State intervention in HSCEI-tied ELS sale debacle could backfire: scholars

Surveyed economics professors stress 'market principles' and say government role must be 'kept to a minimum'

By Feb 19, 2024 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

South Korea’s economics scholars oppose government-led countermeasures, including compensation packages, to handle mounting retail investor losses from investments in the Hang Seng China Enterprises Index (HSCEI)-tied high-risk stock instrument, a survey showed on Monday.

According to a survey of 296 economics professors polled by The Korea Economic Daily for a week from Feb. 10, only 15 of 46 respondents said it would be appropriate for the government to work out compensation packages for investors who suffered losses from the stock investment.

Thirty-one professors, accounting for 67.4% of those who responded, expressed opposition to a government-led compensation program.

“For the government to set these rules may have a positive aspect in terms of investor protection. However, more serious negative aspects such as the distortion of market principles, increased burden on financial institutions and side effects from state regulations must be considered," said Kim Jae-young, an economics professor at Seoul National University.

The respondents also said it is “improper” for the government to issue an order that domestic banks, which sold HSCEI-tied financial products to retail investors, work out compensation packages independently from the government.

Any state intervention, scholars said, should be limited to cases where banks violated rules concerning their sale of financial products, such as insufficient explanations or inadequate warnings given to investors of potential investment risks.

"If a bank thoroughly followed rules in selling such products and investors were fully aware of related risks, then the bank shouldn’t be held accountable,” said a professor who requested anonymity.

“It is also questionable whether the government, which has been negligent in supervision, can establish fair compensation standards.”

HSCEI-ELS TUMBLE BELOW KNOCK-IN LEVEL

Last year, Chinese shares listed on the Hong Kong bourse fell sharply, placing the city’s main stock index, the HSCEI, among the world’s worst-performing gauges.

With little hope for a meaningful rebound in H-shares this year, Korean retail investors, particularly those who have bought into equity-linked securities (ELS) tracking the HSCEI are facing collateral damage from its significant descent.

The HSCEI has more than halved to 5,511.06 points as of Monday from a high of 12,106.77 on Feb. 19, 2021.

ELS are derivative products, the returns of which are determined based on the performance of underlying assets such as a stock index or individual shares.

ELS investors are entitled to promised returns if the underlying asset’s price stays above a certain level, or knock-in level, until maturity, usually three years.

However, if the price of underlying assets falls below the knock-in level, usually 50% of the price at the time of the ELS purchase, investors are asked to accept the entire losses incurred.

LOSSES SNOWBALL

Most of the products were sold before the Hong Kong index’s decline, raising concerns about huge principal losses if H-shares fall further from the current level.

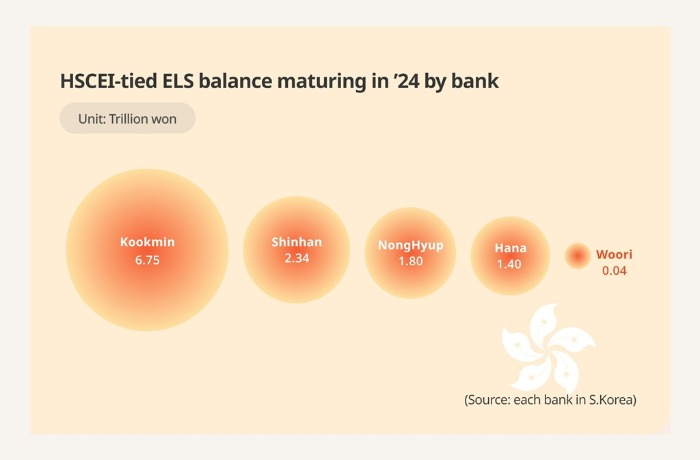

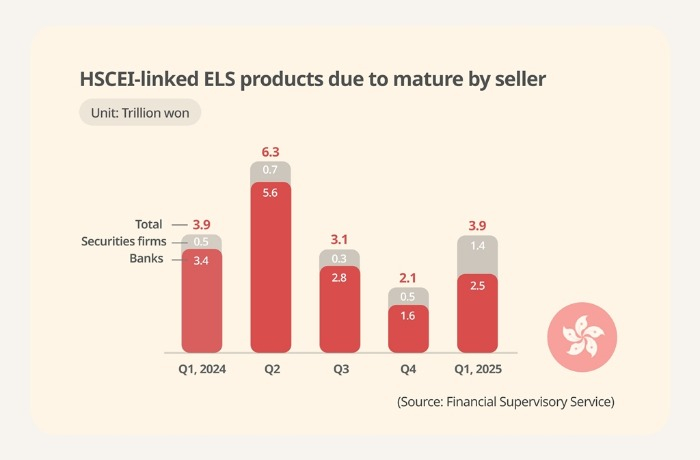

As of November last year, the total outstanding balance of the HSCEI-tied ELS products sold by Korean banks and securities firms stood at 19.3 trillion won ($14.5 billion), of which about 80%, or 15.4 trillion won, will mature this year.

Korean retail investors suffered about 230 billion won losses from such investments as of mid-January, industry data showed.

In the first half alone, 10.2 trillion won worth of the ELS products will expire, and investors are projected to suffer from more than 6 trillion won worth of principal losses from HSCEI-tied ELS investments, industry officials said.

Some investors have filed petitions with regulators, seeking compensation for their losses while accusing banks of improperly selling financial products.

As ELS products tracking the H-share Index face large-scale losses, Korea’s financial authorities are looking into the situation.

"Apart from government moves, it is desirable for financial companies to simultaneously implement a procedure to compensate voluntarily,” Lee Bok-hyun, chief of Korea’s financial regulator, the Financial Supervisory Service, said earlier this month.

Some Korean banks have suspended ELS sales as the banks came under scrutiny by the financial market watchdog.

“The essence of the ELS debacle is whether investors were aware of possible losses in advance. The government's hasty call on banks to prepare voluntary compensation is nothing more than a stopgap measure to appease disgruntled investors,” said Hongik University economics professor Yu Jong-min.

Thirty-two professors, or 69.6% of 46 respondents, said it would be “inappropriate” for the government to consider a complete ban on banks’ ELS sales.

Write to Eui-Jin Jeong at justjin@hankyung.com

In-Soo Nam edited this article.

-

Korean stock marketKorean banks stop ELS sales after HSCEI debacle

Korean stock marketKorean banks stop ELS sales after HSCEI debacleJan 31, 2024 (Gmt+09:00)

4 Min read -

Korean stock marketKorea’s ELS market to stagnate after HSCEI debacle: KOFIA chairman

Korean stock marketKorea’s ELS market to stagnate after HSCEI debacle: KOFIA chairmanJan 23, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELS

Korean stock marketKorean investors doomed to suffer $171 mn losses from HSCEI ELSJan 22, 2024 (Gmt+09:00)

3 Min read -

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS sale

Korean stock marketS.Korea launches official probe into HSCEI-tied ELS saleJan 08, 2024 (Gmt+09:00)

5 Min read -

Korean stock marketKorean ELS investors biting nails over sharp falls in Hong Kong shares

Korean stock marketKorean ELS investors biting nails over sharp falls in Hong Kong sharesNov 24, 2023 (Gmt+09:00)

3 Min read