Robotics

POSCO to buy Korean robotics firm stake for steel business

POSCO to fortify robotics and factory automation sectors as the group’s new growth drivers

By Dec 01, 2024 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s steel-to-battery materials conglomerate POSCO Group will invest in the leading domestic robotics company to boost its ailing steel business through factory automation as it seeks a new growth engine.

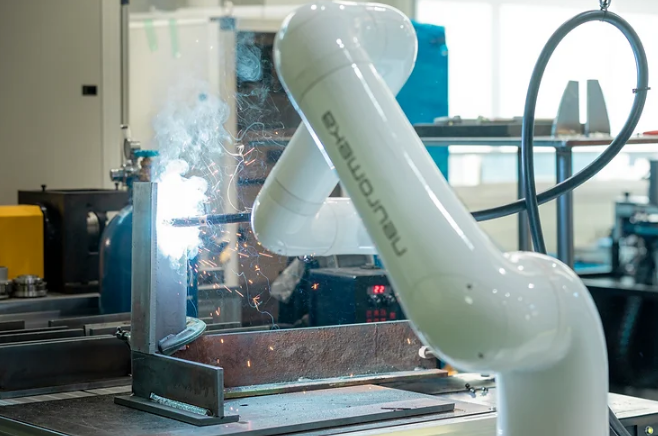

Neuromeka Co., Korea’s top collaborative robotics maker, announced on Friday it will issue 10 billion won ($7.2 million) in convertible bonds to POSCO Holdings Inc., parent of the world’s No. 7 steelmaker POSCO and EV battery materials producer POSCO Future M Co.

POSCO Holdings is set to secure a 3.81% stake in Neuromeka if the conglomerate converts the debt securities into the Kosdaq-listed company’s stocks.

Neuromeka’s share price jumped 7.77% to end at 26,350 won in the Korean stock market — its highest close since July 24, outperforming a 2.33% fall in the tech-heavy Kosdaq market.

The group is expected to jointly develop, with Neromeka, collaborative robots and artificial intelligence systems in order to automate its steel factories.

The company's collaborative robots can work in the same space as humans without the need for safety fences. Its industrial robots can move along three or more axes and are used in manufacturing with automated, programmable systems.

TO CUT COSTS

The steel sector is less automated than other industries such as the semiconductor and automotive businesses.

POSCO, which has automated some manufacturing processes such as moving molten iron, seeks to use the technology for other tasks, according to company officials.

“POSCO, which has been struggling against cheaper products from China, is poised to cut expenses such as labor costs through factory automation,” said a steel industry source. “The company will implement smart factories through AI integration.”

The leading Korean steelmaker shut down a wire rod mill in the country while seeking to sell off its entire stake in a Chinese stainless steel joint venture amid a supply glut and cutthroat competition with rivals on the mainland.

NEW GROWTH DRIVERS

POSCO Holding’s purchase of Neuromeka’s convertible bonds is its first investment since Chang In-hwa, the group’s chairman and chief executive, took office in March.

Chang is expected to beef up the robot and factory automation sectors as new growth drivers, industry sources said. His predecessor Choi Jeong-woo led the transformation of POSCO Future M into a battery materials producer.

“We aim to implement an intelligent factory, which integrates AI and robotics technology, moving beyond a smart factory,” Chang said earlier.

POSCO Group is expected to make major investments in those sectors alongside Neuromeka, industry sources said.

Korean conglomerates such as Samsung Group have been focusing on the convergence of robotics and AI technology to expand their businesses in the enterprise AI sector marked by strong growth potential. Samsung Electronics Co., the world’s top memory chipmaker, is the second-largest shareholder in Rainbow Robotics Co. while LG Electronics Inc. is the No. 2 shareholder in Robotis Co.

Chang has been focusing on selling non-core assets with low profitability to restructure 120 units by 2026.

As part of this goal, POSCO Future M sold its entire stake in a high-purity hydrogen peroxide joint venture to business partner OCI Co.

Write to Woo-Sub Kim at duter@hankyung.com

Jongwoo Cheon edited this article.

More to Read

-

-

Corporate restructuringKorean steel giant POSCO to sell Chinese JV PZSS amid US-China trade war

Corporate restructuringKorean steel giant POSCO to sell Chinese JV PZSS amid US-China trade warNov 08, 2024 (Gmt+09:00)

4 Min read -

Corporate restructuringPOSCO to sell entire stake in P&O Chemical to OCI

Corporate restructuringPOSCO to sell entire stake in P&O Chemical to OCIAug 25, 2024 (Gmt+09:00)

2 Min read -

RoboticsPOSCO DX to focus on AI-led intelligent factory systems

RoboticsPOSCO DX to focus on AI-led intelligent factory systemsJul 18, 2024 (Gmt+09:00)

2 Min read -

Corporate strategyPOSCO seeks restructuring for $1.9 bn injection in battery materials

Corporate strategyPOSCO seeks restructuring for $1.9 bn injection in battery materialsJul 14, 2024 (Gmt+09:00)

2 Min read

Comment 0

LOG IN