Content platforms

A Goliath vs. Davids battle in the S.Korean OTT market

NetflixŌĆÖs efforts to double down on its lead in Korea are paying off, with its April viewership up to 11.6 million

By May 22, 2023 (Gmt+09:00)

3

Min read

Most Read

Hankook Tire buys $1 bn Hanon Systems stake from Hahn & Co.

NPS to hike risky asset purchases under simplified allocation system

Osstem to buy BrazilŌĆÖs No. 3 dental implant maker Implacil

UAE to invest up to $1 bn in S.Korean ventures

US multifamily market challenges create investment opportunities

Netflix Inc. is poised to further distance itself from its money-losing local peers in the South Korean video streaming market this year, as it makes bolder investments in Korean content productions and cheaper ad-supported subscription plans. ┬Ā

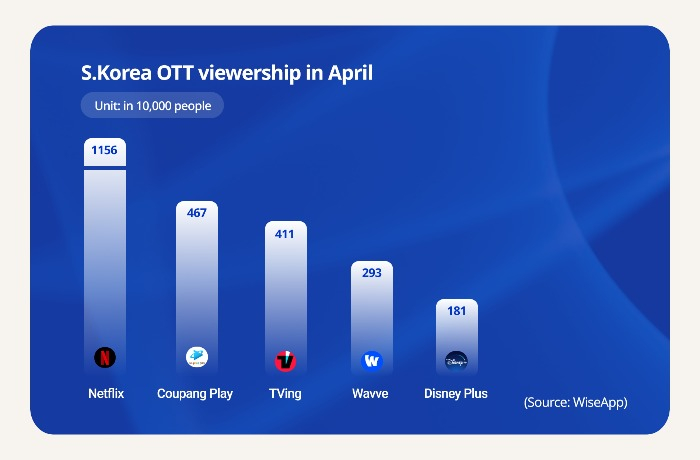

According to Korea-based app market tracker WiseApp on Monday, Korean subscribers to Netflix numbered 11.6 million as of April, making it an unrivaled leader in the Korean video streaming market.

The countryŌĆÖs top three homegrown over-the-top (OTT) platforms ŌĆö Coupang Play, TVing and Wavve ŌĆö drew 4.7 million, 4.1 million and 2.9 million viewers, respectively, over the same period.

Industry observers expect the US video streaming giant to further widen its lead in Korea this year as it prepares to spend $2.5 billion in Korea over the next four years and offer cheaper subscription plans to woo penny-pinching younger viewers.

In contrast, homegrown OTT players are expected to tighten their belts after reporting a slowdown in earnings growth.

NETFLIX BECOMES BOLDER IN KOREAN EXPANSION

Netflix Co-Chief Executive Ted Sarandos pledged to invest $2.5 billion in Korean content production over the next four years during his meeting with President Yoon Suk Yeol, who visited the US last month on his first state visit.

The new investment is double the total spending the US streaming giant has made in Korea since its advance into the country in 2016.

Its bold investment decision comes after enjoying huge global successes with Korean shows such as ŌĆ£Squid Game," ŌĆ£The GloryŌĆØ and ŌĆ£Physical 100.ŌĆØ

It is confident about Korean content given that Korean pop culture, from music to movies to food, is also enjoying a heyday on the global stage, which has turned the small Asian country into a battleground among global and domestic OTT players.

NetflixŌĆÖs plan to re-ignite its growth with Korean content is expected to be backed by its tiered, ad-supported subscription plans.

It recently introduced domestic subscribers to a new 5,500 won ($4.17) per month ad-supported plan that allows two concurrent streams at a higher video quality of 1,080p resolution.

At its launch last year, the ad plan was supported by the lower 720p video quality, and users could watch content on only one device during a viewing period.

The new cheaper plan has already succeeded in adding more viewers, especially frugal viewers in their 20s and 30s.

Last week, Netflix disclosed that its ad-based plan has attracted nearly five million global monthly active users since its launch six months ago. The company raked in $1.7 billion in operating profit in the first quarter of this year.

MONEY-LOSING KOREAN OTT PLAYERS

The US streaming giantŌĆÖs success is not being replicated by its smaller Korean rivals,┬Āwhose efforts to produce competitive shows have resulted in huge losses.

Wavve, jointly run by KoreaŌĆÖs top mobile carrier SK Telecom Co. and three major local broadcasters, logged a 121.3 billion won operating loss last year, widening its losses of 55.8 billion won in 2021 and 16.9 billion won in 2020.

Korean entertainment powerhouse CJ ENM Co.ŌĆÖs OTT streaming platform TVing, which was merged with Seezn run by domestic telecom giant KT Corp., reported a 119.1 billion won loss in 2022, surpassing its losses of 76.2 billion won in 2021 and 6.1 billion won in 2020.

Watcha Inc. logged 55.5 billion won in operating loss last year.

All are expected to remain in the red this year. Poor performance will likely restrain the homegrown OTT players from making aggressive investments for some time.┬Ā

Wavve CEO Lee Tae-hyun said last month that the company does not foresee an imminent turnaround over the next one or two years.

Worse yet, WatchaŌĆÖs auditing firm, Shinhan Accounting Corp., last month noted in a report the uncertainty of Watcha as a going concern, citing its complete capital erosion, growing debt and cash scarcity.

Write to Ji-Eun Jeong at jeong@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Content platformsNetflix to inject $2.5 bn in Korean drama series, movies over next 4 years

Content platformsNetflix to inject $2.5 bn in Korean drama series, movies over next 4 yearsApr 25, 2023 (Gmt+09:00)

2 Min read -

Content platformsKT spurs content creation with hot Netflix drama Attorney Woo

Content platformsKT spurs content creation with hot Netflix drama Attorney WooJul 25, 2022 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsCJŌĆÖs TVing, KTŌĆÖs Seezn set for merger to challenge OTT leader Netflix

Mergers & AcquisitionsCJŌĆÖs TVing, KTŌĆÖs Seezn set for merger to challenge OTT leader NetflixJul 13, 2022 (Gmt+09:00)

4 Min read -

EntertainmentTVing partners with Paramount Plus to challenge Netflix in Korea

EntertainmentTVing partners with Paramount Plus to challenge Netflix in KoreaJun 17, 2022 (Gmt+09:00)

3 Min read -

EntertainmentSquid GameŌĆÖs mega-hit spurs Netflix to release record K-content

EntertainmentSquid GameŌĆÖs mega-hit spurs Netflix to release record K-contentJan 19, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN