S.Korean government seeks to lower streaming service rates

Following a wave of streaming service rate hikes in late 2023, the country’s average household telecom spending is set to jump

By Feb 14, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

The South Korean government is seeking to lower the country’s video streaming service, or over-the-top (OTT) media service, rates as part of its efforts to tame the country’s inflation.

According to streaming service industry sources on Wednesday, the Korean presidential office is reported to have ordered related state agencies to find ways to lower streaming service fees, and the Ministry of Science and ICT, the country’s telecom policy regulator, has already embarked on the process to scrutinize a series of streaming service rate hikes in the country over recent months.

As streaming services have become one of the mainstream entertainment media in the country, their fee hikes are poised to increase households' financial burden, which worries the government.

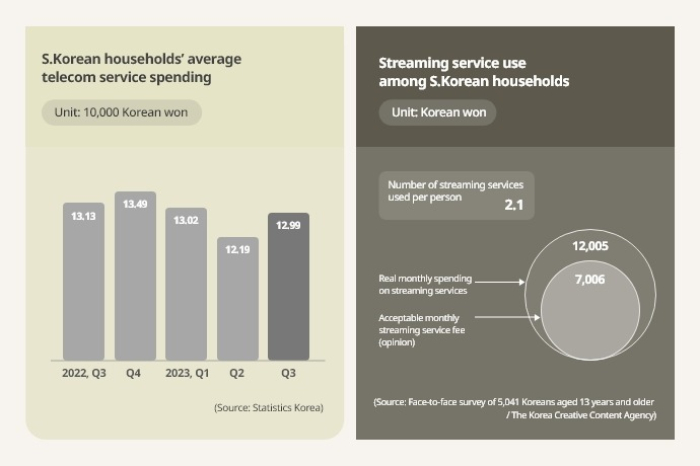

The Korea Economic Daily recently reported that the average Korean household telecom service spending would jump to the historic high of more than 140,000 won ($104.75) in 2025 from 129,969 won as of the third quarter of 2023, considering that the streaming service cost will be included in the country’s official household telecom service spending statistics next year.

Korean households spent 12,005 won on average monthly for streaming services as of the third quarter of last year.

The country currently offers the average household telecom service sending data comprising the cost of telecom services, including data, and media devices. Streaming service fees are under the cultural service spending category.

STREAMFLATION

Major video streaming platforms have hiked their service rates across the globe since last year to improve their profitability.

In Korea, the price of their subscription rates climbed by 20.3% to 43% over the past six months.

Netflix, the dominant OTT player in Korea, in December stopped offering its basic ad-free plan for 9,500 won a month, while YouTube jacked up the monthly rate for its premium service by 43% to 14,900 won in the same month.

A month earlier, Disney Plus already raised its ad-free premium service rate to 13,900 won a month from the previous 9,900 won.

TVing, a home-grown OTT owned by Korean entertainment powerhouse CJ ENM Co., has also upped its standard service rates to 13,500 won from 10,900 won and its premium service to 17,000 won from 13,900 won.

A wave of streaming service rate hikes has led to the coining of the term “streamflation” worldwide.

According to the Korea Creative Content Agency, 86.5% of 5,041 respondents aged 13 years and older to its survey subscribed to a streaming service last year. The average number of streaming platforms used per person also reached 2.1.

Their spending on OTT services will rise significantly this year following streaming service rate hikes late last year, boding ill for the Korean government’s efforts to ease inflation pressure.

In a separate move, the Science and ICT ministry in November announced measures to cut telecom service rates, forcing the country’s mobile carriers to trim their service rates to join the government in a bid to further slow inflation.

But it would not be easy for the Korean government to wield power over the pricing practice of streaming services, considering that the country’s dominant OTT players are mostly foreign players such as Netflix and YouTube.

According to Seoul-based mobile app analysis service MobileIndex Insight, Netflix, the global streaming giant, ranked No. 1 streaming service in Korea, with 12.92 million monthly active users.

UNLEVEL PLAYING FIELD

Foreign streaming operators such as Netflix are nearly exempt from the Korean government’s media regulations under current laws.

The Korean government has almost no means of regulating foreign streaming services even if they violate consumer rights in Korea.

This means the government’s attempt to lower OTT service rates would force only local players to cut their rates as Korean streaming service operators are subject to a slew of rules set by the country’s antitrust watchdog Fair Trade Commission.

Local streaming service operators worry the government’s pressure to cut streaming service rates would create an even more unlevel playing field between local and foreign players.

Unless foreign OTT giants agree to lower their rates, the Korean government’s attempt to cut the country’s overall telecom service rates will not succeed, said an official from the local streaming service industry.

Write to Ji-Eun Jeong at jeong@hankyung.com

Sookyung Seo edited this article.

-

EconomyKorea’s inflation at 6-month low in further relief to BOK

EconomyKorea’s inflation at 6-month low in further relief to BOKFeb 02, 2024 (Gmt+09:00)

2 Min read -

EconomyKorea’s consumer inflation reaches 3.6% in 2023 on high utilities

EconomyKorea’s consumer inflation reaches 3.6% in 2023 on high utilitiesDec 29, 2023 (Gmt+09:00)

2 Min read -

Tech, Media & TelecomKorea’s besieged mobile carriers grapple with OTT players’ rate hikes

Tech, Media & TelecomKorea’s besieged mobile carriers grapple with OTT players’ rate hikesDec 27, 2023 (Gmt+09:00)

3 Min read -

Tech, Media & TelecomUnder siege by OTT players, Korean mobile carriers seek higher VOD sales

Tech, Media & TelecomUnder siege by OTT players, Korean mobile carriers seek higher VOD salesAug 31, 2023 (Gmt+09:00)

3 Min read -

Content platformsA Goliath vs. Davids battle in the S.Korean OTT market

Content platformsA Goliath vs. Davids battle in the S.Korean OTT marketMay 22, 2023 (Gmt+09:00)

3 Min read