Business & Politics

SK beats Hyundai Motor to become S.Korea’s No.2 conglomerate

Dunamu has become the first crypto conglomerate; ranking 44th

By Apr 28, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

SK Group, which has SK Inc. as its holding company, is now South Korea’s second-largest conglomerate by asset size – replacing automotive behemoth Hyundai Motor Group.

The ascent is the result of continued investments in battery and biotech industries and the semiconductor arm’s robust sales.

17 YEARS IN MAKING

South Korea’s Fair Trade Commission (FTC) announced Wednesday that SK Group’s total amount of assets last year increased 52 trillion won from the previous year to exceed 292 trillion won ($230 billion.) Looking at SK’s journey so far, the group was the country’s fifth-largest conglomerate in 2004; and became the third-largest in 2005.

Hyundai Motor Group, which consists of Hyundai Motor Co. and Kia Corp., has 258 trillion won in total assets.

Perhaps not surprisingly, Samsung Group maintains the first position with 484 trillion won in total assets.

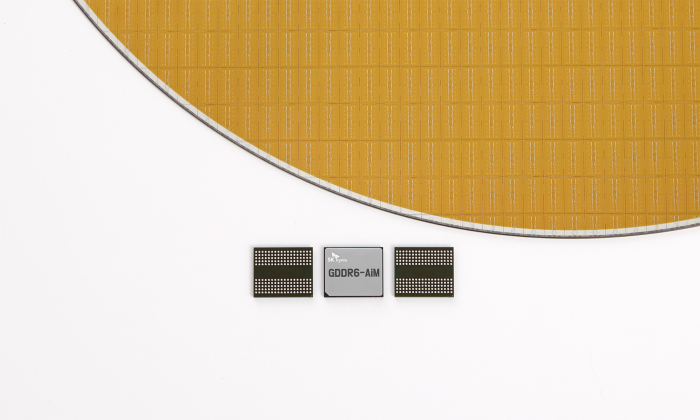

SK’s asset increase is led by its semiconductor arm, which saw a 21 trillion won jump in capital.

SK Hynix Inc. enjoyed strong sales of semiconductor chips amid the growing demand for parts amid the global pandemic. The company had also acquired Intel Corp.’s SSD business and the Dalian NAND flash manufacturing facility in China.

The revenue from Hynix was put into good use, industry insiders explained.

“Chairman Chey Tae-won’s Deep Change initiative bumped up the group’s asset size by exploring new growth engines,” an SK employee told The Korea Economic Daily while explaining the campaign was about seeking fundamental innovations.

IT’S THE LAW

Each year on May 1, South Korea’s top financial watchdog compiles two lists of conglomerates and their leaders based on asset size that will be under a special set of regulations. The bigger the asset size, the more a business needs to disclose to Seoul.

Based on the latest data, the FTC labeled 76 groups to have at least 5 trillion won in total assets; and 47 groups as having more than 10 trillion won in total.

The regulatory body makes the categorizations in the name of preventing monopoly and monitoring any unlawful practices of the companies’ chief executives and their familial relations.

FIRST CRYPTO CONGLOMERATE

Dunamu Inc., the operator of Korea’s largest cryptocurrency exchange Upbit, became the country’s first conglomerate in the digital asset industry.

Dunamu’s total assets stand at a whopping 11 trillion won thanks to bullish sentiment on virtual currency at home and abroad. Incorporated in April 2012, Dunamu is now the 44th largest South Korean company by asset size.

Apart from Dunamu, eight other companies have been designated as conglomerates for the first time such as game developer Krafton Inc. and food and beverage company Nongshim Co.

Three companies got removed from the conglomerate list: IMM Investment Corp., Korea Investment Holdings, and Daewoo Engineering & Construction.

With the latest revision to the antitrust legislation, the financial services firms, insurance companies, and private equity fund operators are exempt from the conglomerate list. In the case of Daewoo, it was acquired by Jungheung Construction Co.

Eight companies got included in the 10 trillion won club for the first time including Jungheung, Dunamu, and HMM Co.,, formerly known as Hyundai Merchant Marine.

COUPANG EXEMPTION

The FTC has been pushing to include foreign nationals to the list of owner-turned-heads of conglomerates it monitors. Until now, this compilation only includes entrepreneurs of South Korean citizenship.

But the financial commission was betting on a pledge that President-elect Yoon Suk-yeol made during his campaign – which was to make “logical adjustments” to the antitrust legislation – to expand its authority beyond Korean nationals.

“Designating a CEO who is a foreign national to be under stricter monitoring requires careful consideration as that could lead to legal actions against a foreigner,” Fair Trade Commission Vice Chairman Kim Jae-shin said. “The commission will decide on possible revisions to the current system at the earliest possible date in order to minimize market uncertainty.

Write to So-Hyeon Kim, Ji-Hoon Lee, Kyung-Min Kang at alpha@hankyung.com

Jee Abbey Lee edited this article.

More to Read

-

Electric vehiclesSK buys power semiconductor maker for EV chip business

Electric vehiclesSK buys power semiconductor maker for EV chip businessApr 27, 2022 (Gmt+09:00)

2 Min read -

Korean startupsYoon admin to launch special startup-support track

Korean startupsYoon admin to launch special startup-support trackApr 27, 2022 (Gmt+09:00)

2 Min read -

Artificial intelligenceSK Telecom’s bet on air mobility, metaverse in full display at World IT Show

Artificial intelligenceSK Telecom’s bet on air mobility, metaverse in full display at World IT ShowApr 18, 2022 (Gmt+09:00)

3 Min read -

-

Korean startupsCoupang wraps up 2021 with record sales of $18.4 bn

Korean startupsCoupang wraps up 2021 with record sales of $18.4 bnMar 04, 2022 (Gmt+09:00)

3 Min read

Comment 0

LOG IN