Samsung Group

Lawmakers’ move to amend law could rattle Samsung governance

Samsung Life and Samsung Fire & Marine would have to dump $18.2 bn in Samsung Electronics shares under the revised law

By Nov 10, 2022 (Gmt+09:00)

2

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

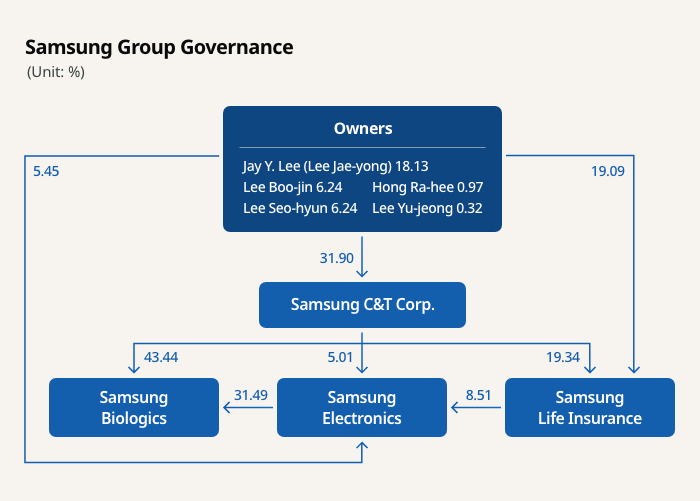

South Korean lawmakers are moving to revise an insurance industry law that would force Samsung Group-affiliated insurers to sell their shares in Samsung Electronics Co., weakening Chairman Jay Y. Lee’s grip on the world’s top memory chipmaker.

In 2020, Rep. Park Yong-jin and Rep. Lee Yong-woo of the main opposition Democratic Party of Korea proposed a bill that would evaluate insurers’ stock and bond holdings based on the market price, or mark-to-market accounting. Currently, such assets are calculated based on acquisition prices.

The bill is widely known as the “Samsung life insurance law” since it will only affect Samsung Life Insurance Co. and Samsung Fire & Marine Insurance Co. if it passes the National Assembly.

The ruling People Power Party and the main opposition party are discussing whether to hold a bill review subcommittee under the National Policy Committee next week, according to political sources on Wednesday.

“I want the bill to pass the parliament during the current session at any cost to ensure asset management in the insurance industry is done in a sound and fair manner,” Rep. Park of the main opposition party said in a letter to lawmakers of the National Policy Committee.

Under the current law, Korea bans any insurer from holding shares issued by related companies such as its major shareholders beyond 3% of its total assets to prevent risks linked to the relevant companies from hurting the insurer.

The law is also designed to ensure the insurer makes payments to policyholders promptly when requested.

$18.2 BN IN SAMSUNG ELEC SHARES COULD BE DUMPED

Samsung Life is the largest shareholder of Samsung Electronics with an 8.5% stake worth 30.6 trillion won ($22.3 billion) as of Nov. 7. At the current market price, the stake represents 10.9% of Samsung Life’s total assets of 281 trillion won, whereas the stake's book value at the time of acquisition represents only 0.2% of its assets.

If the bill is passed, Samsung Life must sell 22.2 trillion won in Samsung Electronics shares. Samsung Fire & Marine, which holds a 1.5% stake in the electronics firm, is also required to unload 2.7 trillion won worth of the shares.

In addition, the Samsung insurance units must pay a combined 5 trillion won in corporate taxes when they sell Samsung Electronics shares.

If the revised bill is passed as planned, analysts said Samsung Electronics Chairman Lee will have a loose grip on the tech giant, given its corporate governance structure. Lee is the top shareholder of Samsung C&T Corp., which is the No. 1 shareholder of Samsung Life.

If Samsung Life and Samsung Fire & Marine reduce their stakes in Samsung Electronics to 3% as required by the new law, the total stake held by Chairman Lee and his friendly shareholders in the electronics company would fall to about 13% from the current 20.8%.

Write to Hyeong-Ju Oh and Jeong-Soo Hwang at ohj@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

Leadership & ManagementJay Y. Lee inaugurated as chairman of Samsung Electronics

Leadership & ManagementJay Y. Lee inaugurated as chairman of Samsung ElectronicsOct 27, 2022 (Gmt+09:00)

1 Min read -

Samsung GroupSamsung Group to speed up corporate governance reform

Samsung GroupSamsung Group to speed up corporate governance reformAug 15, 2022 (Gmt+09:00)

3 Min read -

Samsung GroupSamsung Group hires governance expert for unprecedented reorganization

Samsung GroupSamsung Group hires governance expert for unprecedented reorganizationApr 11, 2022 (Gmt+09:00)

5 Min read -

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake sale

Corporate governanceSamsung Life shares rally as governance issue looms on likely stake saleSep 02, 2020 (Gmt+09:00)

5 Min read

Comment 0

LOG IN