NPS logs positive H1 return led by fixed incomes, alternatives

By Aug 28, 2020 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

KT&G eyes overseas M&A after rejecting activist fund's offer

Mirae Asset to be named Korea Post’s core real estate fund operator

StockX in merger talks with Naver’s online reseller Kream

Meritz backs half of ex-manager’s $210 mn hedge fund

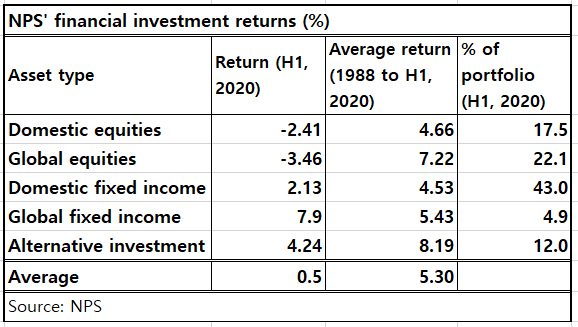

A strong rebound in stock markets during the April-June quarter sharply narrowed losses from equities portfolios, which suffered a more than 30% plunge in March alone in the wake of the coronavirus outbreak.

In the first three months to March, NPS reported a negative return of 6.08%, offsetting its 2019 return of 11.31%, that was its highest in history.

“During the first half of 2020, NPS reported a negative return at one point as the global spread of coronavirus brought an unprecedented shock to financial markets,” NPS said in a statement. “But thanks to our diversified portfolio and risk management, we recovered and achieved a positive return as of the end of June."

A string of stimulus measures unveiled by developed countries and loosened monetary policies provided a support to stock markets, while pulling interest rates lower. Lowered bond yields and the firmer won against the dollar boosted valuation gains from fixed-income securities.

By asset type, both domestic and global fixed-income securities reported positive returns during the first six months to June, outperforming their benchmark indices.

Investment gains from alternative assets are based on their interest and dividend incomes, without reflecting mark-to-market assessments, which occur annually at the end of the year.

The world’s third-largest pension scheme managed 752.2 trillion won ($634 billion) in assets as of the end of June, up 15.5 trillion won from the end of last year.

Write to Jung-hwan Hwang at jung@hankyung.com

Yeonhee Kim edited this article

-

Real estateMirae Asset to be named Korea Post’s core real estate fund operator

Real estateMirae Asset to be named Korea Post’s core real estate fund operatorApr 29, 2025 (Gmt+09:00)

-

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concern

Asset managementMirae Asset bets on China as Korean investors’ US focus draws concernApr 27, 2025 (Gmt+09:00)

-

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fund

Alternative investmentsMeritz backs half of ex-manager’s $210 mn hedge fundApr 23, 2025 (Gmt+09:00)

-

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark project

Real estateRitz-Carlton to return to Seoul, tapped by IGIS Asset for landmark projectApr 22, 2025 (Gmt+09:00)

-

Real estateS.Korean gaming giant Netmarble eyes headquarters building sale

Real estateS.Korean gaming giant Netmarble eyes headquarters building saleApr 18, 2025 (Gmt+09:00)