Tech, Media & Telecom

Quantum computing firm IonQ hit by short seller report

The US startup ranks sixth among most-bought foreign stocks by S.Korean retail investors since April

By May 05, 2022 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

IonQ Inc., a US-listed quantum computing firm, has become a new target of short selling-focused Scorpion Capital, taking a hit from the US hedge fund’s harsh comments in its 183-page investigative report on the startup earlier this week.

Calling IonQ’s claim that it has the world’s most powerful quantum computer “a hoax” and a “quantum Ponzi scheme,” Scorpion said in the report on May 3 that such a machine doesn’t exist and the startup is just one of countless academic projects rather than a company.

There was no immediate response from IonQ to the report, which sent its shares to their historic closing low of $7.15 on Tuesday. The stock extended its decline to an all-time low of $6.47 on Wednesday, before bouncing back to end at $7.50.

The quantum computing firm, co-founded by two US-based physics professors in 2015, garnered attention after it received funding from world-leading companies and venture firms, including Samsung Electronics Co., Amazon Web Services, Google Ventures, Lockheed Martin and Airbus Ventures.

It has also made its name by teaming up with global companies. In January of this year, the Maryland-based startup agreed with Hyundai Motor Co. to use quantum computers to improve the performance, cost and safety of lithium batteries for electric vehicles.

Last month, the two companies also agreed to expand their partnership to apply quantum machine learning to image classification and three-dimensional object detection for future mobility.

IonQ became the world’s first publicly traded quantum computing firm in October 2021 through a special purpose acquisition company.

IonQ announced in October 2020 that it had developed the world’s most powerful quantum computer with a 32-qubit system, or with 32 perfect qubits.

However, based on interviews with 25 people, including IonQ's ex-employees, its customers and quantum computing experts, Scorpion alleged: "The company’s claims of a 32-qubit machine are fraudulent.”

REMINISCENT OF NIKOLA

The US hedge fund also questioned CEO Peter Chapman’s educational credentials regarding his work experience at MIT Artificial Intelligence lab at the age of 16, adding that IonQ is reminiscent of Nikola, a US electric truck maker.

In 2020, Trevor Milton, founder and then-executive chairman of Nikola, resigned after investment fund Hindenburg Research accused him of making false assertions about Nikola's technology.

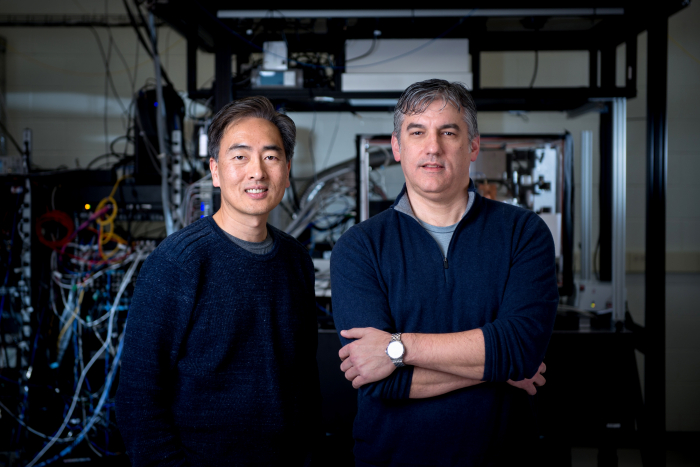

IonQ was founded by Kim Jungsang, a professor in the department of electrical and computer engineering at Duke University and Chris Monroe, a physics professor at the University of Maryland.

In March, the quantum computing firm was named to TIME’s annual list of 100 Most Influential Companies.

The magazine said at the time that quantum computing stands to revolutionize industries from medicine to energy and beyond. It also credited IonQ with offering clients access to quantum computing as a service, compatible with existing cloud computing service providers.

IonQ started out with $2 million in seed funding and raised an additional $20 million from GV, Amazon Web Services, and NEA in the following years.

In September 2021, Hyundai Motor joined its pool of investors with the injection of 7.1 billion won ($6 million) in the US startup.

As of May 4, IonQ ranked sixth among most-bought foreign shares by South Korean retail investors since the start of April, according to the Korea Securities Depository.

Write to Go-Woon Lee at ccat@hankyung.com

Yeonhee Kim edited this article.

More to Read

-

Future mobilityHyundai Motor expands partnership with quantum computing firm IonQ

Future mobilityHyundai Motor expands partnership with quantum computing firm IonQApr 20, 2022 (Gmt+09:00)

3 Min read -

Future mobilityHyundai Motor invests in cloud, hydrogen firms for future mobility

Future mobilityHyundai Motor invests in cloud, hydrogen firms for future mobilityMar 17, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN