Office deals in Seoul, Bundang surge 45% on-year in Q1

The sales of Alpharium Tower and E-Mart HQ led the record; 2022's full-year office deal volume will be similar to 2021's

By Apr 27, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

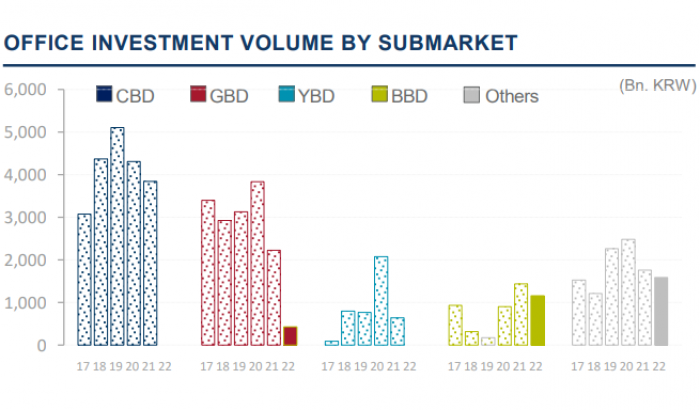

The seven office deals include one from Gangnam Business District (GBD), two from BBD and four from "other areas" in Seoul except for the three key business districts -- GBD, Central Business District (CBD) and Yeouido Business District (YBD). Of the seven deals, the two major transactions were Alpharium Tower I and II in Pangyo, Korea’s so-called Silicon Valley in BBD, and Shinsegae Inc.’s supermarket chain E-Mart Inc. headquarters in Seongsu, Seoul.

In February, Korea’s Mastern Investment Management Co. acquired Alpharium Tower I and II from ARA Asset Management Korea for around 1 trillion won. The sale price was 9.1 million won ($7,214.2) per square meter, the highest-ever office price per unit area in Pangyo. Alpharium Tower is a core asset and has game developer NCSOFT Corp. and Samsung Group's tech service unit Samsung SDS Co. as key tenants.

The second-highest record in the area is 8.2 million won ($6,493.8) per square meter of Pangyo Alpha Dome City’s 6-1 block in 2020, when a Korea Teachers' Credit Union (KTCU)-led consortium bought a 50% stake in the block from a Public Officials Benefit Association (POBA)-led consortium. Tech giants Kakao Corp. and Naver Corp. will begin to use the block in May.

In GBD, Korea's Koramco REITS Management and Trust Co. purchased Gangnam P Tower, with a flooring area of 44,073 cubic meters, for 424.5 billion won via its blind pool fund from Hangang Asset Management Co. More offices in Seoul and BBD are being acquired through blind pool funds and REITs, Cushman & Wakefield stated.

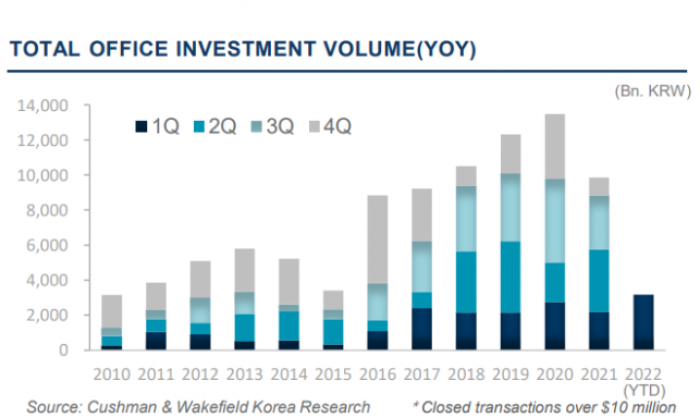

The full-year office deal volume of 2022 will be similar to that of 2021, the real estate firm said. Some landmark offices in Seoul kicked off the sales process at the end-2021, including Jongno Tower and Jongno Place in CBD and Multicampus Yeoksam and Apro Squre in GBD. The deals are scheduled to be completed in the second half of this year.

Also, the bidding price of International Finance Center (IFC) in YBD is expected to reach the mid-4 trillion won level, marking the largest deal of this year, the report added.

The selling prices of offices in 2022 will be similar to those in the past years as effective rents are rising due to increased demand for offices, declining vacancy rates and interest rate hikes, the report said. The average vacancy rate of grade-A offices in Seoul and BBD was 3.5% during the first quarter, down 170 basis points from the fourth quarter of 2021.

The increase in rental prices supports the offices’ capitalization rates despite steep hikes in interest rates, and some office deals this year will break previous records, the real estate firm said in the report.

Write to Tae-Ho Lee at thlee@hankyung.com

Jihyun Kim edited this article.

-

Alternative investmentsMastern buys Pangyo office landmarks for $834 mn

Alternative investmentsMastern buys Pangyo office landmarks for $834 mnFeb 07, 2022 (Gmt+09:00)

2 Min read -

Alternative investmentsOffice deals in Seoul hit record-high $14 bn in 2021: JLL

Alternative investmentsOffice deals in Seoul hit record-high $14 bn in 2021: JLLFeb 03, 2022 (Gmt+09:00)

3 Min read -

Real estateGrade-A offices in Seoul hit lowest vacancy rate in Q1 2022

Real estateGrade-A offices in Seoul hit lowest vacancy rate in Q1 2022Apr 11, 2022 (Gmt+09:00)

2 Min read -

Real estatePangyo, Bundang among Asia's hot office areas, DWS says

Real estatePangyo, Bundang among Asia's hot office areas, DWS saysDec 20, 2021 (Gmt+09:00)

2 Min read -

Real estateOffices in Gangnam attract global investors amid market volatility

Real estateOffices in Gangnam attract global investors amid market volatilityMar 14, 2022 (Gmt+09:00)

2 Min read