Grade-A offices in Seoul hit lowest vacancy rate in Q1 2022

Emerging business areas in Seoul and its suburbs will expand with tenants looking for reasonable rentals

By Apr 11, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

Grade-A offices saw their lowest-ever quarterly vacancy rate in the first quarter of 2022 since 2010, when Canada-based real estate investment manager Colliers started conducting research on the Korean market.

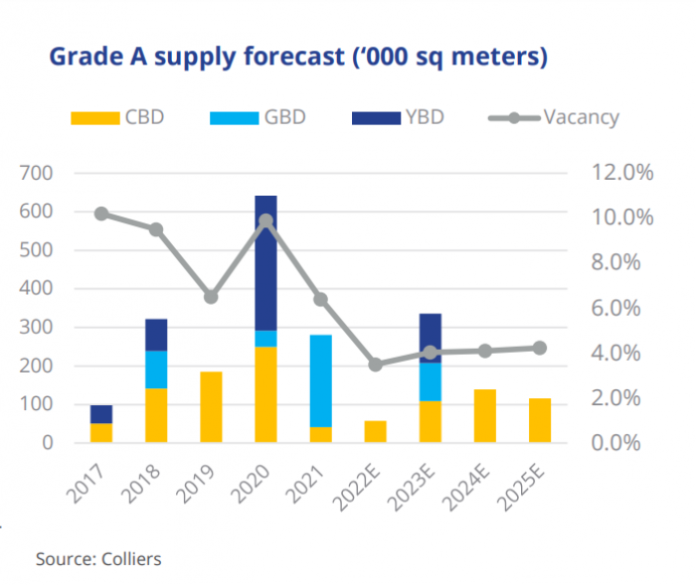

Seoul's office vacancy rate will continue to decline as there are no new offices planned for the next five years, except for new supply in the central business district (CBD) around Seoul station, Colliers said.

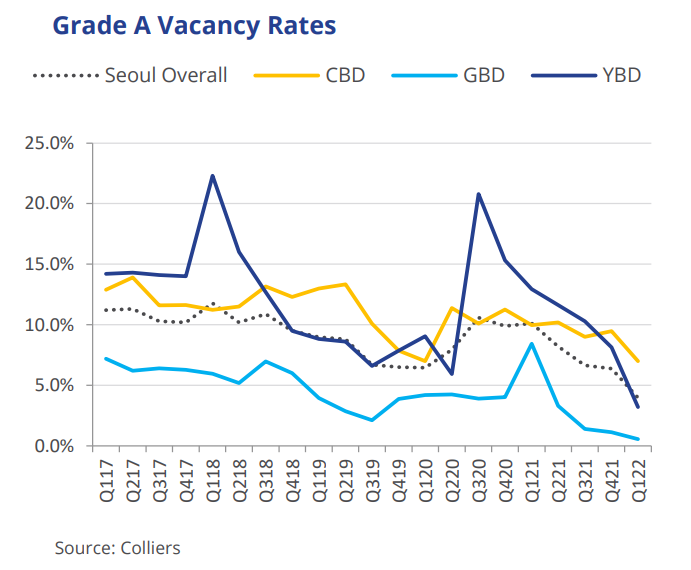

The grade-A offices in Seoul posted a 4% of the average vacancy rate during the first quarter, the real estate company said in its Seoul Office Market report on April 8. Particularly, grade-A offices in the Gangnam business district (GBD) are almost fully leased with a 0.6% vacancy rate.

“As most tech firms prefer to rent offices in Gangnam, real estate owners of the area don’t offer rent-free periods anymore and select quality tenants,” said Jay Cho, a senior director at Colliers Korea. “Tenants who focus on reasonable rentals might want to look for properties in other, emerging areas,” Cho added.

Colliers forecast a shortage of offices in Seoul for the next three years. In terms of new supply, there is only one grade-A office building this year, the new annex of the Bank of Korea near Seoul Station. The redevelopment of Korean public broadcaster MBC’s former headquarters site in Yeouido, the main financial district of Seoul, will be completed next year and provide more grade-A offices. The combined flooring areas of new offices in Seoul will be only 100,000 square meters or less by 2024, said the report.

The vacancy rate will continue to decline in CBD and the Yeouido business district (YBD), the report said. The CBD saw a 7% vacancy rate during the first quarter of 2022, down 250 basis points from the previous quarter. In CBD, the 33-story office landmark Jongno Tower will be fully leased as electric vehicle battery maker SK On Co. and some other SK Group affiliates are set to move to the building. In YBD, container liner HMM Co. has signed a rental agreement for nine floors of Parc 1 Tower, a 69-story landmark.

The CBD, especially the Seoul Station area, will have more office supply than other business districts in Seoul over the next five years. The new supply includes the Bank of Korea annex in the first half of this year and Meritz Fire & Marine Insurance Co.’s new building next year. Millennium Hilton Seoul, sitting at the foot of Mt. Namsan and adjacent to Seoul Station, is planned to be redeveloped as a mixed-use complex comprising a hotel, office and retail spaces.

Given reduced rentable space in the three business districts, tenants will move to other areas like Seongsu or Magok in Seoul, suburb Gwacheon or Korea’s so-called Silicon Valley Pangyo, the report said. As renting multiple offices for a business becomes more popular and there is an increase in shared offices outside of the three business districts, the emerging business areas will continue to expand, Cho said.

Write to A-Young Yoon at youngmoney@hankyung.com

Jihyun Kim edited this article.

-

Real estatePangyo, Bundang among Asia's hot office areas, DWS says

Real estatePangyo, Bundang among Asia's hot office areas, DWS saysDec 20, 2021 (Gmt+09:00)

2 Min read -

Alternative invesmentsOffice deals in Seoul hit record-high $14 bn in 2021: JLL

Alternative invesmentsOffice deals in Seoul hit record-high $14 bn in 2021: JLLFeb 03, 2022 (Gmt+09:00)

3 Min read -

Alternative invesmentsMastern buys Pangyo office landmarks for $834 mn

Alternative invesmentsMastern buys Pangyo office landmarks for $834 mnFeb 07, 2022 (Gmt+09:00)

2 Min read -

Real estateOffices in Gangnam attract global investors amid market volatility

Real estateOffices in Gangnam attract global investors amid market volatilityMar 14, 2022 (Gmt+09:00)

2 Min read -

Artificial intelligenceOffice investment falls 15% in Q3 2021, CBRE says

Artificial intelligenceOffice investment falls 15% in Q3 2021, CBRE saysOct 26, 2021 (Gmt+09:00)

2 Min read