Korean steel giant POSCO to sell Chinese JV PZSS amid US-China trade war

The sale of the JV, dubbed ‘little POSCO in China,’ is part of Chairman Chang’s rigorous reform drive

By Nov 08, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korean steel giant POSCO Holdings Inc. is seeking to sell its entire stake in a Chinese stainless steel joint venture as it faces growing competition with Chinese steelmakers amid a supply glut.

Industry sources said on Friday that POSCO Holdings, the parent of Korea’s top steelmaker POSCO, plans to sell its stake in POSCO Zhangjiagang Stainless Steel Co. (PZSS), a JV with Shagang Group, China’s second-largest steel producer also known as Shasteel.

POSCO Holdings and POSCO China own a combined 82.53% stake in the JV. Shagang Group holds the remaining stake.

POSCO has picked a Korean accounting firm as the sale's lead manager and has begun reaching out to investors for the deal estimated at 500 billion won ($361 million), sources said.

If the sale of the entire stake, including that owned by Shagang, is not feasible, POSCO will consider selling a 50% stake and continuing the business through joint management, according to sources.

‘LITTLE POSCO’ IN CHINA

Established in 1997 in Zhangjiagang, Jiangsu province, PZSS is a large facility capable of producing 1.1 million tons of stainless steel annually – about half the volume of POSCO’s entire Korea production.

Industry officials said POSCO is exiting PZSS amid Beijing's push for steel self-sufficiency by urging domestic steelmakers to play a greater role in supply. This has contributed to a supply glut amid a slowdown in the country’s construction sector.

Stainless steel is widely used in construction materials, automobiles, home appliances and aircraft components.

Dubbed “little POSCO” because the JV had an integrated steel production facility capable of processing raw iron into expensive steel, PZSS was once a cash cow.

Built with an investment of over 1 trillion won, the Zhangjiagang plant was seen as a successful example of POSCO’s overseas expansion, generating hundreds of billions of won annually through 2010.

With the rapid rise of Chinese steel producers in the following years, however, PZSS began to bleed money.

PZSS produced 1.1 million tons of stainless steel in 2019 but cut its production volume to 839,000 tons last year.

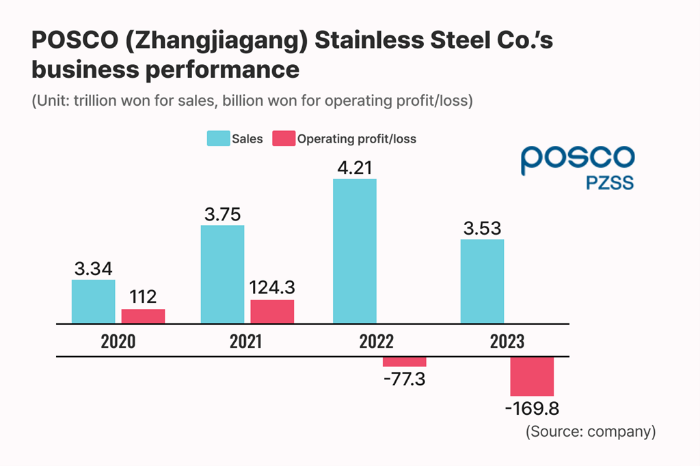

The JV’s operating loss more than doubled to 170 billion won in 2023 from 77.3 billion won in 2022.

LOSING TECH LEAD

POSCO’s technological lead over its Chinese rivals has also dwindled.

Analysts said China’s Tsingshan Holding Group, the world’s biggest stainless steel producer, has swiftly narrowed its technology gap with POSCO.

“With Chinese steel companies growing stronger, PZSS is now at a disadvantage in terms of price competitiveness,” said a POSCO official.

China’s 43 stainless steel producers churned out a combined 28.21 billion tons of the product in the first nine months of this year, some 15% more than the country’s demand of 24.17 million tons.

CHAIRMAN CHANG’S RESTRUCTURING DRIVE

Chang In-hwa, chairman and chief executive of POSCO Group, has vowed to take drastic cost-cutting measures to counter difficulties caused by a global steel oversupply and the intensifying US-China trade war.

He also pledged to seek mergers and acquisitions in promising sectors beyond steel and battery materials during his three-year term to secure new growth drivers.

The steelmaking group has been selling off non-core assets and unprofitable businesses to boost its financial status and secure funds for future growth engines.

POSCO Holdings said in July it aims to raise 2.6 trillion won through restructuring by 2026.

To achieve this, POSCO plans to sell or liquidate as many as 120 non-core assets and unprofitable businesses.

The conglomerate aims to achieve a 200 trillion won market capitalization by 2030 from the current 70 trillion won.

The CEO said in April that POSCO will take drastic cost-cutting measures to counter economic difficulties while reinforcing new businesses, including POSCO Future M Co., a battery materials affiliate.

Of 38 overseas affiliates, 13 POSCO companies fell into the red last year. Among those loss-making units, PZSS posted the highest losses in 2023.

POSCO’s corporations in Argentina and Turkey each posted some 70 billion won in losses last year.

CHINA EXIT

Analysts said some Korean companies are preparing to pull out of China due to the heightened geopolitical risk in the wake of Donald Trump’s US presidential election win.

The US has tightened restrictions on Chinese steel products as part of its protectionist measures.

While emphasizing his America First policy, Trump pledged to impose punitive tariffs above 60% on Chinese steel imports.

POSCO has collaborated with the Shagang Group for more than 27 years in China.

Korea’s two other major steelmakers, Hyundai Steel Co. and Dongkuk Steel Mill Co., are also considering pulling out of China, sources said.

Write to Ji-Eun Ha and Jun-Ho Cha at hazzys@hankyung.com

In-Soo Nam edited this article.

-

Corporate restructuringPOSCO to sell entire stake in P&O Chemical to OCI

Corporate restructuringPOSCO to sell entire stake in P&O Chemical to OCIAug 25, 2024 (Gmt+09:00)

2 Min read -

Corporate strategyPOSCO seeks restructuring for $1.9 bn injection in battery materials

Corporate strategyPOSCO seeks restructuring for $1.9 bn injection in battery materialsJul 14, 2024 (Gmt+09:00)

2 Min read -

Corporate strategyPOSCO aims to quadruple operating profits by 2030

Corporate strategyPOSCO aims to quadruple operating profits by 2030Jul 02, 2024 (Gmt+09:00)

2 Min read -

BatteriesPOSCO seeks additional lithium deals from Argentina, Chile

BatteriesPOSCO seeks additional lithium deals from Argentina, ChileJun 17, 2024 (Gmt+09:00)

3 Min read -

Corporate strategyPOSCO tightens belts, seeks M&A within 3 years: new chairman

Corporate strategyPOSCO tightens belts, seeks M&A within 3 years: new chairmanApr 23, 2024 (Gmt+09:00)

3 Min read -

Leadership & ManagementPOSCO taps ex-President Chang In-hwa as its next group chairman

Leadership & ManagementPOSCO taps ex-President Chang In-hwa as its next group chairmanFeb 08, 2024 (Gmt+09:00)

4 Min read