Steel

POSCO fully recoups initial investment in Roy Hill mine

The S.Korean steel giant invested 1.3 trillion won ($962 million) in Australia’s single largest iron ore mine in 2010

By Oct 10, 2023 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

POSCO Holdings Inc., the holding company of South Korea’s top steelmaker POSCO, has fully recovered its initial investment of 1.3 trillion won ($962 million) in the Roy Hill iron ore mine in Australia made nearly 14 years ago after collecting its latest quarterly dividends.

The company announced on Tuesday that the board of Roy Hill Holdings Pty Ltd., the operator of Roy Hill mine operations in Australia, approved a plan to dole out 800 million Australian dollars ($512 million) in dividends for the July-September period, and the Korean steel maker with a 12.5% stake in the mine has received about 85 billion won in quarterly dividends.

With the latest dividend payment, the world’s sixth-largest steelmaking group has collected 1.1 trillion won in total dividends from the iron ore mine in Australia since the third quarter of 2020 when its first dividends of 50 billion won were paid.

Considering discounts on POSCO’s iron ore purchases from Roy Hill under their partnership deal, the Korean steel giant has recovered 100% of its original investment in Australia’s single largest iron ore mine with the combined dividend payments, it said.

POSCO in 2010 decided to invest 1.3 trillion won in the Roy Hill mining project led by Australia’s Hancock Prospecting Pty Ltd. The Roy Hill consortium was formed in 2012, with Hancock holding the largest 70% stake, Marubeni Corp. with 15%, POSCO with 12.5% and China Steel with 2.5%.

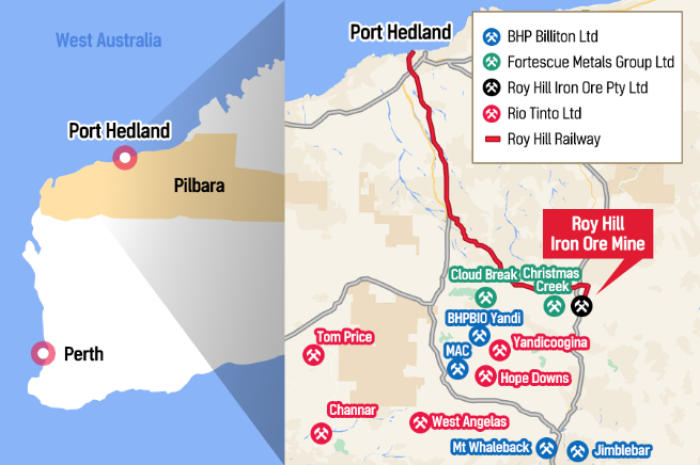

The mine located in Western Australia’s Pilbara region boasts 2.3 billion tons of iron ore reserves, with an annual production capacity of 63 million tons.

POSCO sources more than 20% of its annual iron ore supply from the Roy Hill mine.

The Korean steel giant’s investment in the mine is considered a “successful investment that ensures stable raw material supply and high dividend payments,” said a POSCO official.

FROM AN UGLY DUCKLING TO A GOLDEN GOOSE

This is a drastic U-turn in the market's earlier views about the company’s decision to invest in the Australian iron ore mine more than 13 years ago.

When POSCO announced the investment in 2010, its shareholders criticized it as a wrong bet, citing highly fluctuating iron ore prices at that time.

It was the Korean steelmaker’s biggest-ever raw material investment then.

But since the completion of the mine’s construction in October 2015, Roy Hill ramped up production to 55 million tons per annum in 2018 and has grown into the world’s fifth-largest iron ore company in 2020.

POSCO received its first iron ore shipments from Roy Hill in 2015 and the first quarterly dividends in October 2020 from the mine.

Roy Hill currently delivers iron ore to many countries, including South Korea, China, Japan and Taiwan.

POSCO Holdings expects handsome dividend gains from Roy Hill Holdings for the rest of this year as the iron ore mine operator is expected to report A$900 million in net profit in the third quarter after posting A$2.7 billion in net profit in fiscal 2023 ended in June 2023.

The Korean steel giant has invested in 21 raw material mining and development projects across the world since 1981 when it made its first raw material investment in a coal mine in Australia.

Its self-sufficiency rate of raw materials reaches some 40%.

POSCO last month vowed to lead Korea’s efforts to deepen cooperation with Australia in resource development and national security.

Australia, rich in resources such as iron ore, coal, lithium, rare earth minerals and renewable energy, is an important trade partner of Korea. Asia’s fourth-largest economy’s investment in the Oceanian island nation doubled to $1.5 billion in 2022 from 2019.

Write to Mi-Sun Kang at misunny@hankyung.com

Sookyung Seo edited this article.

More to Read

-

Hydrogen economyPOSCO to lead Korea-Australia hydrogen, minerals partnership

Hydrogen economyPOSCO to lead Korea-Australia hydrogen, minerals partnershipSep 08, 2023 (Gmt+09:00)

2 Min read -

-

-

Corporate restructuringPOSCO launches holding firm to develop non-steel biz

Corporate restructuringPOSCO launches holding firm to develop non-steel bizMar 02, 2022 (Gmt+09:00)

2 Min read

Comment 0

LOG IN