POSCO wins shareholder support to launch holding firm

The steelmaker aims for a threefold rise in corporate value by 2030, led by EV battery materials and hydrogen businesses

By Jan 28, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea's POSCO Co. will transform into a holding company structure on Mar. 2, after its plan to split itself into a holding firm and a steelmaking unit received overwhelming support from shareholders.

The launch of a holding company means the steel giant is undergoing a massive structural transformation since its privatization in 2000 and underscores its determination to go beyond steel into an eco-friendly, highly-valued materials producer.

On Jan. 28, the split-off plan won 89.2% support from shareholders attending its extraordinary shareholder meeting. That comfortably exceeded the level required to pass the plan, or more than two-thirds of shareholders who cast votes in the gathering.

"By transforming into a holding company structure, we will accelerate our efforts for balanced growth between steel and new businesses, and build our identity as an eco-friendly materials company to be valued as a growth stock," POSCO Group Chairman and Chief Executive Choi Jeong-woo said in an opening speech for the shareholder meeting.

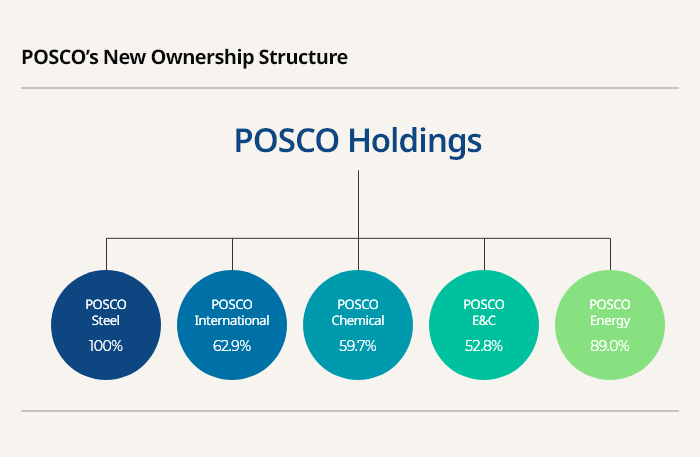

POSCO Group last month approved the restructuring plan, under which POSCO Holdings will be at the top of the group corporate governance structure.

The holding firm will own 100% of POSCO Steel to be launched, which it pledged not to list on the stock market.

POSCO Holdings will focus on hydrogen production and electric vehicle battery materials development, while discovering future growth engines, including M&As.

It will finance those new businesses with dividends from its subsidiaries, and make them independent units once they reach a certain level of success.

"POSCO is sharply undervalued with a market cap at less than half of its highest level reached in 2007," he told shareholders.

"The prevailing view is that POSCO is a low-growth steel stock, and the potential of our growth businesses has not been properly appreciated."

POSCO Group aims to triple its corporate value from the current 40 trillion won by boosting EV battery materials and hydrogen production.

To that end, it will expand the annual production of cathode and anode materials, used in EV batteries, to 700,000 tons by 2030 versus the current 114,000 tons.

The world's sixth-largest steelmaker also plans to ramp up steel output to 60 million tons by 2030 from the current 45 million tons by expanding facilities in the US, Indonesia and India.

On Monday, its largest shareholder National Pension Service (NPS) decided to give its nod to POSCO's split-off plan.

To win the hearts of shareholders, POSCO unveiled a string of shareholder-friendly measures, including the retirement of treasury shares and not taking public the steelmaking unit and other businesses to be separated from its to-be-launched holding company.

Write to Jung-hwan Hwang at jung@hankyung.com

Yeonhee Kim edited this article.

-

Battery materialsPOSCO Chemical, GM to launch new battery material JV in US

Battery materialsPOSCO Chemical, GM to launch new battery material JV in USDec 02, 2021 (Gmt+09:00)

4 Min read