Content platforms

Korea’s homegrown OTT Watcha at crossroads amid dearth of cash

Domestic OTT players are waging an uphill battle with cash-rich global peers such as Netflix to create content

By Apr 16, 2023 (Gmt+09:00)

4

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s homegrown over-the-top (OTT) platform Watcha Inc. is struggling to raise funds as it faces an uphill battle to win over customers in one of the world’s fastest-growing on-demand video streaming markets.

The domestic OTT startup, once regarded as a growing rival to Netflix Inc. in the Korean market, has recently seen its capital fully eroded by debt alongside snowballing operating losses over the past couple of years.

According to Watcha’s audit report submitted to the Financial Supervisory Service, the OTT operator’s sales revenue on a consolidated basis was 73.3 billion won ($56.1 million) in 2022, up 3.5% from 70.8 billion won the year prior.

Its operating loss, however, widened to 55.5 billion won from 24.8 billion won.

Watcha’s auditing firm, Shinhan Accounting Corp., in its report noted the uncertainty of Watcha as a going concern, citing its complete capital erosion, growing debt and cash scarcity.

As of the end of 2022, Watcha’s current liabilities – debt that must be settled within the fiscal year or the firm’s operating cycle – exceeded its current assets by 32.3 billion won.

Its cashable assets stood at 4.2 billion won at the end of last year, down significantly from 28.1 billion won at the end of 2021.

CONTENT WAR

Korea is rapidly emerging as a battleground for domestic and global OTT players to secure content as locally produced movies and drama series have become global hits.

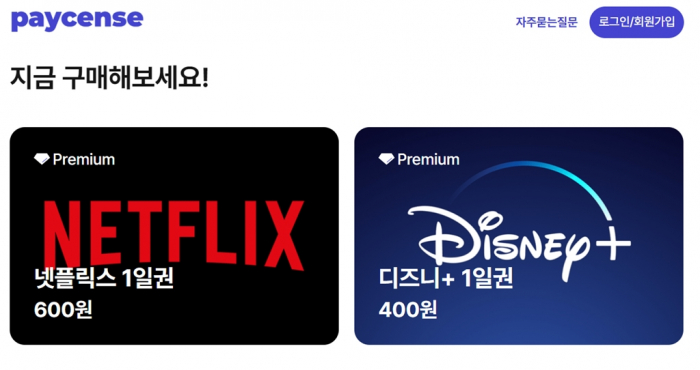

In Korea, Netflix is the dominant player with its viewership growth far exceeding that of its competitors thanks to a string of popular content releases like Squid Game and All of Us are Dead.

Other global OTT operators, including Disney Plus, Paramount Plus and Apple TV Plus, have also launched their services in Korea on their own or in partnership with domestic players.

In response, Korea’s homegrown players have joined forces with their local rivals to take on their bigger overseas competitors seeking to gain ground in Korea.

Last year, Korean entertainment powerhouse CJ ENM Co.'s OTT streaming platform TVing merged with Seezn, run by telecommunications giant KT Corp., to gain the upper hand in the increasingly competitive on-demand video streaming market.

CJ ENM has been spending heavily to pursue acquisitions in Korea and abroad to capitalize on the global success of K-content ranging from TV series and movies to pop music groups.

CJ, the producer of the Oscar-winning film Parasite, runs more than a dozen cable TV channels, including drama channel tvN and music channel Mnet as well as TVing.

Korea’s top mobile carrier SK Telecom Co., which runs OTT service Wavve in collaboration with three local major broadcasting companies, is also spending heavily to secure popular content to compete with its local and foreign rivals.

TVing and Wavve posted operating losses of 119.2 billion won and 121.7 billion won, respectively, last year amid fierce competition.

BLOOM IS OFF THE ROSE

Amid a heated race for appealing content, movie and drama series watchers have fallen out of love with Watcha, struggling with fast-depleting cash for new investments.

The number of Watcha’s active users dropped to 710,000 as of February, down sharply from 1.39 million users two years earlier.

Founded in 2011 as a content review aggregator, Watcha entered the Korean OTT market with its streaming service Watcha Play in 2015.

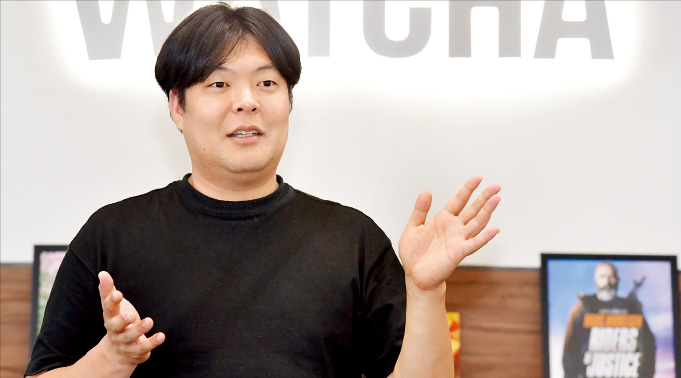

Founder and Chief Executive Park Tae-hoon is the largest shareholder. Other major investors include Korea’s venture capital firms Atinum Investment Co., Kakao Ventures Corp. and Company K Partners Co. as well as state-run Korea Development Bank.

Watcha has been striving to secure funds but such efforts have gone awry largely due to weak investment sentiment amid high interest rates and worsening economic conditions.

In the first half of last year, the company attempted to attract a pre-IPO investment of 100 billion won but failed to draw investors.

Korea’s third-largest mobile carrier LG Uplus Corp. and the country’s top bookstore chain Kyobo, SK Telecom, KT, CN ENM and Ridi Corp., the Korean version of Kindle, once sought to acquire Watcha but have all withdrawn their interest in the crosstown rival.

Watcha said it is looking at various ways to raise funds, including adding more interim commercials to its drama series and OTT content at lower service charges while making the most of its content review service, which provides personalized content recommendations.

Based on its in-house artificial intelligence system that analyzes 650 million pieces of review data and recommends films and drama series, Watcha last year released an original gay romance drama series, Semantic Error, which instantly became a hit.

“With the investment market slumping plus its users leaving for other global OTT platforms, it may be hard for smaller domestic companies such as Watcha to raise enough money,” said an industry official.

Write to Joo-Wan Kim at kjwan@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Mergers & AcquisitionsLG Uplus poised to acquire homegrown OTT platform Watcha

Mergers & AcquisitionsLG Uplus poised to acquire homegrown OTT platform WatchaDec 06, 2022 (Gmt+09:00)

2 Min read -

EntertainmentK-content shares rise as OTTs bask in success of dramatized webtoons

EntertainmentK-content shares rise as OTTs bask in success of dramatized webtoonsJan 20, 2021 (Gmt+09:00)

3 Min read -

Mergers & AcquisitionsKorea’s No. 1 bookstore Kyobo seeks to acquire OTT platform Watcha

Mergers & AcquisitionsKorea’s No. 1 bookstore Kyobo seeks to acquire OTT platform WatchaSep 20, 2022 (Gmt+09:00)

2 Min read -

Mergers & AcquisitionsCJ’s TVing, KT’s Seezn set for merger to challenge OTT leader Netflix

Mergers & AcquisitionsCJ’s TVing, KT’s Seezn set for merger to challenge OTT leader NetflixJul 13, 2022 (Gmt+09:00)

4 Min read -

Tech, Media & TelecomTwo thirds of Koreans use OTT services; YouTube favored

Tech, Media & TelecomTwo thirds of Koreans use OTT services; YouTube favoredFeb 02, 2021 (Gmt+09:00)

1 Min read

Comment 0

LOG IN