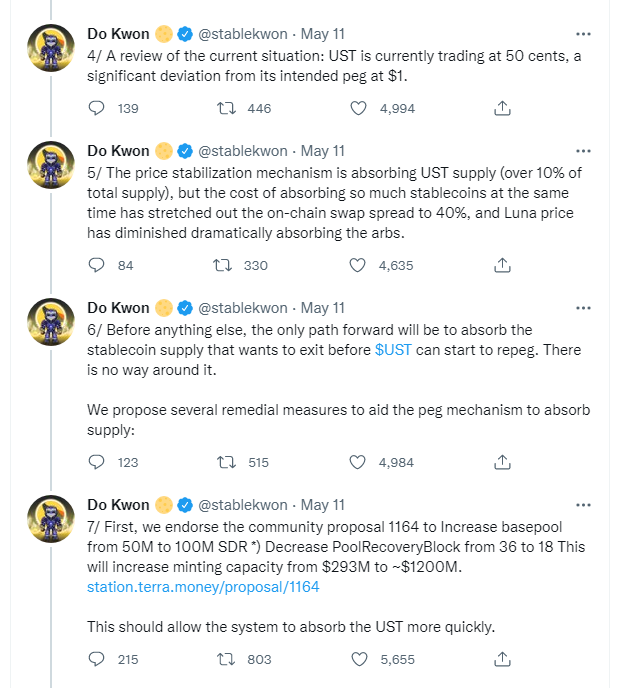

On Wednesday, Kwon shared how the company plans to reverse the downward trend in a thread of tweets.

“I understand the last 72 hours have been extremely tough on all of you — know that I am resolved to work with every one of you to weather this crisis, and we will build our way out of this,” Kwon tweeted. “Together.”

Terraform Labs will increase its minting capacity from $293 million to $1.2 billion.

Kwon elaborated, “Naturally, this is at a high cost to UST and LUNA holders, but we will continue to explore various options to bring in more exogenous capital to the ecosystem & reduce supply overhang on UST.”

The need for stronger regulation on stablecoins is gaining ground in the US government.

On the same day as Kwon's tweet, Senate Banking Committee chairman Sherrod Brown issued a statement underlining this need. Brown said the sharp decline of UST raises general questions about stablecoins and should be interpreted as a warning to be skeptical of the stablecoin sector.

Over in Seoul, local media reports say that law enforcement officials are trying to identify the person who came to Kwon's wife's house and asked about his whereabouts. The wife has now been reportedly placed in protective police custody at her own request.

Investors have taken to online forums to write about "going to Han River," a euphemism for suicide by drowning.

On the country's main portal Naver, the number of keyword searches for Mapo Bridge surged to 760 on Thursday from the previous average of 300 per day.

The Mapo police station announced it has strengthened patrol around the area as a preventative measure.

(Updated with the latest from crypto exchanges and investor reactions in South Korea.)

Write to Jin-Woo Park at jwp@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

MetaverseSKT, SK Square invests $40 mn in Korea metaverse game firm

MetaverseSKT, SK Square invests $40 mn in Korea metaverse game firmMay 06, 2022 (Gmt+09:00)

1 Min read -

Business & PoliticsSK beats Hyundai Motor to become S.Korea’s No.2 conglomerate

Business & PoliticsSK beats Hyundai Motor to become S.Korea’s No.2 conglomerateApr 28, 2022 (Gmt+09:00)

3 Min read -

FintechS.Korea’s top securities firms enjoy high returns on fintech investment

FintechS.Korea’s top securities firms enjoy high returns on fintech investmentApr 08, 2022 (Gmt+09:00)

2 Min read -

-

CryptocurrenciesTotal of 19 mn Bitcoins mined, pushing price upward

CryptocurrenciesTotal of 19 mn Bitcoins mined, pushing price upwardApr 05, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN