Korea's NPS upped alternative investment by 33% in 2021

It committed $157 billion to alternative assets last year; overseas real estate increased, domestic properties reduced

By Aug 12, 2022 (Gmt+09:00)

LG Chem to sell water filter business to Glenwood PE for $692 million

Kyobo Life poised to buy Japan’s SBI Group-owned savings bank

KT&G eyes overseas M&A after rejecting activist fund's offer

StockX in merger talks with Naver’s online reseller Kream

Mirae Asset to be named Korea Post’s core real estate fund operator

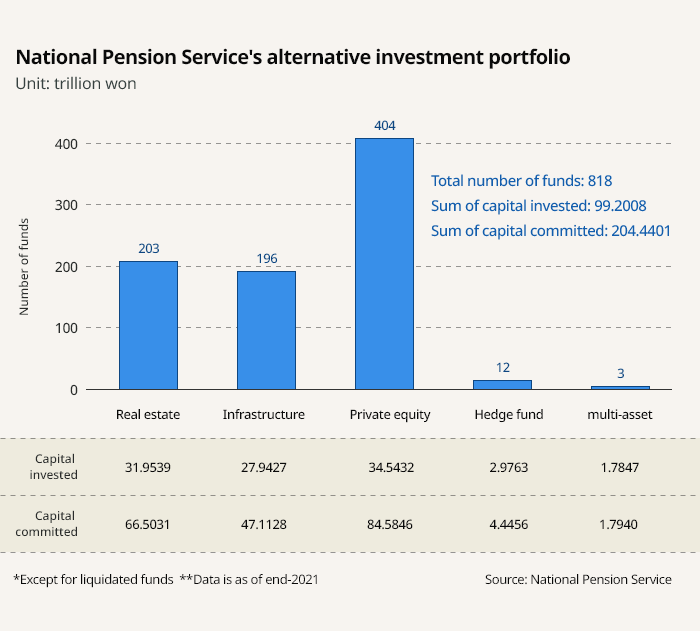

The National Pension Service (NPS) of South Korea committed 204.4 trillion won ($156.7 billion) to alternative investment as of end-2021, up 32.7% from the previous year, the NPS said on Aug. 12. The world’s third-largest pension fund manages 918 trillion won in assets.

Of the committed capital, 99.2 trillion won has been invested in alternative assets. Cash reserves and other liquid assets increased 48.8% to 105.2 trillion won as of end-2021 over the previous year.

By asset class, private equity commitments topped the list at 84.6 trillion won, followed by real estate with 66.5 trillion won and infrastructure with 47.1 trillion won. The pension fund committed less capital to hedge funds and multi-assets, with 4.4 trillion won and 1.8 trillion won, respectively.

Capital invested in the top three asset classes was less than half of its total commitment. The pension fund injected 34.5 trillion won into private equity, 32 trillion won into real estate and 27.9 trillion won toward infrastructure.

LESS LOCAL, MORE OVERSEAS REAL ESTATE

In the real estate sector, the pension fund shrank investing in domestic properties and ramped it up abroad. As of end-2021, its Korean real estate investment totaled 5.3 trillion won, down 9.3% from the previous year. Overseas real estate investment, meanwhile, reached 26.6 trillion won, up 14.8% from end-2020.

By region, 41.7% of real estate investment targeted the Americas, 23.2% aimed at Asia and Australia, and 21% targeted Europe. All other regions together accounted for 14%. The pension fund cut exposure to project-based funds to 38.6% as of end-2021 from 45.2% a year earlier, while ramping up blind pool funds of real estate.

The BlackRock Real Estate Securities Fund topped the NPS’s real estate investment, receiving 1.1 trillion won from the pension fund. The pension giant’s other key investments include a combined 1.1 trillion won in Blackstone’s six overseas asset funds and 1.7 trillion won in three funds managed by the Korea Corporate Restructuring Real Estate Funds’ domestic property funds.

Other key real estate fund managers include Rockpoint, where the NPS invested a combined 733.9 billion won in seven funds; and TPG, into which the pension fund injected 435.5 billion won.

UP VALUE-ADDED, DOWN OPPORTUNISTIC IN INFRA

The pension giant invested 27.9 trillion won in infrastructure as of end-2021, up 12% year-on-year. By region, North America led with 25.1%, followed by Europe and Asia with 20.2% and Australia with 14.4%. Latin America accounted for a mere 0.6%. Project-based funds accounted for 55.2%, and blind pools made up the remaining portion.

Of the project-based infrastructure funds, the NPS injected 968.9 billion won into value-added strategies as of end-2021, which it didn’t invest in at all the previous year. The pension giant invested no capital in opportunistic strategies for project-based funds.

Of the blind pool infrastructure funds, the NPS slashed investing in opportunistic strategies to 861.5 billion won as of end-2021 from 2.3 trillion won at end-2020. Instead, it bulked up value-added investment to 2.6 trillion won from 838.5 billion won during the same period.

The institutional investor kicked off multi-asset investment last year, injecting 600 billion won each in Morgan Stanley, Allspring Global Investments and BlackRock.

Its private equity investment increased 25.6% to 34.5 trillion won, while hedge fund investment leaped 59.9% to 3 trillion won as of the end of 2021.

Write to Ji-Hye Min at spop@hankyung.com

Jihyun Kim edited this article.

-

Pension fundsNPS to slash Korean asset proportion, increase overseas stocks

Pension fundsNPS to slash Korean asset proportion, increase overseas stocksMay 27, 2022 (Gmt+09:00)

3 Min read -

Pension fundsNPS sees 14 investment managers resign by end-June

Pension fundsNPS sees 14 investment managers resign by end-JuneJul 08, 2022 (Gmt+09:00)

1 Min read -

Pension fundsNPS, KTCU to invest $390 mn in US major power generator

Pension fundsNPS, KTCU to invest $390 mn in US major power generatorMay 19, 2022 (Gmt+09:00)

2 Min read -

Private equitySK Square taps NPS PE expert as global investment head

Private equitySK Square taps NPS PE expert as global investment headMay 12, 2022 (Gmt+09:00)

2 Min read -

Real estateFormer NPS real estate chief named Allianz RE's Asia head

Real estateFormer NPS real estate chief named Allianz RE's Asia headMay 20, 2022 (Gmt+09:00)

1 Min read -