Tech, Media & Telecom

Samsung Display picked as sole OLED screen supplier for foldable iPhone

The South Korean display giant is expected to supply more than 15 million foldable OLED displays for the foldable iPhone series

By Apr 14, 2025 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

Samsung Display Co., the display-making unit under Samsung Electronics Co., will exclusively supply organic light-emitting diode (OLED) displays for Apple Inc.’s first foldable iPhone series, which is expected to hit the market late next year.

With the South Korean display giant chosen as the sole provider for the world’s No. 1 smartphone seller, it is forecast to cement its lead in the global foldable OLED display market with a share of more than 70% versus the current 40%.

According to smartphone industry sources on Sunday, Apple has picked Samsung Display as the sole provider of OLED screens for its first foldable iPhone series, expected to be rolled out in late 2026.

The order volume has not been confirmed, but the Korean supplier is expected to provide more than 15 million OLED displays for the foldable iPhone annually — more than the initially projected 9 million units.

The Korean display maker is said to have beaten its local rival LG Display Co. and China’s BOE, which had been floated as strong contenders to share Apple’s first foldable OLED display orders.

Considering that the US smartphone maker orders the same component from at least two suppliers to have an upper hand in price negotiation, its decision to choose Samsung Display as the exclusive foldable OLED supplier is seen as unusual.

LEAD IN FOLDABLE OLED TECHNOLOGY

Industry observers said the global smartphone leader made this decision because of Samsung Display’s unrivaled leadership in foldable OLED technology, thanks to its extensive expertise as the foldable screen supplier to Samsung Electronics.

The Korean display maker has been supplying foldable screens for Samsung Electronics’ foldable Galaxy series since the Korean tech giant started selling the world’s first foldable smartphones in 2019.

Notably, Samsung Display’s technology in minimizing screen creasing, which is the greatest concern among smartphone buyers when buying foldable mobile phones, is almost incomparable, said industry experts.

That is believed to be one of the reasons that Apple has chosen Samsung Display as its sole foldable OLED provider: the US smartphone maker considers quality the top priority when choosing a part supplier.

BIGGER PIE IN THE MARKET

Apple’s first foldable iPhone is expected to feature a 7.8-inch main display when unfolded, similar to the screen size of the iPad mini, and a 5.5-inch cover display.

Featuring premium OLED panels, it is expected to adopt a book-style design similar to Samsung Electronics’ Galaxy Z Fold.

Apple’s leap into the foldable smartphone market is poised to rejuvenate the global foldable OLED display market.

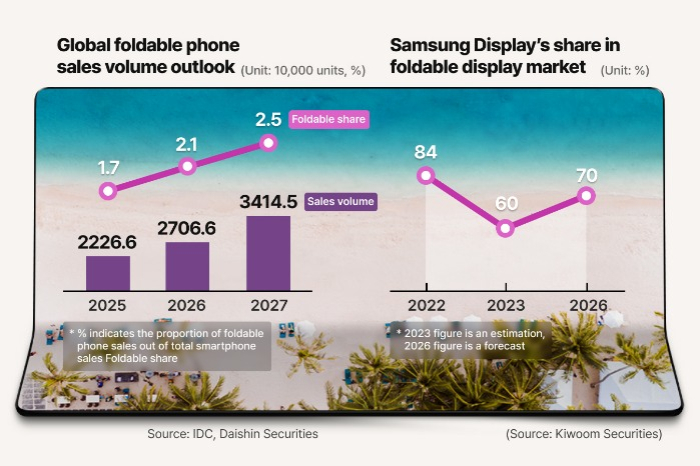

According to Counterpoint Technology Market Research, foldable smartphone shipments grew 2.9% in 2024 from 2023 and are expected to drop 4% this year from last year.

Their high price is considered the biggest hindrance to the growth of the foldable smartphone market.

The first foldable iPhone series is expected to sell for over 2 million won ($1,400) per unit, similar to the price of Samsung’s foldable Galaxy smartphones.

But once the iPhone — America’s best-selling smartphone — is released in a foldable form, foldable mobile phones are expected to regain momentum in the US, one of the top three global smartphone markets, boding well for the overall foldable smartphone market, said analysts.

In line with the anticipated increase in foldable smartphone demand, the market share of Samsung Display in the global foldable panel market is forecast to bounce back above 70% in 2026 after dipping below 50% in 2024.

Until 2022, it maintained a market share above 80%, but the rapid ascent of Chinese rivals has eaten away at it since then.

Write to Jeong-Soo Hwang and Chae-Yeon Kim at hjs@hankyung.com

Sookyung Seo edited this article.

More to Read

-

ElectronicsSamsung Display to build $1.8 billion OLED plant in Vietnam

ElectronicsSamsung Display to build $1.8 billion OLED plant in VietnamSep 24, 2024 (Gmt+09:00)

3 Min read -

ElectronicsSamsung Display surrenders foldable screen throne to BOE

ElectronicsSamsung Display surrenders foldable screen throne to BOEMar 15, 2024 (Gmt+09:00)

2 Min read -

ElectronicsSamsung Display sues BOE over iPhone 12 panel patents

ElectronicsSamsung Display sues BOE over iPhone 12 panel patentsJun 30, 2023 (Gmt+09:00)

2 Min read -

ElectronicsSamsung, LG ditch BOE in likely Apple deal for iPad Pro OLED panels

ElectronicsSamsung, LG ditch BOE in likely Apple deal for iPad Pro OLED panelsFeb 21, 2023 (Gmt+09:00)

2 Min read -

EarningsSamsung Display enjoys record profit on Apple iPhone 14

EarningsSamsung Display enjoys record profit on Apple iPhone 14Jan 31, 2023 (Gmt+09:00)

1 Min read

Comment 0

LOG IN