Personal pensions

Korea’s personal pensions gamble with risky stocks for higher returns

By Dec 08, 2020 (Gmt+09:00)

3

Min read

Most Read

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

South Korea’s individual pension fund holders are moving their money out of banks and insurance companies into brokerages in pursuit of higher returns in a time of unprecedented economic uncertainty and ultra-low interest rates.

Pension funds, public or private, tend to be risk averse as they are designed to provide a safe and stable stream of income at retirement, but increasingly people are entrusting their pension savings with stock dealers to make quick money.

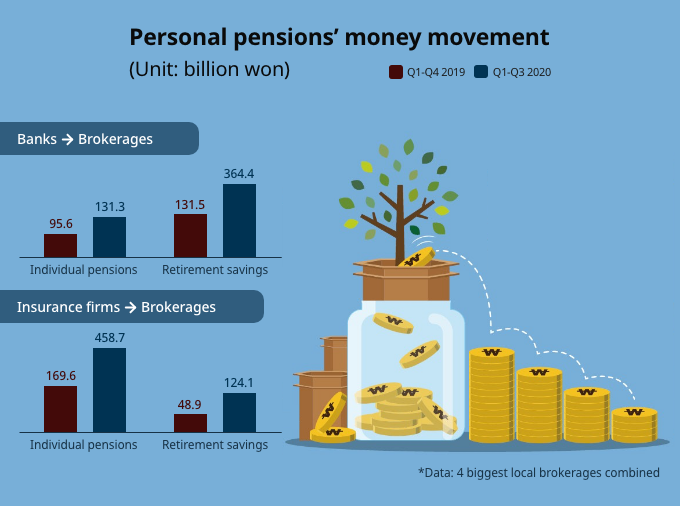

According to a tally by the country’s four largest brokerages – Samsung Securities, Mirae Asset Daewoo, NH Investment & Securities and KB Securities – a record 1.79 trillion won ($1.65 billion) moved from banks and insurers to brokerage firms in the first nine months of the year. That’s more than double the 445.5 billion won in such movement for all of 2019.

FEAR OF MISSING OUT PROMPTS FUND FLOWS INTO STOCKS

Analysts credit this to individuals, anxious not to miss out on handsome gains from a stock market bull run, who are making the move to boost their returns.

“Retirement pensions with the principal and interests guaranteed account for 80% of all pension schemes, but their rate of return often comes below the inflation rate. They are now looking for solid returns through stock investment,” said Nam Chae-woo, a research fellow at the Korea Capital Market Institute (KCMI).

In 2019, returns from principal-protected retirement savings stood at 1.77% compared with a 6.38% return from performance-based dividend-type pension products, according to the labor ministry.

The KCMI expects the trend of money transfer in personal pensions, akin to the 401k plans in the US, to continue next year, given the bullish stock market outlook amid historically low interest rates.

The local stock markets are widely expected to continue their upward trend into 2021, fueled by aggressive purchases from retail investors, who have emerged as a significant buying force of late.

The main Kospi index rose for a fifth straight session to an all-time high of 2,745.4 points on Monday on heavy fund inflows from foreigners, institutional investors and individuals. In early Tuesday trade, the benchmark index fell 1.1% on profit-taking.

The National Pension Service is also reaping high returns from its expanded investments in both local and overseas stock markets.

The state-run pension scheme eked out a 4.17% return in the first nine months of the year.

According to the Financial Supervisory Service, pension savings funds, focused on stock investments, yielded a 10.5% return last year. By contrast, annuity trust and pension savings insurance products, which heavily invest in bonds, posted a return of 2.34% and 1.84%, respectively.

Data show personal pension fund holders are favoring exchange-traded funds (ETFs) over direct purchasing of individual stocks as a hedge against the stock market’s volatility.

According to the Korea Exchange, the value of daily ETF transactions rose to 4.8 trillion won on average in December from 1.8 trillion won in early January.

“ETFs are less risky than individual stocks. Transaction fees are also lower,” said Kim Dong-yup, head of Mirae Asset Investment and Pension Center.

“At a time of ultra-low interest rates, it’s no wonder many personal pension holders are turning their eyes to stock investment.”

Write to Jae-Won Park and Bum-Jin Chun at wonderful@hankyung.com

In-Soo Nam edited this article.

More to Read

-

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demand

Debt financingKookmin Bank raises $700 mn in forex bonds amid strong demandApr 30, 2025 (Gmt+09:00)

-

Real estateColliers to lead $689 million sale of IGIS Asset-owned Signature Tower

Real estateColliers to lead $689 million sale of IGIS Asset-owned Signature TowerApr 11, 2025 (Gmt+09:00)

-

Real estateIGIS taps Samjong KPMG, Cushman & Wakefiel, NAI for sale of AP Tower

Real estateIGIS taps Samjong KPMG, Cushman & Wakefiel, NAI for sale of AP TowerApr 11, 2025 (Gmt+09:00)

-

Travel & LeisureSoftBank-backed Yanolja raises stake in Modetour as No. 2 shareholder

Travel & LeisureSoftBank-backed Yanolja raises stake in Modetour as No. 2 shareholderMar 27, 2025 (Gmt+09:00)

-

Private equityMBK Special Situations relinquishes Korean investment advisory license

Private equityMBK Special Situations relinquishes Korean investment advisory licenseMar 21, 2025 (Gmt+09:00)

Comment 0

LOG IN