Corporate restructuring

POSCO launches holding firm to develop non-steel biz

It aims to triple its corporate value to $107.7 billion with intensive investment in lithium, nickel, hydrogen

By Mar 02, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

POSCO, the world’s sixth-largest steelmaker, on Wednesday launched a holding company to develop the group into an eco-friendly future materials producer.

POSCO Holdings Inc. aims to ramp up operating profits from the non-steel business to 50% of the entire group’s profit from the current 20%, tripling the corporate value to some 130 trillion won ($107.7 billion) from 43 trillion won last year.

“POSCO played a role about 50 years ago when the steel was South Korea’s future growth industry. POSCO Holdings will now continue the role in the future eco-friendly materials sector, a future industry,” said POSCO Group Chairman and Chief Executive Choi Jeong-woo in a ceremony to mark the launch of the holding company.

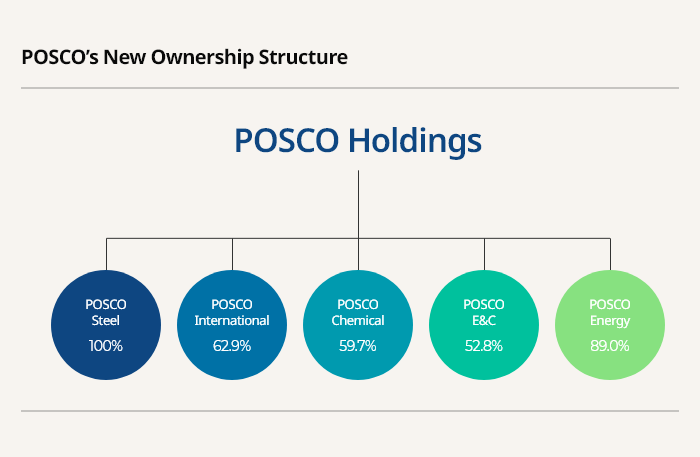

POSCO Holdings is at the top of the group corporate governance structure with subsidiaries such as South Korea’s top steelmaker POSCO Steel, POSCO Chemical CO., POSCO International Corp. and POSCO E&C under the wing of the holding company.

HYDROGEN, LITHIUM AND NICKEL

The firm is set to develop new growth engines for the group, create synergies among subsidiaries and lead environmental, social and governance (ESG) management. It will play a key role in the development of new growth engines in hydrogen, lithium and nickel, while its subsidiaries will focus on the existing core businesses such as steel and battery materials.

POSCO Holdings plans to accelerate growth in non-steel businesses, raising their sales and operating profits to 60% and 50%, respectively, of the group’s total by 2030 from 50% and 20% in 2021.

It will actively invest to become the world’s leading company of battery raw materials by securing lithium production capacity of 220,000 tons and nickel capacity of 140,000 tons by 2030.

That will build the electric vehicle value chain that contains cathode and anode materials produced by POSCO Chemical and EV steel sheets made by POSCO.

The holding company plans to invest 10 trillion won by 2030 in its hydrogen business, aiming to grow the unit with an annual sales of 2.3 trillion won through an output of 500,000 tons. By 2050, it targets a production capacity of 7 million tons, becoming one of the world’s top 10 players.

Write to Jung-hwan Hwang at jung@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Corporate restructuringPOSCO wins shareholder support to launch holding firm

Corporate restructuringPOSCO wins shareholder support to launch holding firmJan 28, 2022 (Gmt+09:00)

2 Min read -

Corporate restructuringNPS approves POSCO's split into holding firm, steelmaker unit

Corporate restructuringNPS approves POSCO's split into holding firm, steelmaker unitJan 24, 2022 (Gmt+09:00)

2 Min read -

Shareholder valuePOSCO plans to cancel treasury shares in its holding firm

Shareholder valuePOSCO plans to cancel treasury shares in its holding firmJan 05, 2022 (Gmt+09:00)

2 Min read -

Carbon neutralityPOSCO mothballs Korea’s oldest blast furnace for carbon neutrality

Carbon neutralityPOSCO mothballs Korea’s oldest blast furnace for carbon neutralityDec 29, 2021 (Gmt+09:00)

3 Min read

Comment 0

LOG IN